Thesis

Naval Dominance: A Historical Imperative

Throughout history, naval power has been a critical pillar of military strength. From the ancient triremes of Greece and Rome, which secured control of vital trade routes in the Mediterranean, to the Viking longships that enabled raids and settlements across wide swaths of Europe, the ability to dominate at sea has had profound geopolitical consequences. Centuries later, the defeat of the Spanish Armada by the British Royal Navy changed the balance of power in Europe and set the stage for British naval dominance. By the modern era, Germany, despite its continental focus, recognized the importance of maritime power — its naval buildup in the late 19th and early 20th centuries threatened Britain’s longstanding supremacy and helped spark a global naval arms race.

A robust navy does more than secure coastlines; it projects influence onto distant shores. A formidable fleet safeguards the flow of essential goods and energy resources, protecting commerce from piracy or hostile blockades. It also deters aggression: the very existence of a powerful navy compels adversaries to think twice before threatening a nation’s interests abroad. Over the last two centuries, British and American navies have demonstrated that whoever holds the reins of naval superiority can dictate trading conditions, broker alliances on favorable terms, and sway the outcome of conflicts across the globe. However, to retain its effectiveness and keep up with technological progress, navies must replace lost ships with more advanced vessels while also increasing fleet sizes.

The Decline in US Shipbuilding Capacity

In recent decades, America’s ability to build and sustain a large navy has eroded significantly, with troubling consequences for military readiness. Over the past 20 years, the US Government Accountability Office (GAO) has issued roughly 40 reports flagging problems in Navy ship programs. Taken together, these failures have been described as a “lost generation of shipbuilding,” leaving the Navy less prepared than it was before.

The list of setbacks is long and costly. The Littoral Combat Ship (LCS) program, intended to produce dozens of agile coastal warships, saw its costs double during construction; the Navy cut its original order from 52 ships down to 35 and is now retiring some of those vessels after barely a decade of service. The futuristic Zumwalt-class stealth destroyer was slashed from 32 planned ships to only three as expenses skyrocketed – at an estimated $7 billion per ship, each destroyer ended up costing even more than a Nimitz-class aircraft carrier. Even the Navy’s newest supercarrier, the USS Gerald R. Ford, was delayed by unproven technology. Its magnetic catapult, advanced radar, and other new-age features have been marred by cost overruns and reliability problems, to the point that the carrier took years longer than expected to become operational.

These missteps have real consequences. For example, ship classes have been curtailed or retired early, as evidenced by the aforementioned LCS program. US shipyards today struggle not only to build new warships on schedule but even to keep up with repairs on the existing fleet. By one Navy estimate in February 2024, the United States was 20 years behind on its maintenance work, with some ships being decommissioned simply because shipyards lacked the capacity to overhaul them. All of this means that the US Navy has fewer deployable ships at any given time. Long gone are calls for 600-ship fleets — a March 2024 30-year shipbuilding plan the US Navy submitted to Congress aimed for a fleet of 381 manned ships and 134 unmanned vehicles, including 78 unmanned surface vessels (USVs).

The decline of American shipbuilding wasn’t a sudden development, but rather the cumulative result of post-Cold War downsizing and industrial atrophy. The US once viewed its shipyards and merchant fleet as strategic assets and subsidized them accordingly. However, those supports were removed in the 1980s, and the industry withered. By 2016, the number of shipyards capable of building large vessels declined by 80% and annual output had declined by nearly 90% relative to 1953 levels. As of 2023, the US accounted for only 0.10% of global commercial shipbuilding.

With naval ship construction now concentrated in only a handful of specialized US yards and a lack of skilled workers or equipment on standby, there is little surge capacity. If a shipbuilding program falters, there are few alternatives to pick up the slack since most US naval warships only have one specialized builder. In short, America’s naval industrial base has become lean to the point of brittle, undermining the nation’s ability to field enough ships quickly in a crisis. This predicament would be alarming under any circumstances, but it is especially so given the rapid naval buildup of a rising peer competitor in China.

China’s Rapid Naval Expansion & Strategic Challenge

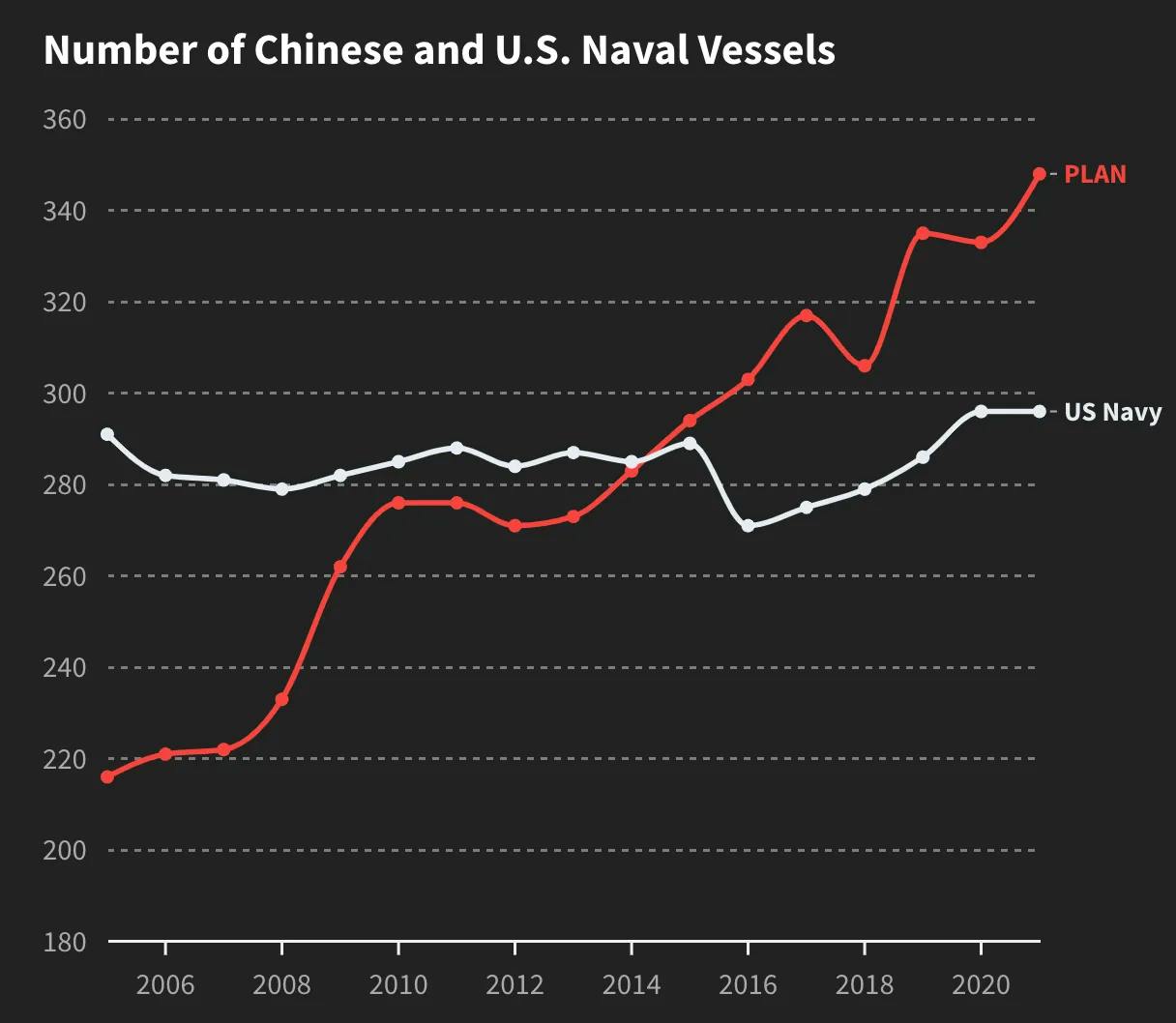

While US shipbuilding has sputtered, China has been racing in the opposite direction: expanding and modernizing its navy at an unprecedented pace. In the span of about 25 years, China’s People’s Liberation Army Navy (PLAN) has transformed from a coastal defense force into a blue-water fleet operating across the Indo-Pacific and beyond. According to the US Department of Defense, China now fields the largest navy in the world. It surpassed the US Navy sometime between 2015 and 2020, with roughly 355 battle-force ships (not counting dozens of smaller missile-armed patrol craft).

The Chinese Navy is on track to grow its size to 420 ships by 2025 and about 460 by 2030. By comparison, the US Navy had under 300 deployable ships as of November 2022, a figure essentially flat or even declining – the Navy projects around 290 ships by 2030, a decline from 2024 levels. In other words, barring a dramatic change, the US fleet will remain far smaller than China’s in sheer numbers for the foreseeable future.

Source: CSIS

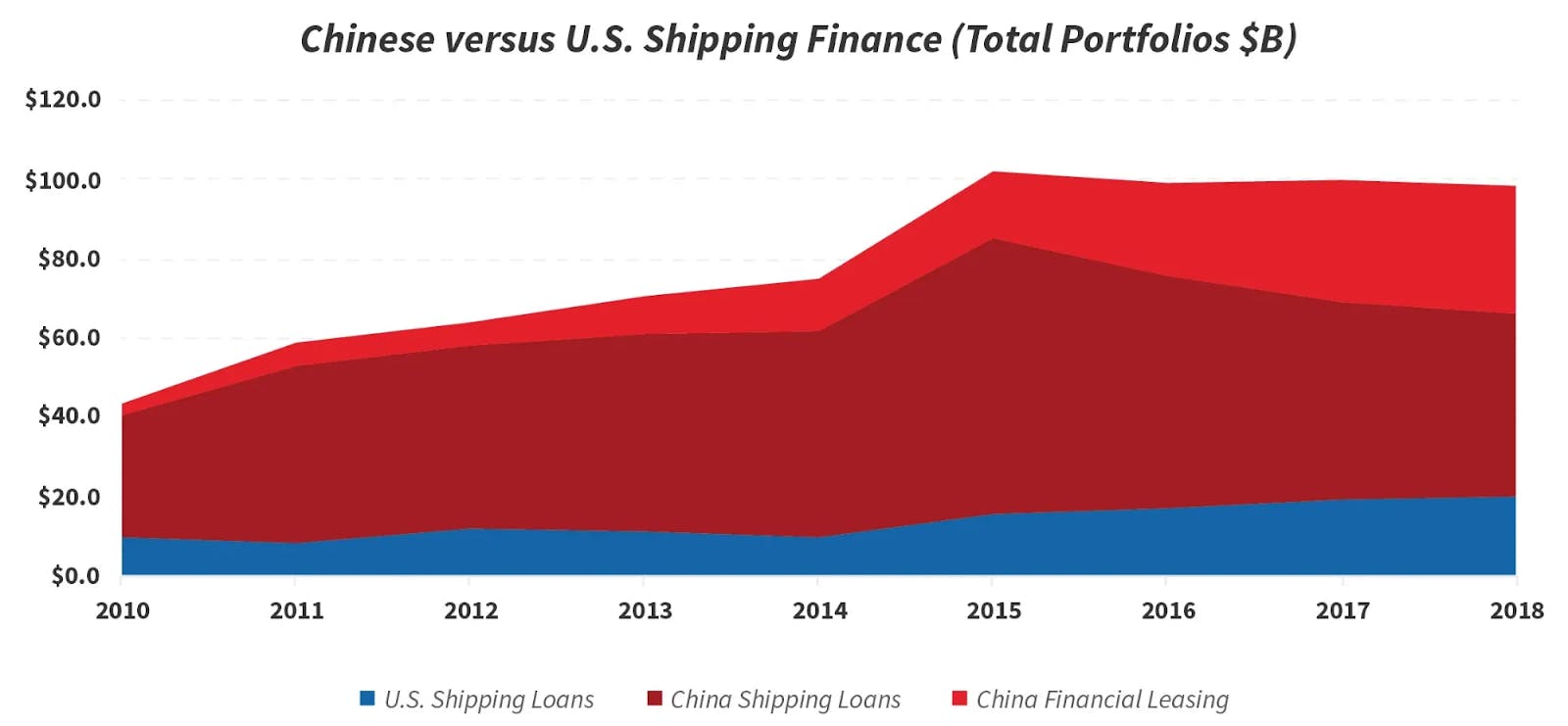

China’s naval growth is not just about quantity, it’s also about capability and strategic ambition. Beijing has invested in advanced destroyers, stealthy submarines, large amphibious assault ships, and even aircraft carriers. Just as important, it has built a vast shipbuilding infrastructure to support this expansion. China’s government heavily subsidizes its shipyards, with CSIS estimating $127 billion in state support between 2010 and 2018 — a figure that has likely increased since.

Source: CSIS

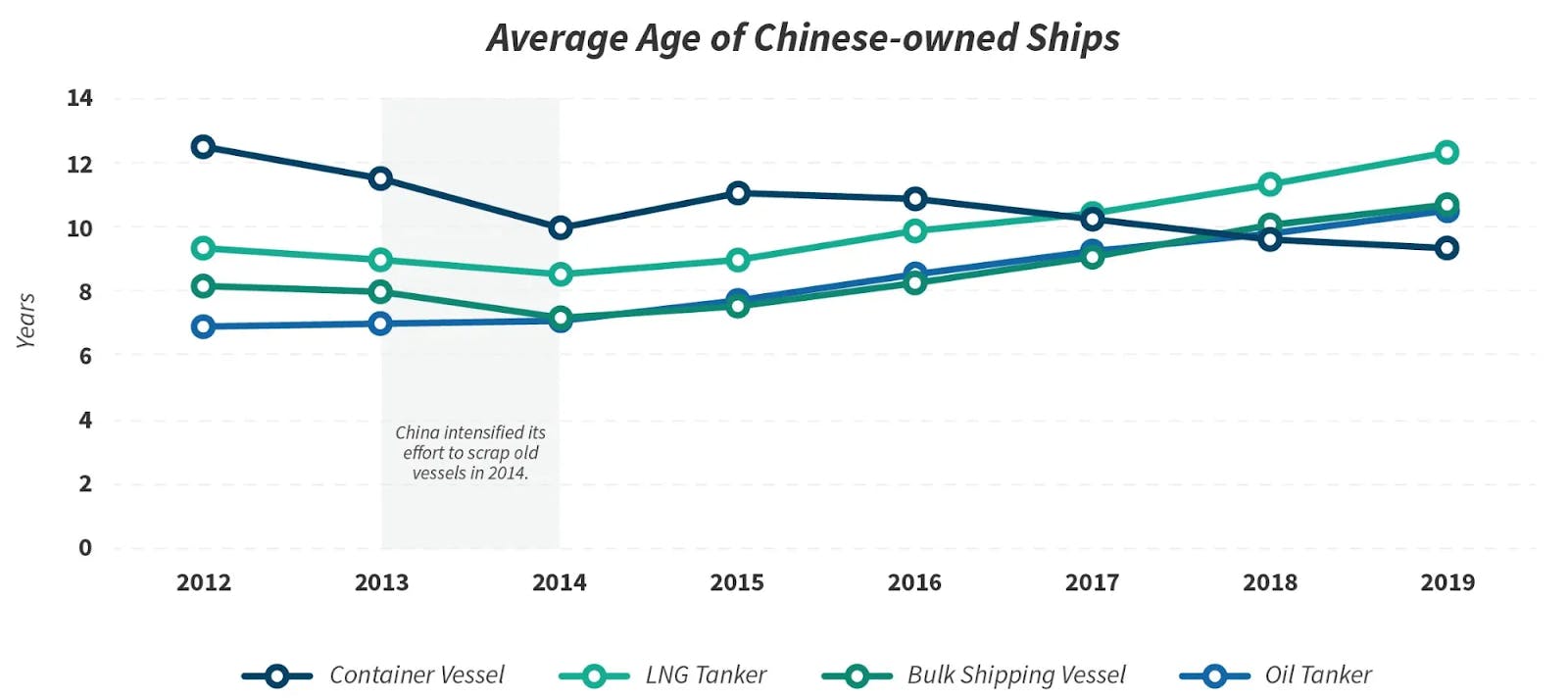

In an effort to boost demand, China also introduced a “scrap and build” subsidy program in 2010, allowing Chinese shipping companies to upgrade their fleets at substantially reduced costs. Initially, companies were required to destroy older vessels before receiving the full subsidy. However, beginning in 2014, firms became eligible to receive subsidies even before initiating construction of replacement vessels. This adjustment increased the incentive to retire older ships, as companies could now access subsidy funds upfront.

Source: CSIS

Moreover, the sheer size of China’s shipbuilding capacity is staggering, with over 20 major facilities (building both warships and commercial vessels) and over 140 dry docks for ship construction and repair as of February 2024. This industrial capacity translates into astonishing output: a leaked US naval intelligence briefing from July 2023 noted that Chinese shipyards have a manufacturing capacity of roughly 23 million tons of shipping per year, compared to under 100K tons in the US – a more than 200-to-1 advantage. In practical terms, China can launch new ships much faster and in greater volume than the United States can. The PLAN’s expansion has already given China a powerful presence in its regional waters, and it’s increasingly operating in the Indian Ocean, Mediterranean, and other far-flung areas.

Strategically, this naval buildup underpins China’s bid to become a global superpower and reshape the balance of power in Asia. China’s leadership has articulated clear goals for its navy: to take Taiwan by force if necessary, to exert control over the East and South China Seas, and to secure vital maritime trade routes carrying oil and raw materials to the mainland. Beijing also aims to deny the US Navy access to its near waters and erode American influence in the Western Pacific. To achieve this, China is developing so-called “anti-access/area-denial” (A2/AD) capabilities — long-range anti-ship missiles, bomber aircraft, hunter-killer submarines, and smaller autonomous ships — all aimed at keeping US carrier strike groups at a distance.

In tandem with these efforts, China has frequently infringed on the maritime claims of neighboring nations, including the Philippines and Japan, challenging their control over disputed islands and exclusive economic zones. In short, China is using its growing fleet both as a shield (to guard its interests) and a sword (to assert its power). The result is a fundamental challenge to the US Navy’s historical dominance of the seas. For the first time in recent memory, the US faces a peer competitor at sea – one with the capacity and the intent, to outrun America’s naval presence if current trends continue. This new reality demands a rethinking of how the United States approaches building and maintaining naval power.

The Shift Toward Autonomous & Attritable Systems

Confronted with the challenges of a revitalized Chinese fleet and a constrained US shipbuilding base, American defense planners are increasingly looking to new technologies and operational concepts to level the playing field. One of the most promising avenues is the development of autonomous and attritable systems for naval warfare.

Attritable platforms are systems designed to be low-cost and expendable, meaning commanders can risk (or even lose) them in large numbers without suffering an unacceptable strategic loss. This is a stark contrast to traditional capital ships, which are enormously expensive and crewed by hundreds, making their loss devastating. By contrast, unmanned systems, including uncrewed surface vessels (USVs), underwater drones, and aerial drones, can be made relatively cheap and in bulk, offering a way to field large numbers of assets quickly despite a tight budget or limited shipyard space. Just as importantly, autonomous craft remove human sailors from harm’s way, allowing bolder tactics in high-threat environments.

The importance of these new systems is already evident in real-world conflicts and simulations. In recent war games, swarms of networked drones have repeatedly proven decisive. A 2020 RAND study of US-China conflict scenarios found that having an advantage in interconnected and attritable unmanned vehicles could give US forces a major edge, potentially tipping the balance in a clash with China.

Nowhere has the importance of these systems been more evident than in Ukraine, where the use of USVs in the Black Sea has imposed severe operational and economic costs on Russia. One RAND commentary from November 2024 noted that “a new age of naval warfare has been inaugurated in the Black Sea”, much like the introduction of torpedoes or anti-ship missiles did in earlier eras. Initial Ukrainian raids, such as the September 2023 attack on Sevastopol, forced the Russian Black Sea Fleet to reduce patrols near Ukrainian waters and scramble to retrofit ships with close-in weapon systems. By mid-2023, Ukraine had transitioned to swarm tactics, using electronic spoofing and distributed strikes guided by SpaceX’s Starlink.

Beyond economic warfare, USVs have directly shaped battlefield dynamics by neutralizing high-value Russian assets at minimal cost. The use of relatively inexpensive USVs to deploy FPV drones, which successfully destroyed Russia’s costly Pantsir-S1 air defense system (valued at $15–20 million), highlights the asymmetric return on investment of such systems. Large-scale strikes, such as the August 2023 Kerch Bridge attack, forced Russia to deploy S-400 air defense batteries away from frontline operations, reducing their overall effectiveness.

The US Department of Defense has taken notice. In 2023, Pentagon leaders announced a new initiative called “Replicator” aimed explicitly at fielding swarms of autonomous weapons on a fast timeline to counter China. Deputy Defense Secretary Kathleen Hicks described it as a plan to deploy “thousands” of small drones across multiple domains (air, land, and sea) within 18–24 months. The first phase, backed by roughly $1 billion in funding, focuses on massed lethal autonomous surface drones and loitering munitions to help blunt a potential Chinese invasion of Taiwan. The logic is straightforward: overwhelm the invader’s ships and landing craft with so many robotic attackers that their defenses cannot cope.

This marks a shift in Pentagon priorities toward agile, attritable systems that can be produced and deployed rapidly, rather than exquisite but slow-to-field programs. In essence, the US military is preparing to fight quantity with quantity – leveraging American strengths in technology and automation to offset the sheer scale of China’s shipbuilding. This is not to say the era of the traditional warship is over, but it’s clear that autonomous and expendable systems will play an increasingly central role in future naval warfare.

Moving Beyond Big Warships: A New Paradigm

The embrace of autonomy also reflects a growing realization: the US cannot rely on a few giant warships to guarantee control of the seas in the modern threat environment. Large vessels like aircraft carriers, cruisers, and big-deck amphibious ships pack tremendous firepower, but they also concentrate huge value on single targets. In an age of precision-guided missiles, that makes them potentially vulnerable “eggs in one basket.”

For instance, China has developed long-range anti-ship ballistic missiles (notably the DF-21D, dubbed the “carrier killer”) specifically to target US carriers from afar. Some analysts have warned that, without new defensive measures, a multi-billion-dollar US supercarrier could be turned into a “sitting duck” by a much cheaper missile salvo. The traditional answer to these threats was to add more armor, more point-defense weapons, or more electronic countermeasures to each ship, while also layering on more and more functionality in the hope of creating an all-encompassing platform.

But this approach backfired: costs ballooned, ships became overengineered and brittle, and maintenance burdens soared. All of this exacerbated the cycle of bigger, pricier hulls that could only be built in limited numbers. Today’s reality calls for a different approach: distributing combat power across many more platforms, some of them unmanned and relatively inexpensive. By shifting toward fleets of smaller, autonomous vessels, the Navy can make its force more flexible, resilient, and sustainable.

Small, robotic craft have several advantages that complement (and in some roles, could replace) their larger counterparts. First is sheer manufacturability. A 10-foot or 20-foot unmanned boat can be built in days or weeks on an assembly line, not years in a specialized shipyard. They require far fewer unique components — no onboard crew facilities, for example – and can potentially be produced by commercial boatbuilders or even adapted from civilian designs. This means that in a crisis, production of such vessels could be ramped up quickly, tapping into the broader manufacturing base. By contrast, constructing an aircraft carrier or destroyer is a massive undertaking that only a couple of yards in the country can do, and surging production is nearly impossible given current constraints.

Second, a swarm of small vessels is inherently harder to defeat than a single large one. Ten autonomous boats carrying surveillance gear or weapons can disperse over a wide area, making it difficult for an adversary to track and destroy them all. This resilience by numbers is a key reason the Navy is experimenting with concepts like “distributed maritime operations,” which aim to network many smaller nodes together rather than depending on a handful of high-value units. Smaller unmanned systems are not only cheaper to acquire but also far less costly to lose.

For the price of one guided-missile frigate, the US Navy could deploy dozens of armed USVs, each replaceable far faster than a crewed ship and without risking sailors’ lives—dramatically complicating an enemy’s calculations. An adversary might hesitate to waste an expensive anti-ship missile on a low-cost drone decoy; and if they do, the exchange favors the US in terms of cost. In essence, swarms of low-cost vessels turn the economics of naval combat around – imposing high costs on the enemy to eliminate our cheap assets, while any hits they manage to score yield only limited gains.

None of this is to suggest the US Navy will (or should) scrap its carriers and destroyers overnight. Capital ships still have roles – for power projection, air defense, and as floating airfields and sea bases that unmanned craft cannot yet perform at scale. However, the Navy’s own leadership acknowledges the need for a more balanced and distributed fleet. Navy force structure assessments and strategy documents from November 2024 signal a shift toward a “more distributed fleet architecture” with much greater use of unmanned vessels alongside traditional ships.

For example, instead of sending one or two warships to patrol a chokepoint or shadow a potential adversary, the Navy could deploy a dozen mini-drones and a couple of larger unmanned vessels, covering more area and presenting more dilemmas to any opponent. This concept has already been demonstrated in exercises: the Navy’s Unmanned Integrated Battle Problem exercises in 2021 tested teams of unmanned surface and air vehicles working together with manned ships, showing promising results in extending sensor range and targeting abilities. The trajectory is clear – naval power is becoming as much about software, sensors, and smart swarms as it is about steel hulls and heavy firepower.

How Saronic Fits In

All these factors – the historical primacy of sea power, the worrying decline of shipbuilding, the meteoric rise of China’s navy, and the advent of attritable autonomous warfare – converge on a stark conclusion: the United States must rapidly adapt to avoid losing its maritime edge. This is precisely the context that necessitated the founding of Saronic, a company dedicated to developing autonomous surface vessels at scale. While Saronic is focused on addressing defense imperatives, it also supports commercial applications of its ASVs, recognizing that there are similarly critical missions and use cases across industries – such as maritime security – that benefit from these advanced capabilities and platforms.

Saronic builds autonomous surface vessels (ASVs) for the US Navy and other defense customers, with a focus on speed, modularity, and operational autonomy. Its fleet — which includes the 6-foot Spyglass, 14-foot Cutlass, and 24-foot Corsair — is designed to perform missions such as surveillance, targeting, and loitering munitions launch, either independently or as part of a coordinated swarm. By specializing in smaller-scale, software-driven designs, Saronic aims to complement existing shipbuilding programs and meet the evolving needs of naval, maritime, and commercial operations, while addressing the Navy’s evolving requirements in particular. Saronic aims to deliver flexible, rapidly deployable maritime systems that complement larger naval platforms and fill critical gaps in America’s strained shipbuilding ecosystem.

Founding Story

Saronic was founded in 2022 by Dino Mavrookas (CEO), Vibhav Altekar (CTO), Doug Lambert (COO), and Rob Lehman (CCO). The company was conceived with a singular focus: to develop cutting-edge ASVs and modernize naval operations.

For Dino Mavrookas, the company’s CEO, the journey to founding Saronic began decades earlier at Rutgers University. A junior in college when 9/11 happened, he had planned to build a career in cybersecurity — until the attacks sparked a sudden sense of duty in him. A chance encounter with a Navy recruiting office in a New Jersey strip mall set him on an entirely new course. That day, he learned about the SEALs’ mission and culture, and within months he took a leap of faith and enrolled in the notoriously grueling BUD/S program to prepare to become a SEAL. Mavrookas succeeded, earned a place on SEAL Team 6, and completed nine combat deployments over the course of 11 years.

After leaving the SEALs in 2015 after 11 years in the Navy, Mavrookas enrolled at Wharton, where he earned his MBA, and subsequently he accepted a job at Vista Equity Partners in Austin. He spent almost four years there and focused on industries ranging from cybersecurity to media. However, he eventually felt a “second call to serve” in defense.

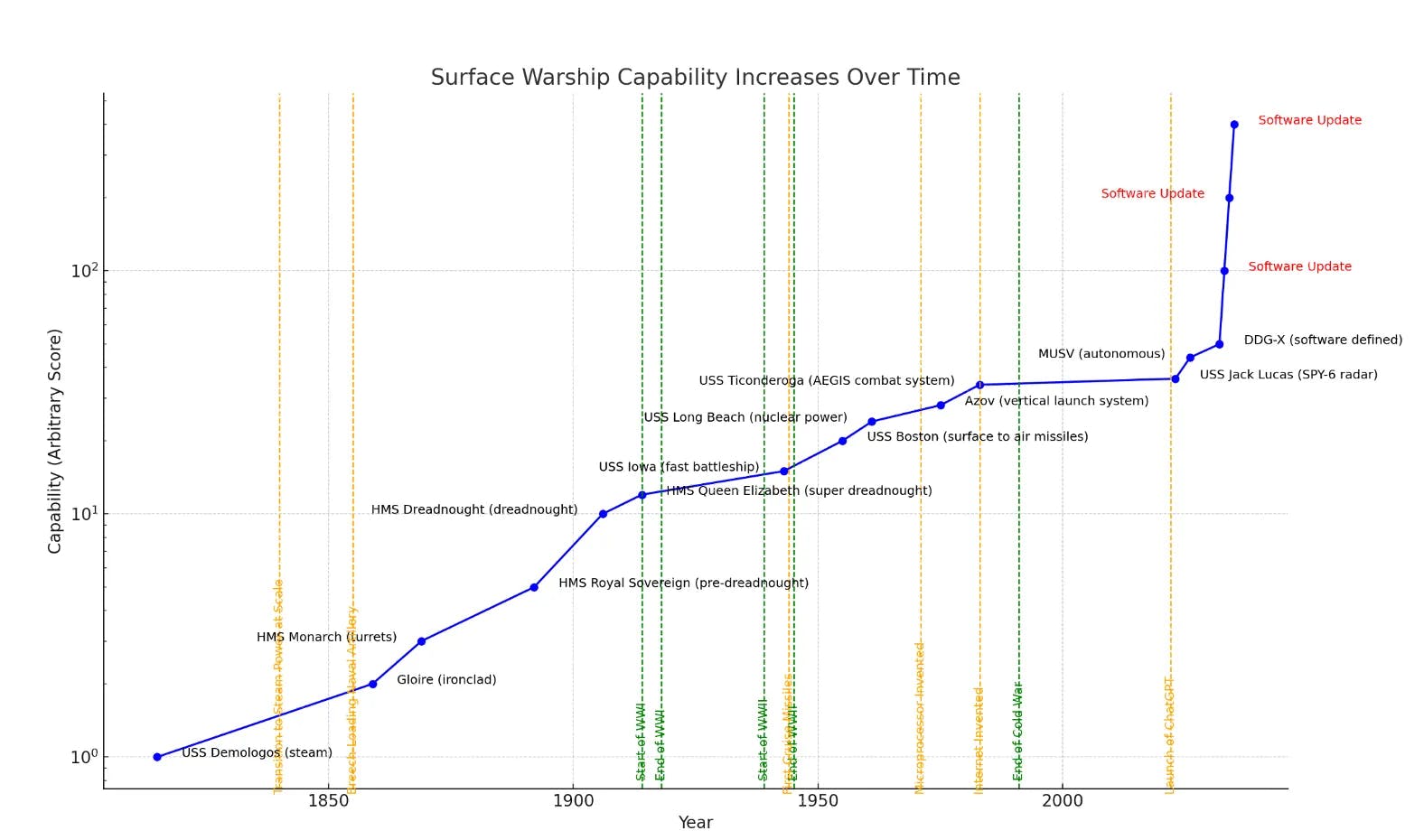

Mavrookas saw a critical gap in maritime defense: naval vessels and related technologies lagged at least two decades behind autonomous vehicles in the air or on land, yet maritime threats were evolving rapidly. After participating in 8VC’s Build Program, Saronic was able to start working with the Navy in mind as a future primary customer; acknowledging the challenge but also seeing a path for transformative change.

Even before formalizing Saronic, Mavrookas had begun assembling a small team. Key to their vision was Vibhav Altekar (Co-Founder & CTO), who had studied Electrical Engineering at UC Davis. After helping scale Standard Metrics for 8VC, Altekar joined Anduril* in 2018, where he became an engineering manager focusing on perception software for autonomous defense systems. In 2022, drawn by the prospect of pushing maritime technology forward, he left Anduril to co-found Saronic.

Another linchpin was Rob Lehman (Co-Founder & CCO), a Marine with 21 years of combined active-duty and reserve service, who had transitioned into industry roles at Northrop Grumman, ManTech International, and eventually served as CEO of TTI, a maritime technology supplier. Before joining Saronic, Lehman had founded 9 Line Solutions, where he helped companies navigate government contracts —expertise that would become critical in engaging with the Department of Defense.

Rounding out the founding team was Doug Lambert (Co-Founder & COO), who had studied Electrical Engineering at Lehigh University and completed a Master of Engineering Management at Dartmouth. Lambert spent more than six years as a senior electrical engineer at Liquid Robotics, rising to Head of Engineering, and later served as VP of Engineering at Terradepth. His background in building advanced maritime hardware complemented Vibhav’s software expertise, Mavrookas’ operational and strategic vision, and Rob Lehman’s deep understanding of Capitol Hill.

While they recognized that the Navy could be a difficult customer to acquire, their approach was grounded in the belief that quick, incremental testing and close collaboration with both policymakers and service members would be essential to modernizing maritime operations. Within their first 90 days, theysecured two government contracts — an unusual feat for an early-stage defense startup — and by the 180-day mark, theyhad prototypes of their ASVs in the water.

Product

Saronic’s maritime solutions revolve around a family of autonomous surface vessels (ASVs) that share a modular open-architecture design. Each system — the six-foot Spyglass, 14-foot Cutlass, and 24-foot Corsair — can operate independently or in concert, giving naval, maritime, and commercial operators the flexibility to tailor missions across short, medium, and long ranges. A fourth vessel is under development, but like the rest of the lineup, it remains focused on surface operations rather than sub-surface missions.

Spyglass

Source: Saronic

The most compact offering, Spyglass, is six feet long and travels up to 30 nautical miles (nm), has a top speed of 20 knots, and supports payloads of up to 40 pounds. In one demonstration, multiple Spyglass ASVs launched from a US Navy vessel and quietly tracked a target during a nighttime ISR mission. Their beyond-line-of-sight communications linked each unit to a single operator interface, routing data via redundant radio-frequency pathways. By combining various sensors, passive sensing modes, and advanced edge computing, Spyglass units can identify and classify nearby vessels while maintaining low observability.

Cutlass

Source: Saronic

Building on Spyglass’s architecture, Cutlass measures 14 feet long and is built for more ambitious roles within the Joint Force. It offers a 300 nautical mile range, a top speed of 20 knots and can carry up to 200 pounds of mission-specific payloads, ranging from loitering munitions to modular sensor packages. During IBP 24.1, Saronic integrated the Altius loitering munition onto Cutlass to test maritime launch conditions for aerial drones, demonstrating how a surface platform can extend the operational envelope of unmanned aircraft. A built-in mast and radar provide additional situational awareness, while a microservices-based software architecture allows rapid integration of custom payloads or effectors.

Corsair

Source: Saronic

Corsair, unveiled in October 2024, was Saronic’s most powerful platform at that point. At 24 feet, it reaches speeds over 35 knots and covers up to 1K nautical miles with a payload capacity of 1K pounds. Designed for blue-water operations, Corsair can deliver a wide range of kinetic or non-kinetic effects, all while operating as a standalone unit or part of a larger swarm. Its fuel load illustrates Corsair’s high-endurance profile.

As of October 2024, Saronic was reportedly building five prototypes of the Corsair vessel, with live demonstrations having already been conducted for select end users.

Marauder

Unveiled in April 2025, Marauder is Saronic's first truly large vessel, measuring 150 feet in length—placing it firmly in MUSV territory. The vessel is designed to carry up to 40 metric tons, has a range of up to 3,500 nautical miles, and can loiter for more than 30 days. In addition, Marauder has a cruise speed of 12 knots and a burst speed of over 18 knots. As of May 2025, public information about Marauder was limited.

Source: Axios

Mirage and Cipher

Introduced in April 2025, Mirage and Cipher are Saronic's newest ships, measuring 40 and 60 feet in length, respectively. Mirage has a range exceeding 2K nautical miles and a payload capacity of 2K pounds, effectively doubling the Corsair's capabilities. Cipher surpasses this, offering a range upwards of 3K nautical miles and a payload capacity of 10K pounds. As of May 2025, detailed public information about both Mirage and Cipher remains limited.

Source: Saronic; Left to right: Saronic’s Corsair (24'), Mirage (40'), and Cipher (60')

General Functionality

All of these vessels rely on a Modular Open Systems Architecture (MOSA), ensuring that any software or hardware component can be swapped between platforms. This high level of interoperability extends beyond Saronic’s own systems: during the US Navy’s Integrated Battle Problem (IBP) 24.1 exercise, Spyglass and Cutlass were integrated with Anduril’s Lattice software to facilitate unified command and control. The result was a heterogeneous fleet — unmanned boats, aerial drones, and more — all managed within a single, scalable network.

Rapid experimentation is central to Saronic’s development ethos. The company says it can move an update from simulation to real hardware in under 90 minutes, and then to open-ocean trials in as little as 48 hours. Saronic’s footprint in Galveston’s Gulf waters allows robust open-sea testing, while additional testing happens on both coasts to support larger-scale demonstrations. To handle the complexity of data collection and replay, the company relies on tools like Foxglove and MCAP, reclaiming up to 20% of its engineering time that would otherwise be spent coding bespoke visualization software.

Each vessel also employs an extensive networking architecture that enables secure, distributed operations and shifts decision-making to the edge. This allows a single operator to oversee dozens—or even hundreds—of ASVs. Tracking data is seamlessly shared among swarm members, enabling coordinated maneuvers that keep manned platforms like cruisers or destroyers at a safer standoff distance.

Saronic’s autonomy software is built around microservices and open-source frameworks. Techniques like CLIP (Contrastive Language–Image Pre-training) differentiate similar-looking vessels, while VQ/GPT models generate realistic weather and adversarial scenarios for advanced simulation.

Working with ASVs presents additional challenges because their operation must account for interactions with both air and water environments, unlike subsurface or aerial vehicles. Factors such as ocean temperature, salinity, and sea state significantly influence vessel performance and efficiency. Saronic’s engineers continuously refine these dynamics by analyzing real-world data from incremental testing.

Customer

The Navy’s Growing Interest in USVs

The US Navy’s interest in unmanned surface vessels has grown markedly in recent years, driven by both technological progress and strategic necessity. From 2019 to 2020, Navy leadership began publicly emphasizing the need for USVs to increase fleet capacity and distribute combat power. The Navy’s Unmanned Campaign Plan, released in 2021, laid out a vision to integrate unmanned systems across all domains, with USVs playing a key role in surveillance, minesweeping, and as adjunct missile magazines. This enthusiasm, however, met initial skepticism from Congress, which was concerned about unmanned vessel reliability and the concepts of operation. Congress slowed funding for large USVs in FY 2020–21, directing the Navy to further test and refine the technology before moving to procurement.

In response, the Navy adjusted its approach: it leveraged prototyping funds from the Pentagon’s Strategic Capabilities Office (for Ghost Fleet Overlord) and focused on proving concepts with prototypes. By FY2024, Congress started to warm to USVs – appropriating increased R&D funding and standing up an LUSV program. The Navy also set up an unmanned task force at the Pentagon level to coordinate development, which has since been replaced by the Disruptive Capabilities Office. The Navy even appointed a Director of Unmanned Systems on the OPNAV staff (sometimes informally called “N99”) to serve as an advocate for unmanned requirements and budgets.

Establishment of Unmanned Surface Vessel Squadrons

To integrate these unmanned vessels into operations, the Navy has established dedicated unmanned surface vessel units. USVRON-1, introduced in 2019, was created to test, develop, and operate medium and large USVs in fleet contexts to create new warfighting advantages. This unit controls existing prototype USVs – including the Sea Hunter and Sea Hawk from the ACTUV program and the Ghost Fleet Overlord vessels – and works on tactics for teaming them with conventional naval forces.

In addition to USVRON-1, the Navy is expanding its unmanned surface fleet on other fronts. It established USVRON-3 in 2024 and plans to stand up USVRON-7 in 2025, both based in San Diego. These newer squadrons are primarily focused on small USVs to support the Navy’s needs. In particular, the Navy is fielding the Global Autonomous Reconnaissance Craft (GARC) – a 16-foot robotic boat used for surveillance and reconnaissance. Hundreds of these small craft are planned: the Navy has already invested over $160 million in GARC systems and aims to ramp up production to 32 vehicles per month by late 2025. USVRON-3 and USVRON-7 will operate and maintain fleets of these and other small USVs, experimenting with how swarms or networks of small unmanned boats might patrol chokepoints, provide targeting data, or perform other missions at the tactical edge

For Saronic, the establishment of Squadron 7 is an important development: it creates a clearer pathway for the procurement and deployment of companies’ USVs. Instead of ad-hoc experimental buys, the Navy now has official units that will budget for and buy USVs to equip their squadrons.

The DoD “Replicator” Program

Replicator is a Department of Defense initiative announced in late August 2023 with the aim of fielding thousands of attritable autonomous systems across multiple domains within 18–24 months. Deputy Secretary of Defense Kathleen Hicks introduced Replicator as a direct response to China’s numerical advantage, seeking to “replicate” affordable drones at scale to complicate adversary planning. The program is not a single new funding line but rather a coordinated push to harness existing and new production efforts for a rapid surge in unmanned capabilities. Importantly, Replicator is explicitly focused on the Indo-Pacific theater and envisages swarms of drones (air, surface, and subsurface) that can be deployed quickly to deter aggression.

Under Replicator’s umbrella, the Pentagon has re-prioritized resources and cut red tape to accelerate procurement of key systems. About $500 million was earmarked in the FY2024 budget to kick-start Replicator projects and another $500 million is expected for FY2025. The first tranche of Replicator capabilities was reported to include all-domain attritable systems, which likely means a mix of aerial drones and small USVs/UUVs for the Navy. By early 2024, insiders hinted that certain Navy USV efforts, such as GARC, would be part of Replicator’s initial wave. The rationale is that initiatives already at the prototype stage, which can be manufactured quickly in large quantities (such as a small unmanned vessel easily produced by a commercial shipyard), make the strongest candidates.

Replicator is understood to be structured in multiple phases. Phase I focuses on identifying unmanned and autonomous technologies already in development — particularly those that can be scaled, produced, and fielded quickly. Phase II aims to accelerate production lines by removing barriers to mass procurement, leveraging commercial manufacturing and streamlined contracting. Finally, Phase III involves expanding operational concepts — integrating these systems with existing force structures and adapting doctrine to best utilize large numbers of affordable, attritable drones. Given Saronic’s focus on building autonomous, attritable systems, it is likely already pursuing the Replicator initiative, though the company has not publicly released any information on this effort.

Medium Unmanned Surface Vehicle (MUSV)

The Medium Unmanned Surface Vehicle (MUSV) program is the Navy’s first venture into medium-sized autonomous ships designed for intelligence, surveillance, and reconnaissance (ISR) and other support missions. In 2020, the Navy awarded L3Harris Technologies a $34.9 million contract to design and build an MUSV prototype, with options for up to nine vessels in total. The MUSV’s primary role is to extend the fleet’s sensing range and networked awareness by scouting ahead, conducting ISR, and potentially carrying electronic warfare or other payloads that support manned warships.

Navy officials see MUSVs as a critical element of future distributed operations. Rear Admiral Fred Pyle noted in January 2023 that recent exercises had demonstrated the value of medium USVs for missions like cyber surveillance and targeting support. After experimentation in 2022, including MUSV prototypes participating in the Rim of the Pacific (RIMPAC) exercise, the Navy grew “very excited about the prospects of what MUSV can bring” to the fight. The plan is for MUSVs to act as forward-deployed “eyes and ears” of the fleet, focusing on “ISR and targeting, counter-ISR and targeting, and information operations missions.” The Navy’s Program Executive Office for Unmanned and Small Combatants (PEO USC) is working closely with fleet commanders to refine what capabilities these medium USVs should have. The exact timeline for full MUSV procurement is still being determined, as the Navy debates the mix of small versus medium USVs for ISR.

Ghost Fleet Overlord & Large USV Prototypes

At the larger end of the USV spectrum is the Navy’s “Ghost Fleet Overlord” program, which has developed prototype unmanned ships roughly the size of small warships. Launched in 2018 by the Department of Defense’s Strategic Capabilities Office (SCO), Ghost Fleet Overlord was intended to accelerate the Navy’s adoption of unmanned and autonomous systems by converting existing commercial vessels into unmanned platforms. In partnership with the Navy, SCO outfitted these vessels with autonomous navigation systems, upgraded their mechanical and electrical systems for reliability, and added a command-and-control architecture for remote operation.

The first phase of the program converted two offshore support ships into USV prototypes, late named NOMAD and RANGER. During testing, NOMAD and RANGER together logged nearly 29K nautical miles in autonomous mode, participating in multiple fleet exercises and demonstrating the ability to deploy various payloads. Notably, both unmanned ships even navigated autonomously through the Panama Canal – a complex transit underscoring the maturity of their autonomy systems.

The success of these initial prototypes led the Navy to acquire two additional Overlord vessels for continued experimentation. Unlike the first pair, which were conversions, the third and fourth prototypes (named Vanguard and Mariner) were purpose-built from the keel up as unmanned ships using naval shipbuilders. At around 200–300 feet in length, the Ghost Fleet Overlord vessels are designed to eventually carry significant combat power. In fact, these large USV prototypes have space for 16 to 32 vertical launch missile tubes, suggesting they could act as unmanned missile magazines or sensor platforms in support of the fleet.

The Navy envisions future Large Unmanned Surface Vessels (LUSV) based on this work – armed drone ships that could supplement manned combatants by launching missiles or providing decoy and scouting functions. Data and lessons from the Ghost Fleet Overlord trials are now feeding into requirements for the Navy’s planned LUSV program of record. The SCO formally handed over the Overlord project to the Navy’s PEO Unmanned and Small Combatants in March 2022, with Navy brass hailing NOMAD and RANGER as “catalysts” for developing future USV programs.

Market Size

The defense sector for USVs is expanding rapidly from a relatively small base, with many navies including USVs in their future force structure plans. One projection estimates that the global USV market (largely defense-driven) will grow from around $1.1 billion in 2024 to $2.5 billion by 2034 with a 6.7% CAGR through 2029. Other forecasts focused only on defense and security applications are even more bullish – one predicts cumulative defense USV spending of up to $13.4 billion over 2022–2030, with an annual growth rate of about 10.2%. In short, the total addressable market for defense USVs is on track to more than double in the next decade, fueled by rising global investments in naval autonomous systems.

While the majority of Saronic’s efforts have focused on its work within the defense market, Saronic’s vessels also have applicability to the commercial market and the company is advancing into this space. From oil and gas exploration to oceanographic research, there are a myriad of commercial opportunities whose markets will continue to grow.

Competition

Direct Competitors (Autonomous USV Designers)

Maritime Applied Physics Corporation (MAPC): Maritime Applied Physics Corporation (MAPC) is a defense contractor specializing in innovative maritime technologies, including the Global Autonomous Reconnaissance Craft (GARC), a 16-foot unmanned surface vehicle (USV) designed for low-cost, high-volume surveillance. With a top speed exceeding 35 knots and an operational range of over 400 nautical miles, GARC has become a key component of the US Navy’s expanding unmanned fleet.

In January 2025, the Navy moved to mass-produce GARC at a rate of up to 32 per month, demonstrating its commitment to deploying swarms of small USVs. These craft are relatively inexpensive and attritable, designed to operate in large numbers for missions such as maritime domain awareness, decoy/target roles, and potential one-way strike missions when outfitted with explosives.

Leidos: Leidos, a defense contractor with expertise in autonomous maritime systems, developed the Sea Hunter and Sea Hawk under the Anti-Submarine Warfare Continuous Trail Unmanned Vessel (ACTUV) program, initially funded by DARPA. These 132-foot trimaran USVs were designed for long-range, long-endurance missions, focusing on anti-submarine warfare (ASW) patrols and surveillance. Capable of traveling 10K nautical miles without refueling, they utilize a diesel engine and stabilizing outriggers.

The first vessel, Sea Hunter, was launched in 2016, achieving groundbreaking milestones, including a fully autonomous 5.2K-mile round trip between California and Hawaii without human intervention. By 2021, a second vessel, Sea Hawk, was introduced with enhanced capabilities, including improved endurance, advanced electrical systems, and expanded autonomous navigation technology.

L3Harris: L3Harris, a leading defense technology company, was awarded an initial $35 million contract in 2020 to develop a prototype for the US Navy’s next-generation Medium Unmanned Surface Vessel (MUSV) program. The contract allowed for the procurement of eight additional ships if funding was allocated, although the current budget does not show any funding planned in the coming years for MUSVs.

The L3Harris prototype was designed as a modular, multi-role platform capable of carrying advanced payloads such as radars, electronic warfare systems, and missile launchers. Unlike smaller unmanned vessels used for reconnaissance or decoy roles, the MUSV is intended for long-range, multi-week operations, acting as an autonomous force multiplier for the Navy’s existing fleet.

Beyond the MUSV program, L3Harris played a critical role in the US Navy’s Ghost Fleet Overlord program, which tested large unmanned surface vessels in autonomous fleet operations. The company provided the Machinery Control System and ASView™ Control System for both USV Mariner and USV Vanguard, ensuring they could function with minimal human oversight while performing complex naval missions.

Saildrone: Founded in 2012, Saildrone is a California-based company specializing in autonomous unmanned surface vehicles (USVs) designed for maritime surveillance, intelligence gathering, and environmental monitoring. The company has pioneered the development of long-endurance, wind and solar-powered USVs that can operate autonomously for months at a time. Saildrone’s USV fleet consists of three primary models:

Saildrone Explorer (23 ft): A lightweight, wind-propelled surveillance USV used for maritime domain awareness (MDA) and environmental research.

Saildrone Voyager (33 ft): A hybrid-powered USV optimized for anti-submarine warfare (ASW), equipped with active and passive sonar for undersea monitoring.

Saildrone Surveyor (72 ft): The largest in the fleet, this USV is designed for deep-sea mapping and sub-bottom profiling, carrying advanced multibeam echo sounders for bathymetric surveys.

Saildrone’s platforms feature extensive sensor payloads, enabling autonomous detection, tracking, and undersea monitoring. The data collected by Saildrone USVs is accessible via an API, allowing integration into various common operating platforms (COPs) for real-time intelligence sharing. The US Navy has tested and deployed Saildrone USVs under Task Force 59, which integrates unmanned systems into maritime operations in the Middle East. In the coming years, the 5th Fleet aims to deploy up to 100 unmanned vessels, including Saildrones, to form a "Digital Ocean" surveillance network.

Textron Systems: Textron Systems is a large defense contractor that developed the Common Unmanned Surface Vehicle (CUSV), which has become a key component of the US Navy’s mine countermeasures (MCM) strategy. Textron’s CUSV has also been adapted for ISR, force protection, and armed engagements. Textron’s CUSV is one of the first USVs to enter a Navy program of record for mine warfare and secured a $100 million contract with the Navy in March 2025. It has been tested in armed force protection roles, successfully engaging multiple targets using APKWS precision-guided rockets. Notable features include:

Autonomous Mine Countermeasures: Textron’s CUSV is equipped with mine-sweeping payloads and modular bays for sonar or disposal charges.

Weaponized Configurations: Textron has demonstrated a guided missile launcher variant, capable of engaging small, fast-moving threats autonomously.

Interoperability: The CUSV integrates into existing naval command-and-control networks, enabling fleet-wide unmanned coordination.

SeaSats: Founded in 2020, SeaSats is a US-based company specializing in compact, solar-powered unmanned surface vehicles (USVs) designed for commercial and defense applications. The company raised $10 million in February 2025, its total funding to date. SeaSats provides low-cost, persistent ISR solutions with a focus on near-shore and deep-sea monitoring.

SeaSats’ flagship product, the Lightfish, is a small, solar-powered USV with a low-profile design, making it ideal for covert operations and persistent surveillance. Key features include a 60-lb Payload Capacity that supports a variety of sensors, including cameras, sonar transducers, and water monitoring systems. Lightfish also supports long-duration operations, as it’s equipped with a solar panel, onboard battery, and generator, allowing for extended mission endurance. Finally, Lightfish is controlled by a browser-based UI. Operators can access and control missions via any web-enabled device, offering a user-friendly remote interface.

NATO Initiatives & Allied USV Programs

NATO: NATO has recognized autonomous maritime systems as a strategic priority and has launched several initiatives accordingly. In 2018, NATO launched the Maritime Unmanned Systems Initiative (MUSI) with 16 NATO Allies and NATO partner Australia to pool resources and promote interoperability in unmanned surface and underwater vehicles. NATO’s MUSI facilitates joint testing and development of USVs – for example, the annual exercise REP(MUS) (Robotic Experimentation and Prototyping of Maritime Unmanned Systems) in Portugal brings allies together to experiment with new unmanned vessels. NATO’s Dynamic Messenger exercise series, led by Allied Maritime Command, has further integrated unmanned surface vessels into NATO naval operations.

United Kingdom: The Royal Navy established an autonomy experimentation group (“NavyX”) and has operated the MADFOX USV (Maritime Demonstrator For Operational eXperimentation), a 13-meter autonomous test vessel delivered in 2021. Derived from L3Harris’ Mast-13 vessel, the MADFOX USV has a maximum speed of approximately 40 knots and is equipped with an electro-optic/infra-red imaging sensor. The UK is also investing in unmanned mine-hunting; under Project Wilton, the Royal Navy is integrating unmanned surface craft and submersibles to replace traditional MCM ships by the 2030s.

Turkey: Turkey’s defense industry produces the ULAQ series of armed unmanned surface vessels. Developed by Ares Shipyard and Meteksan Defence, the 11-meter ULAQ is equipped with day/night electro-optical sensors, anti-jamming GNSS infrastructure, self-righting capability, as well as a laser and IR-guided weapon systems. In May 2021, Turkey successfully conducted a live-fire test of the ULAQ, firing Cirit laser-guided missiles from the USV and hitting a sea target at 4 km range. This milestone marked NATO’s first demonstrated USV with anti-ship missile capability. Turkey envisions ULAQ variants for roles including surveillance, escort, and coastal defense, and has continued testing weapon integrations (such as 12.7mm remote weapon stations) on USVs.

France, Belgium, & Netherlands: France and Belgium are jointly pursuing next-generation mine countermeasures under the Belgian-Dutch MCM program. A key component is the ECA Group’s INSPECTOR-125 USV, a 12-meter unmanned surface craft chosen by the Belgian and Royal Netherlands navies to tow mine-hunting sonars and serve as a launch/recovery platform for underwater drones. This stand-off MCM concept keeps manned ships far from minefields while USVs do the dangerous sweep.

Chinese USV Technology

China has rapidly advanced its unmanned surface vessel programs, showcasing both smaller robotic craft and large unmanned warships. A notable example is the JARI USV, a 15-meter, 20-ton unmanned combat vessel developed by a subsidiary of China State Shipbuilding Corporation. The JARI USV is essentially a scaled-down warship: it is equipped with a 30mm remote gun, phased array radar systems, variable depth sonar, electro-optical systems, small anti-ship and anti-air missiles (launched from mini vertical launch cells), and even lightweight torpedoes. With a range of about 500 nautical miles and speeds up to 42 knots, JARI is designed for cooperative operations such as distributed fleet defense or swarm attacks. Chinese media dubbed JARI a “world-leading unmanned warship” when it achieved an initial operating capability in 2019.

Even more striking, China in late 2024 unveiled a large unmanned surface combatant dubbed JARI USV-A “Orca”. The Orca is a trimaran-hulled USV measuring 58 meters in length and 23 meters in beam, with a displacement of around 500 tons. It reportedly has an operational range of over 4K nautical miles and includes long-range strike, air defense, anti-missile, and anti-submarine warfare capabilities. According to naval expert H.I. Sutton, JARI USV-Ais “the largest combat USV in the water with any navy” and is significantly larger than the US Navy's Sea Hunter and Sea Hawk. Both JARI and JARI-USV are manufactured by China State Shipbuilding Corporation (CSSC), which makes one third of all ships in the world. CSSC was sanctioned in 2020 and is widely recognized as a Chinese defense company.

Source: H.I. Sutton

Operationally, China has been testing USVs in roles like swarming and reconnaissance. In recent years, PLA Navy exercises included unmanned boat formations for island surveillance and target practice. China has also reportedly deployed small USVs for tasks such as patrolling artificial island reefs in the South China Sea and as unmanned target vessels for naval training. However, there is limited public evidence of actual armed deployments so far; these systems appear to be in prototype or limited trial use, with full operational fielding likely in the coming years as China refines its autonomy and command integration.

Ukraine-Russia War

Russian USV Technology

Russia has been comparatively slower in USV development, but it is actively pursuing unmanned surfacecraft for both military and security applications. Russia unveiled several USV prototypes in recent years. In 2023, at Russia’s Army-2023 expo, the manufacturer KMZ introduced a “Vizir” multipurpose USV – a medium-sized unmanned boat with a hybrid diesel-electric propulsion system. The Vizir-based USV can reportedly sprint at up to 80 km/h (45 knots) and has a range of about 600 km on hybrid power.

In 2024, at the International Maritime Defense Show, Russia’s state-owned Rostec unveiled several additional USVs, including the “Orkan,” “BEC-1000,” and “Labyrinth.” The Orkan measures 5.3 meters in length and carries a 100-liter fuel capacity. The BEC-1000, a larger 7-meter-long USV, can reach speeds of up to 40 knots with a range of at least 500 km. Meanwhile, the compact Labyrinth, at just 2.95 meters in length, can carry a 100 kg payload and reach a maximum speed of 20 knots.

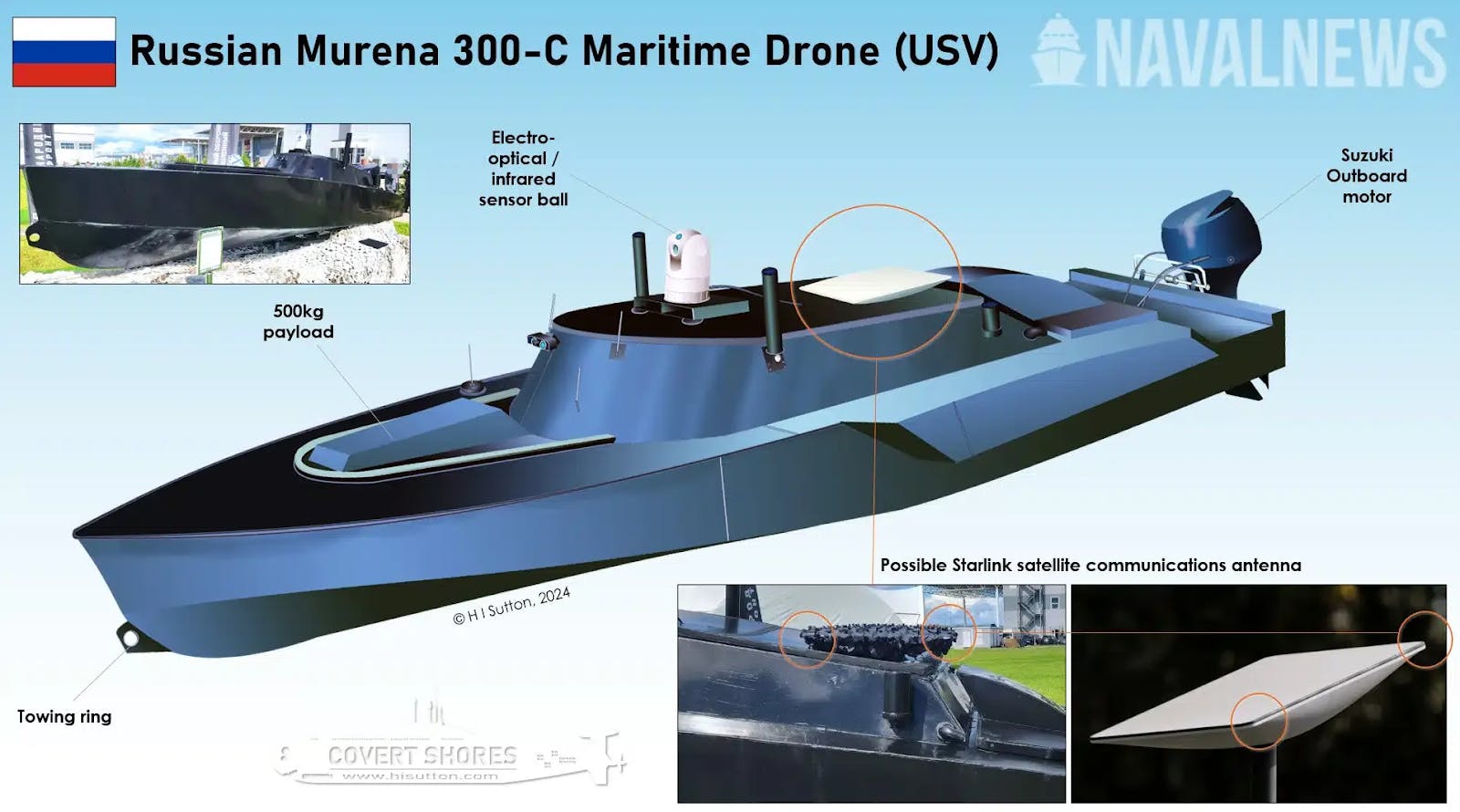

In August 2024, Russia also unveiled the Murena-300S, an unmanned surface vessel (USV) designed to protect naval facilities, conduct mining operations, and perform intelligence, surveillance, and reconnaissance (ISR) missions. Measuring 5.5 meters in length, it can carry a 500 kg payload and has a range of 500 km. The USV is equipped with an inertial navigation system (INS), electro-optical sensors, infrared thermal imaging, and LIDAR. While not officially confirmed, it is widely believed to feature a Starlink antenna.

Source: NavalNews

Ukrainian USV Technology

Ukraine has emerged as a leader in low-cost unmanned surface vehicle (USV) technology, leveraging it to counter Russian naval forces. Its three most important platforms are the Mugara V5, the Sea Baby USV, and new naval drone carriers.

The Magura V5, developed by the Main Directorate of Intelligence of Ukraine (HUR), is the most prominent USV in Ukraine’s arsenal and is designed for surveillance, reconnaissance, patrolling (ISR), and direct combat operations. At 5.5 meters in length and weighing less than 1K kg, it boasts an 800 km operational range and a speed of 78 km/h (42 knots). The Magura V5 carries a 200 kg payload, making it highly effective for targeting warships due to its agility and maneuverability. Costing approximately $273K per unit, it provides a cost-efficient solution for Ukraine’s asymmetric naval strategy.

Complementing the Magura V5 is the Sea Baby USV, engineered by the Security Service of Ukraine (SBU) and sold for $218K. This larger, more heavily armed vessel is built for high-impact strikes, carrying up to 850 kg of explosives. Unlike the Magura V5, which prioritizes mobility, the Sea Baby is designed to engage static naval targets, such as ships docked in port or bridges. Moreover, the Sea Baby has evolved into a modular platform, capable of deploying advanced guided missile launchers, laser guidance systems, and thermobaric weapons, expanding its tactical flexibility.

Ukraine has also introduced a new class of naval drone carrier USVs capable of launching aerial drones, marking a significant evolution in robotic warfare. These vessels, costing around $250K per unit and measuring approximately 18 feet in length, integrate maritime and aerial capabilities by deploying multiple first-person-view (FPV) drones with a range of about five miles. This technology has already been utilized in combat operations, including raids on Russian-occupied oil platforms in the Black Sea, and was reported to have already destroyed a third of Russia’s Black Sea fleet in January 2025. By combining USV and drone capabilities, Ukraine has created a force multiplier that enhances situational awareness and precision targeting.

Ukraine has also accelerated the deployment of USVs armed with anti-aircraft missiles, an area where they were previously vulnerable. These vessels are equipped with two R-73 (AA-11 Archer) air-to-air missiles, providing a missile range of approximately 15 km when surface-launched. At least one vintage Osa air-defense system has been modified to carry R-73 missiles, while British-supplied ASRAAMs have also been adapted for ground-based use. These hybrid systems, creatively combining different missile technologies, are informally referred to as “FrankenSAMs’”

Source: NavalNews

Business Model

Saronic funds its own development of autonomous surface vessels, reducing reliance on government grants and cost-plus deals. By designing, building, and testing platforms before the Navy issues official requirements, Saronic can deliver ready-to-field solutions and shorten development timelines.

Securing a program of record is critical to Saronic’s long-term viability, ensuring stable revenue through initial production contracts and ongoing maintenance agreements. This status would also validate Saronic’s standing, paving the way for future contracts and ensuring a faster path to recurring revenue.

Traction

In April 2024, Saronic showcased the advanced capabilities of its Spyglass and Cutlass USVs, during the US Navy's Integrated Battle Problem (IBP) 24.1 exercise. The company has also significantly expanded its physical infrastructure to support growing demand. In February 2025, Saronic acquired an additional 420K square-foot facility in Austin, Texas, increasing its total operational space in Austin to over 520K square feet. This expansion enhances production capabilities to support its growing Autonomous Surface Vessel fleet, including Corsair. The Austin expansion will also facilitate substantial workforce growth, with Saronic expecting to double its employee base from approximately 300 to 600 by the end of 2025.

Saronic has expanded its partnerships, including a strategic collaboration with Palantir to accelerate the development and delivery of autonomous naval capabilities. This partnership combines Saronic’s expertise in autonomy and manufacturing with Palantir’s software, such as Warp Speed, to enhance operational efficiency and accelerate decision-making.

Saronic’s commitment to revolutionizing the maritime industry also includes plans for Port Alpha, an advanced, next-generation shipyard dedicated exclusively to autonomous vessel production. Announced as part of its latest fundraise, Port Alpha will aim to deliver autonomous ships at speeds unmatched since World War II. Although the location of Port Alpha has not yet been finalized, Saronic plans to invest more than $2.5 billion into the shipyard over its lifetime. As of February 2025, the facility is expected to become fully operational within the next five years.

In April 2025, Saronic announced its acquisition of Gulf Craft, a Louisiana-based shipbuilder. The 100-acre site provides Saronic with strategic positioning on the Gulf Coast, enabling the company to begin production of its MUSV fleet. Saronic intends to invest over $250 million into the facility, increasing its production capacity to 50 ships per year. The company has retained Gulf Craft’s existing workforce and expects the investment to create more than 500 jobs over the next four years, while also acquiring valuable institutional shipbuilding expertise.

Valuation

In February 2025, Saronic raised a $600 million Series C round at a $4 billion valuation, less than a year after raising a $175 million Series B at a $1 billion valuation. The round was led by Elad Gil, with General Catalyst joining existing investors such as Andreessen Horowitz, 8VC, and Caffeinated Capital. According to CEO Dino Mavrookas, the round will enable the company to scale production and pursue larger autonomous platforms. As of April 2025, the company has raised $845 million in total funding.

Key Opportunities

Building a Software-Driven Defense Platform

Saronic’s biggest long-term opportunity is likely to evolve from a maritime robotics specialist into a full-spectrum defense platform — much like Anduril’s transformation from an autonomous systems builder to an integrated defense ecosystem provider. To achieve this, Saronic must look beyond autonomous vessels and develop AI-driven software capable of supporting an array of advanced capabilities, including swarm coordination and automatic target recognition (ATR).

A pivotal move would be to productize Saronic’s autonomy stack, the core technology that enables unmanned vessels to navigate, communicate, and self-coordinate, into a commercial software platform. This approach would parallel Anduril’s Lattice, a centralized AI platform that integrates data from diverse sensors and vehicles for real-time situational awareness and autonomous command-and-control. In theory, Saronic could offer a plug-and-play solution orchestrating multiple autonomous vehicles (surface, subsurface, and aerial), similar to what Overland AI is pursuing.

Finally, continuous software-defined upgrades would allow Saronic to release improvements, security patches, and new AI models to active fleets in real time. This agility would let navies address emerging threats without protracted procurement cycles. While seamless integration between hardware and software is critical to Saronic’s long-term success, allowing others to leverage Saronic’s software would establish the company as the dominant maritime platform.

Source: War On The Rocks

Advanced Munitions Production

On the manufacturing side, Saronic’s expansion into advanced munitions production could further solidify its role as a key defense technology provider. The US Navy has expressed growing interest in next-generation munitions that are cheaper, more precise, and rapidly producible, particularly as stockpiles come under strain from global conflicts.

By integrating AI-driven design optimization and additive manufacturing, Saronic could help develop intelligent munitions — weapons that can dynamically adjust flight paths or optimize lethality based on real-time battlefield conditions. This would position Saronic not just as a vehicle manufacturer but as a comprehensive defense supplier capable of delivering both the autonomous platforms and the smart weaponry that future conflicts will demand.

Scaling Up to Larger Autonomous Vessels

Saronic’s move to develop larger autonomous vessels reflects a natural progression in its maritime technology ecosystem, driven by the need for increased operational flexibility and mission scope. Whereas smaller unmanned surface vessels (USVs) excel at quick-reaction tasks such as reconnaissance, interdiction, and swarms, larger platforms offer distinct advantages as well. By carrying heavier payloads and incorporating larger fuel reserves or alternative propulsion systems, these ships can undertake extended missions without the logistical challenges of frequent refueling.

Moreover, larger autonomous vessels can act as multi-role hubs for broader operations. Their enhanced deck space and stability allow for the integration of complex sensor suites — ranging from maritime radar and sonar systems to electronic surveillance and surface-to-air detection equipment. By combining these capabilities into a single platform, Saronic could streamline mission profiles that previously required multiple smaller USVs operating in tandem. Larger ships would thus serve as mobile command centers for coordinating fleets of unmanned craft, drastically reducing the time and effort required to re-task or redeploy assets.

In addition, these vessels would open up new logistical opportunities beyond the capabilities of smaller craft. Their increased capacity to transport bulk cargo, specialized mission modules, and personnel supports diverse operational scenarios, including port-to-port logistics, offshore resupply, and humanitarian relief.

Saronic’s April 2025 announcement of the acquisition of a shipyard and subsequent expansion into a 150-foot MUSV, over 6x larger than the company’s prior largest product, demonstrates the progression of this thesis.

Mine Countermeasures & Seafloor Mapping

Detecting and neutralizing naval mines is a high-risk, time-consuming task that autonomous vessels are well-suited to handle. Saronic’s unmanned surface vessels (USVs) can be outfitted with sonar and deployable underwater drones to scan and clear dangerous waters without placing human crews at risk. Given the rising importance of mine countermeasures in modern naval strategy, these systems provide a cost-effective way to protect commercial shipping lanes and ensure safe naval operations.

Saronic's vessels could also expand into seafloor mapping and hydrographic surveys, similar to the approach Saildrone has taken. Traditional ocean mapping efforts require expensive, crewed expeditions, but autonomous boats can collect data over long durations with minimal operational costs. This capability is critical for understanding undersea topography, assessing environmental conditions, and even inspecting vital infrastructure such as undersea cables and pipelines. With vast portions of the ocean floor still unmapped, Saronic’s technology could help fill a major gap in maritime intelligence and resource exploration.

Port & Harbor Security

Busy commercial ports and strategic naval bases require constant monitoring to prevent unauthorized intrusions and potential security threats. Saronic’s AI-driven patrol craft could autonomously navigate harbor areas, using cameras and sensors to detect suspicious activity. These vessels function as tireless sentries, providing real-time alerts to security personnel while reducing the need for costly human-operated patrols.

Busy commercial ports and strategic naval bases require constant monitoring to prevent unauthorized intrusions and potential security threats. Saronic’s AI-driven autonomous vessels, such as the 150-foot ASV Marauder, can autonomously navigate harbor areas and waterways, leveraging advanced cameras, sensors, and a proven autonomy stack to detect and report suspicious activities in real-time. These vessels operate tirelessly, providing continuous monitoring without the operational costs associated with human-operated patrols.

In addition to passive monitoring, these autonomous boats could be equipped to actively interdict threats, such as identifying and neutralizing explosive-laden boats before they reach their targets. The ability to operate around the clock makes Saronic’s vessels an ideal solution for reinforcing security at major ports, military installations, and other critical maritime infrastructure.

Commercial Shipping Lane Protection

The global shipping industry faces growing threats from piracy, smuggling, and illicit trafficking, particularly in high-risk transit corridors. Saronic’s autonomous surveillance vessels offer a scalable solution for the persistent monitoring of commercial sea routes. With the capability to autonomously shadow suspicious vessels and relay real-time intelligence to authorities, these platforms could provide an effective deterrent against maritime crime.

Beyond security applications, Saronic’s technology could help shipping companies optimize route planning and avoid environmental hazards. By integrating with maritime data networks, autonomous vessels could provide live updates on weather conditions, ocean currents, and navigational risks, improving efficiency and safety for commercial fleets. With the increasing need for secure and resilient global supply chains, Saronic’s presence in shipping lane protection would represent a significant commercial opportunity.

Force Multiplier for Drug Interdiction

In the realm of law enforcement, Saronic’s autonomous craft offer a compelling answer to maritime drug trafficking. Traffickers increasingly use go-fast boats, semi-submersibles, and other seaborne methods to move narcotics, knowing the open ocean is harder to police. Unmanned vessels could change that equation by dramatically extending the reach of surveillance and response. Equipped with high-end sensors, a network of these craft could patrol remote maritime corridors and track suspicious vessels in coordination with manned assets.

The scale of the opportunity is clear: in fiscal year 2023, US Customs and Border Protection’s Air and Marine Operations (which patrol US waters and airspace) seized or disrupted over 256K pounds of cocaine, 2K pounds of fentanyl, and 4K pounds of methamphetamine – much of it via maritime routes. This reflects both a challenge and an opening: even a modest improvement in detection and interdiction at sea would translate into tons of illicit drugs kept off US streets. Saronic’s ASVs could serve as force multipliers for agencies like the Coast Guard and CBP, autonomously shadowing or stopping suspect vessels.

Key Risks

Navigating Procurement Hurdles & Regulations

The DoD acquisition system is notoriously complex and time-consuming, built on decades-old regulations and procedures. Arcane rules in the Federal Acquisition Regulation (FAR) and multilayered approval processes can be difficult to navigate, resulting in sales cycles that stretch far beyond typical commercial timelines. In short, the pace of defense procurement is often mismatched with the urgency and life cycle of tech startups.

Startups also struggle against entrenched defense contractors that dominate the industry. Government contracts tend to favor companies with decades of past performance and deep customer relationships. Large primes maintain staffs of business development professionals to track opportunities and existing contract vehicles (e.g. IDIQs, GSA schedules) that streamline awards.

In recent years, the DoD has introduced programs to help non-traditional vendors. Initiatives like the Small Business Innovation Research (SBIR) program and the use of Other Transaction Authority (OTA) agreements offer streamlined paths for prototypes and early funding. However, after the prototype phase, startups often face the infamous “Valley of Death” – the gap between a successful demo and a program of record. This transition can last 1–2 years with no revenue, causing many ventures to wither before they secure a production contract.

Defense startups must navigate stringent export control regimes, notably the International Traffic in Arms Regulations (ITAR) and Export Administration Regulations (EAR). Compliance can be daunting: the ITAR and EAR are broad and complex, covering not just obvious munitions but also dual-use technologies like certain sensors, encryption software, and autonomous control systems. Startups also find that ITAR designation can limit their market since selling to allied militaries or even commercial overseas customers might be barred or delayed by licensing.

Defense Budget Volatility

Defense startups operate at the mercy of macro-level budget decisions. The US defense budget can swing significantly due to political and fiscal pressures, creating boom-and-bust cycles that affect programs. A stark example was the 2011 Budget Control Act and subsequent sequestration in 2013, which caused the Pentagon to slash $37.2 billion in spending in the last half of the fiscal year. These sudden cuts disrupted contracts, delayed projects, and affected military readiness. A prime example is the US Army's consideration of halting its Ground Combat Vehicle development due to funding shortfalls. Over the decade of Budget Control Act caps, defense spending reductions totaled more than $1 trillion less than what had been planned for 2012–2021.

In recent years, growing concerns over the national debt led to the passage of the Fiscal Responsibility Act of 2023, which imposed spending caps that effectively kept defense funding flat. Although subsequent legislation has partially mitigated the impacts of these caps, the uncertainty itself carries consequences. Should stricter caps materialize in the future, startups like Saronic could face disproportionately greater challenges than legacy primes, as smaller firms generally have fewer financial reserves, less political leverage, and limited ability to adapt swiftly to funding cuts or secure alternative revenue streams.

Another concern in recent years has been the repeated use of continuing resolutions (CRs) to fund the government. CRs freeze spending at prior-year levels, disrupting planned modernization efforts and preventing the initiation of new programs. This creates uncertainty for defense companies that rely on predictable funding to sustain operations and investments. Prolonged CRs can strain defense companies financially, stall critical research and development, and lead to layoffs or talent attrition, ultimately weakening the industrial base's ability to support long-term national security needs.

Bias Towards Legacy Programs

The defense industry is entwined with US politics, and large contractors and legacy programs wield substantial influence. Large defense primes employ teams of lobbyists and enjoy a “revolving door” of former officials advocating for them. Incumbents often succeed in writing requirements that mirror their existing products, making it hard for a new solution to fit the RFP. The Truth in Negotiations Act and other acquisition statutes meant to ensure fair pricing, ironically give an advantage to those who know how to navigate them (usually incumbents) and can burden new firms with compliance costs. This is reinforced by military decision-makers’ risk aversion – choosing a well-known legacy vendor feels safer career-wise than betting on an unknown startup.

Members of Congress, motivated by jobs and economic benefits in their districts, often directly intervene to sustain programs the Pentagon itself wants to trim or cancel. For example, the Air Force’s repeated attempts to retire the A-10 Warthog attack jet and older model F-15s and F-22s have been stymied by Congress due to the aircraft’s strong constituencies. Another vivid example is the M1 Abrams tank: for years, the Army did not want to buy new Abrams tanks, given thousands already in inventory, but in 2015, lawmakers inserted $120 million for Abrams upgrades to keep the production line open. For a startup, this dynamic can be frustrating: even if their product is superior, it might displace a legacy program tied to hundreds of jobs, and thus face political pushback.

Slow Adoption of Autonomy by the DoD

Despite autonomous systems having certain advantages, the DoD has been cautious about adopting fully autonomous systems, largely due to operational concerns, inertia, and political sensitivities. Military leaders must ensure that autonomous platforms meet stringent safety, reliability, and ethical standards before widespread deployment, which creates long validation and testing cycles that delay fielding. Politically, autonomy also poses challenges — many stakeholders, including policymakers and defense industry incumbents, worry about job displacement, accountability in lethal decision-making, and public perception of AI-driven warfare. These factors contribute to institutional hesitation, with some within the DoD preferring to keep human operators in the loop, even when autonomy could improve efficiency and reduce risk. The result is that startups like Saronic face an adoption gap: they may develop highly capable autonomous vessels, but DoD buy-in could lag behind technological progress.

Summary

The United States faces a pivotal moment in maritime defense. While history has consistently shown that naval dominance is a prerequisite for global influence, the US is now confronting a profound erosion in its shipbuilding base and fleet readiness. Aging industrial infrastructure, spiraling procurement costs, and delays across major naval programs have left the US Navy struggling to maintain both size and capability. At the same time, China has rapidly scaled its shipbuilding capacity and naval fleet, leveraging massive state subsidies and industrial mobilization to build the largest navy in the world. This shift has dramatically altered the balance of power at sea, with China's People’s Liberation Army Navy poised to exert dominance in key maritime theaters unless the US responds decisively.

In response, the US is beginning to pivot toward a more distributed, autonomous, and attritable naval force. Rather than rely solely on a handful of large, costly warships, the Department of Defense is investing in unmanned surface vessels and swarm tactics that favor speed, flexibility, and rapid production. This evolving doctrine is reshaping the future of naval warfare, blending software-defined platforms with decentralized operational models. Saronic, as a defense startup focused on autonomous maritime systems, sits squarely at the intersection of these strategic needs. Its modular, scalable vessels offer a timely solution to the Navy’s growing demand for resilient and cost-effective assets. Ultimately, maintaining maritime superiority in the 21st century may depend less on steel tonnage and more on the intelligent, adaptive networks of autonomous platforms that companies like Saronic are building.

*Contrary is an investor in Anduril through one or more affiliates.