The current state of fintech is worth exploring. Sentiment has most certainly shifted, with fintech funding dropping to the lowest levels since 2017 and high-profile failures like Synapse declaring bankruptcy in April 2024. But at the same time, companies like Robinhood and Coinbase are reaching all-time highs at $93 billion and $100 billion in market cap, respectively. Is fintech dead? Or is it just flying under the radar?

One of the obstacles with fintech is that, while it's all financial technology, it spans a massive swath of services from savings to investing to lending and beyond. In order to evaluate the current state of fintech, it's actually more instructive to evaluate the different pieces within the fintech landscape. So rather than attempt an exhaustive overview of each subset within finance, let's take a specific part of the stack and drill into the latest. First up? Buy Now, Pay Later (BNPL)

Once hailed as the future of consumer finance, BNPL platforms soared during the pandemic-era boom in ecommerce and cheap capital. Companies like Klarna and Affirm were backed by billions in venture capital, pitching a simple idea: let consumers split purchases into interest-free installments, with no credit card required. It seemed like a win for everyone, with shoppers gaining flexibility and merchants seeing higher conversion rates. Klarna was valued at $46 billion at its peak in 2021, making it one of the most valuable private tech companies in Europe. Affirm went public and quickly became a pandemic-era favorite among growth investors. But the excitement didn’t last. Klarna’s valuation has since reportedly dropped to $6.7 billion, and it recently paused plans to go public amid market uncertainty. Affirm’s stock has lost nearly half its value over the past five years.

BNPL, once used to buy Pelotons and designer sneakers, is now being used to pay for Chipotle burritos. What started as a sleek alternative to credit cards has become a way to stretch paychecks from one week to the next. As interest rates climbed and the economy cooled, defaults increased and margins thinned. Regulators have started to take a closer look, questioning whether BNPL encourages overspending or targets vulnerable consumers. Investor sentiment has shifted, and questions about profitability remain front and center. Can BNPL still become a sustainable part of consumer finance, or is it just another pandemic-era bubble?

BNPL 101

BNPL is a short-term financing option that lets consumers split the cost of a purchase, usually into four equal, interest-free installments, paid over several weeks. The process is fast and embedded directly into the checkout flow, allowing customers to select a BNPL plan with just a few clicks. Unlike traditional layaway, shoppers receive the product immediately, and unlike credit cards, many BNPL services avoid charging interest altogether.

BNPL companies generate revenue through several channels. The primary source is merchant fees, which retailers are willing to pay in exchange for the higher conversion rates and larger average order values that BNPL enables. Providers also earn from late payment fees and, for longer-term installment plans, interest charges. Some also monetize consumer purchasing data by offering anonymized behavioral insights to retailers and brands. Additionally, many BNPL platforms earn affiliate or referral fees by driving traffic and sales to partner merchants through their own shopping apps or websites. The major players in the space include Klarna, Affirm, and Afterpay, with others like PayPal, traditional banks, and fintech startups in the market as well.

Much of BNPL’s popularity stems from its immediacy, certainty, and accessibility. Loan decisions are nearly instant, and users are shown clear, fixed payment schedules with no hidden costs. These terms often extend beyond a typical credit card billing cycle, making it easier for users to manage their cash flow. Because most consumers are approved with only a soft credit check, BNPL expands purchasing power to people who might not qualify for traditional credit cards.

Behind BNPL’s Explosive Growth

BNPL’s surge wasn’t accidental. Although BNPL services originated several years before the pandemic, first gaining traction in markets like Australia and Europe during the mid-2010s as niche alternatives to traditional credit, it wasn’t until the pandemic that BNPL truly took off on a global scale. During the pandemic, ecommerce became essential. With people stuck at home, online shopping soared, and BNPL found its way into millions of checkout flows as a convenient, flexible payment option. At the same time, interest rates hovered near zero, creating an ideal lending environment. With capital so cheap, BNPL firms could underwrite loans at scale without worrying about immediate profitability.

On the consumer side, demand was driven by a generational shift. Many younger users, especially Gen Z, had already started to reject traditional credit cards. Concerns about high interest rates, hidden fees, and the potential for long-term debt made credit cards feel outdated. BNPL offered an alternative that felt simpler and safer. Nearly two-thirds of Gen Z said they were actively ditching credit cards for more transparent ways to pay, and more than half believed BNPL helped them manage their finances better.

This rising popularity fueled a massive wave of investment. Venture capital and private equity firms poured money into the space, eager to back the “next big thing” in consumer finance. Klarna raised $639 million in a SoftBank-led round, reaching a $45.6 billion valuation at its peak in 2021. Square, now known as Block, bought Afterpay for $29 billion in one of the largest fintech acquisitions ever. As cheap capital flooded the market and user growth exploded, BNPL became a defining product of the pandemic-era economy.

Why did the BNPL Bubble Burst?

The combination of economic pressures, credit issues, growing competition, and tighter regulation put too much pressure on the BNPL bubble. One major factor was rising global interest rates. Since BNPL companies rely on outside capital to fund loans, higher rates increased their borrowing costs and cut into profit margins. At the same time, consumers began spending less, which led to lower revenues for these companies.

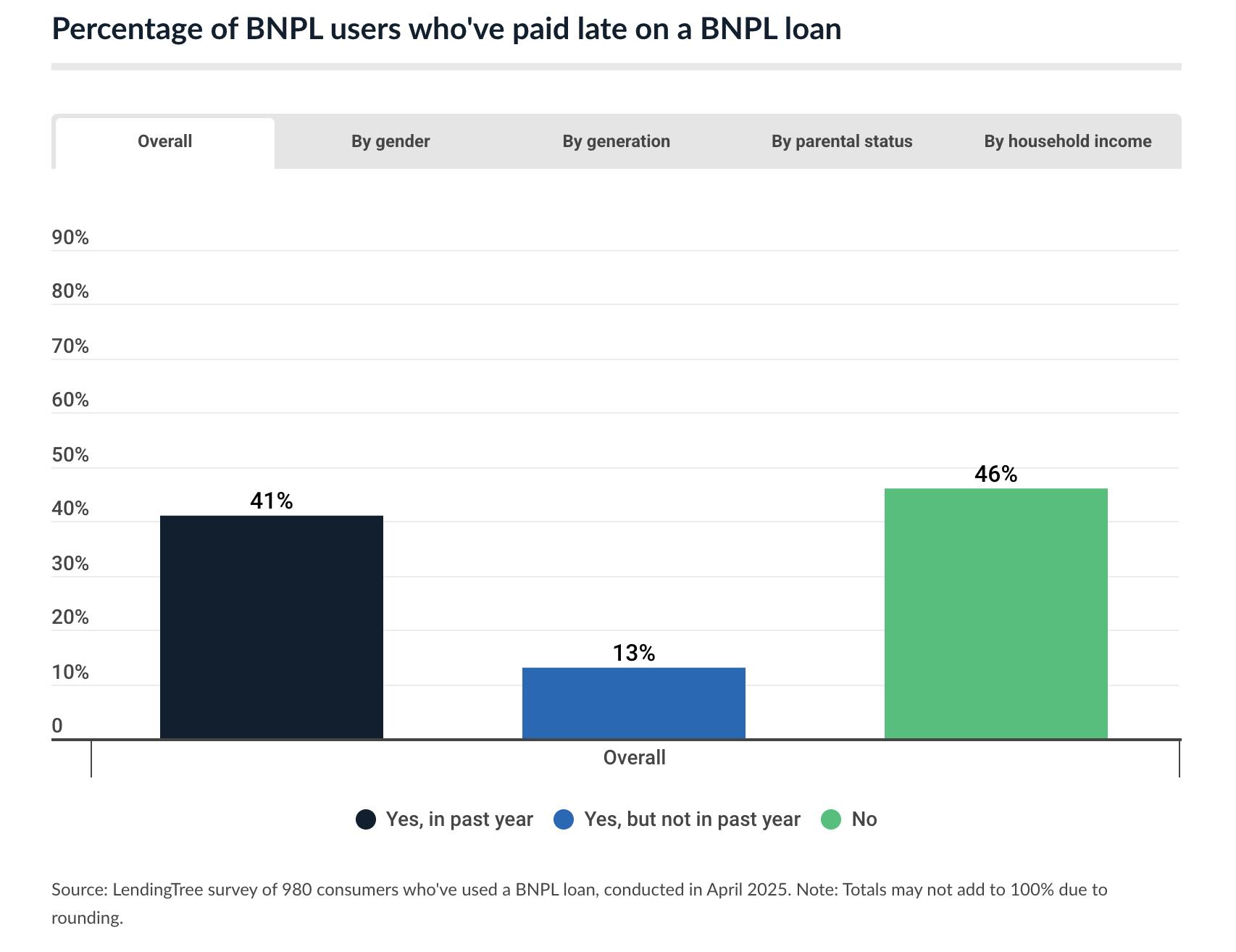

Credit risk also became a serious concern. Many BNPL providers use soft credit checks and minimal underwriting, which makes it easier for high-risk borrowers to get approved. In 2022, 78% of BNPL loans went to people with subprime or deep subprime credit scores. As the economy weakened, more borrowers began missing payments. This problem was made worse by the fact that BNPL loans often aren't reported to credit bureaus, allowing users to take out multiple loans across different platforms (”loan stacking”). One 2022 study showed that 62.7% of borrowers had more than one BNPL loan at the same time, increasing the risk of over-borrowing and default. By April 2024, 54% of consumers had made late payments on BNPL loans, with the rate continuing to rise. In Q1 2025, Klarna saw credit losses rise 17% year-over-year.

Source: LendingTree

The market also became much more competitive. As of 2025, there are hundreds of BNPL providers, which has pushed down the fees they can charge merchants. The average merchant discount rate dropped from 3.84% in 2019 to 3.08% in 2021, which has certainly continued to decrease as competition has further intensified in recent years. More competition is likely to have also raised customer acquisition costs, putting even more pressure on profits.

Regulation has added another layer of difficulty. In the UK, the Financial Conduct Authority is working to bring BNPL fully under its rules, which would require stronger credit checks, clearer terms, and more consumer protection. In Australia, BNPL providers now need a credit license and must meet standards similar to traditional lenders, including stricter borrower assessments to prevent unaffordable lending. In the US, regulation has been lighter. Although the Consumer Financial Protection Bureau raised concerns in the past, as of May 2025, it had shifted focus away from BNPL. This creates a mixed global landscape, with stricter oversight in some countries and ongoing uncertainty in others.

The Reinvention of BNPL

The current state of BNPL shows an industry in transition, with companies making strategic pivots to survive tighter margins and increased competition. Klarna reported its fourth consecutive profitable quarter in Q1 2025, with a $3 million adjusted operating profit and 15% year-over-year revenue growth. The company is now transitioning from being a pure BNPL provider to a full-fledged neobank, expanding into banking services such as debit cards and savings accounts. Similarly, Affirm offers a high-yield savings account with no minimums or fees through a partnership with Cross River Bank. As the BNPL space matures, more companies are likely to broaden their offerings to stay competitive and build customer loyalty.

To cut costs and improve margins, BNPL companies are turning to technology and workforce reductions. Klarna has reduced its workforce by approximately 40% since 2022 and is investing heavily in AI to enhance efficiency. According to the company, its AI assistant, powered by OpenAI, could handle the work of 700 human agents and is increasing company profits by roughly $40 million. However, in May 2025, Klarna reversed course, saying the AI tool “failed to meet the company’s standards for customer experience.”

With unclear advantages from AI as the technology continues to advance, more BNPL companies are, instead, turning to strategic partnerships. These types of partnerships have become crucial, with companies like Affirm partnering with Amazon and Klarna with DoorDash. These partnerships with high-quality retailers not only drive volume and customer acquisition but also create stickiness on both sides of the marketplace.

The industry is also facing commoditization and market saturation. BNPL has become a common, nearly interchangeable option in ecommerce checkout flows. As BNPL becomes ubiquitous, merchants increasingly view providers as interchangeable or even offer multiple options simultaneously, leading to heightened competition for partnerships and reduced brand loyalty. As a result, BNPL providers will also have to compete more aggressively for customer loyalty.

With the sector experiencing significant consolidation, smaller startups are either exiting, merging, or being acquired by larger fintechs. The need for scale, regulatory compliance, and access to capital is driving this trend. BNPL offerings are increasingly being integrated into larger fintech and merchant service ecosystems, such as Stripe and Shopify, as part of comprehensive payment and financial tool suites. Traditional financial institutions and payment processors like Mastercard, Visa, and JPMorgan are also integrating BNPL into their broader financial ecosystems, positioning it as a feature within their existing offerings.

Apple Pay Later, which was discontinued in mid-2024, serves as a notable example of these market dynamics. Despite its short life, it showed how BNPL can be embedded within a broader ecosystem, but also demonstrated how difficult it is to scale profitably without deep credit infrastructure. Apple now partners with Affirm for installment payments, signaling a shift toward specialization through partnerships rather than internal development.

What’s Next for BNPL?

BNPL is entering a more disciplined phase, marked by tighter regulation, smarter underwriting, and clearer paths to profitability. Its next chapter will reward players who can balance innovation with resilience. Profitability and sustainability now depend on strong underwriting, diversified revenue, ecosystem depth, and operational efficiency. Future success will hinge on several key factors that separate the winners from the rest.

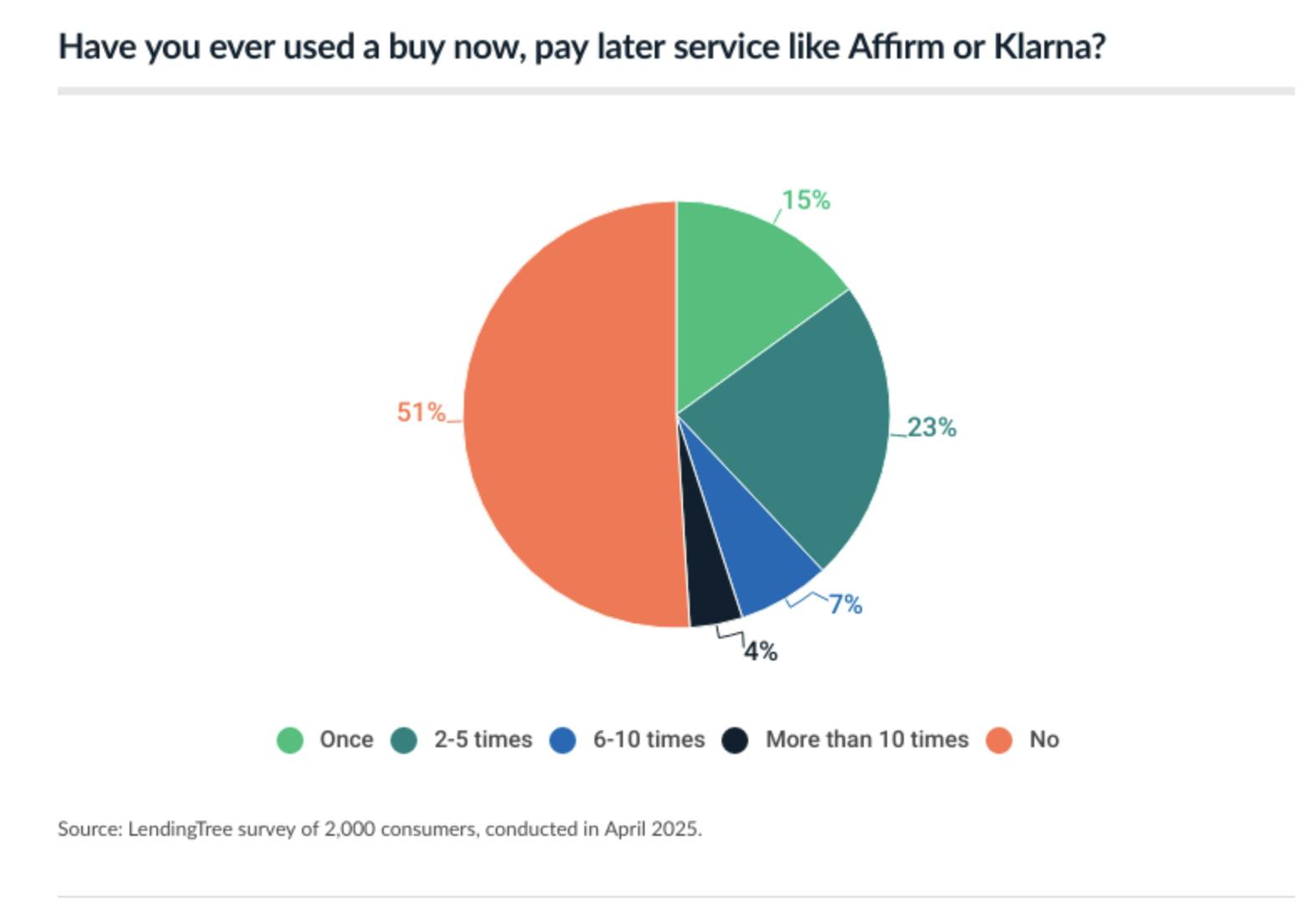

Regulatory adaptation is critical for future success. New laws in major markets, such as the US, UK, and Australia, are imposing stricter licensing requirements, responsible lending obligations, and enhanced consumer protections. BNPL providers must adapt to these frameworks, including implementing robust affordability checks and compliance functions. Regulatory divergence between states and countries is creating a complex environment that will reward adaptable, well-governed firms. As of April 2025, 51% of consumers had still never used a BNPL service, meaning that the platforms that adjust to changing expectations still have a material market to unlock.

Source: LendingTree

Value-added services are becoming important for differentiation. These include data analytics for merchants, customer engagement tools, and integration with digital banking services. Some BNPL providers are inviting consumers onto their app by making it a shopping destination where merchants can advertise new products or flashy deals, creating additional revenue streams beyond traditional payment processing.

Companies are also racing to build scale and create defensible data advantages. Leading BNPL firms are investing in technology and analytics to construct defensible positions, leveraging proprietary data for underwriting, customer engagement, and merchant partnerships. Vertical integration and ecosystem partnerships with banks, fintechs, and merchants are helping some providers achieve scale and lock-in, which is likely to separate winners from the rest.

The winners will likely be those who leverage BNPL as part of a broader financial services ecosystem, rather than a standalone offering. Companies that can successfully integrate payment services with banking, lending, and merchant tools will have the best chance of long-term success in this evolving market.

The Implications For Fintech

The rise, fall, and normalization of BNPL is instructive for most categories within fintech. In the early days of a new financial service, it can feel like the wild west. Despite the volatility in financial services, we still see this today. As one example, in June 2025, Robinhood launched tokenized shares of private companies like OpenAI and SpaceX, despite OpenAI immediately responding to say that it had not partnered with Robinhood to offer those shares.

Are these tokens actual equity? Or just tied in value to actual equities? Unclear. It’s still the wild west. As is true in most new financial service categories, there is almost always a reckoning phase after the initial period of exuberant hype. Other examples:

Neobanks were born around 2016 with higher-quality user experiences and no-fee banking as wrappers around existing financial services. Eventually, these apps saw frozen accounts and regulatory issues. The neobanks to survive the early days have either become banks or partnered with official banks.

Crypto lending started out with the thesis of “high-yield banking services for crypto assets.” The category saw savings rates dramatically higher than traditional savings services. Unfortunately, the fallout included the collapse of Terra and Luna, the failure of FTX, and the implosion of BlockFi. The normalization for this category still remains to be seen.

Across categories of fintech, it seems that you either die a speculative pseudo-gambling app or live long enough to pursue a super app vision anchored in low-risk savings accounts. BNPL is no exception. Already, we’re seeing the largest players, like Klarna, start to transition into more traditional banking services, including mobile banking, putting them in potential competition with companies like Nubank and Revolut. BNPL will likely evolve to be just one of many of their services.

The introduction of higher regulation, more sophisticated underwriting, and clearer paths to profitability are indicative of a particular category maturing. BNPL has a better chance to become a legitimate part of the consumer finance stack today than it did when it was primarily fueled by low-cost growth and unsustainable underwriting. The same is likely true of many other emerging fintech categories. Evaluating any of them is an exercise in understanding regulatory evolution, underlying financial frameworks, and the path to profitability.