The Business Model of AI

On January 16, 2026, OpenAI released a widely-anticipated update on its plans for including ads in AI outputs for lower-paying tier users. This news comes as the company, as well as other major AI frontier labs, has discussed the potential of ads in AI outputs to increase revenue. The primary revenue channels for existing AI companies are enterprise and consumer subscriptions to AI tools, which include chatbots, coding assistants, and potential new products like personal health platforms or wearables. This is true of both hyperscaler AI teams and frontier AI labs. For each major AI provider, enterprise offerings are almost always monetized, though the share of total revenue attributed to enterprise sales varies by company. Consumer usage, on the other hand, is 97% unpaid.

AI companies operating under this freemium structure for consumer usage are not yet profitable, and some analysts don’t believe they will become profitable without major changes to their business models or significant reductions in compute costs. While the exact cost for individual consumer users varies by user and tool, both free and paid users can cost AI companies money. ChatGPT users, for example, pay $0 (Free), $8 (Go), $20 (Plus), or $200 (Pro) per month. The cost of using ChatGPT varies by user, but it can run OpenAI over $1K per query for large, context-rich requests. Some individual users of coding tools have run bills of over $35K in one month, while paying only $200 for the service.

It isn’t likely that these companies would consider abandoning free usage altogether, given the strength of the freemium model in increasing active users and the potential to convert this base to paid users over time. This reality is continually forcing AI providers to consider additional sources of revenue, including integrating ads into outputs.

Studies of internet use show that search result clickthrough rates fell nearly 30% between April 2024 and April 2025. As AI incrementally replaces traditional search, the share of total time and attention dedicated to AI outputs has increased. Advertisers are well aware of this shift and are interested in capitalizing on the share of attention AI tools have captured, with 84% having “observed either early indicators or significant shifts in consumer behavior away from traditional search and web browsing, driven by AI-powered answer engines.”

Statechery’s Ben Thompson has called AI in advertising “the most compelling ad opportunity since web search results pages.” Further, the overwhelming majority of ads are placed by hyperscalers, a major subset of the AI tool providers with the opportunity to place ads in AI outputs. These companies make a significant share of overall revenue from ad placement, and will need to recoup the loss of traditional ad placement by putting ads where users will see them.

Source: Generative Value

Users of AI tools, on the other hand, are against the idea of ads appearing anywhere in association with supposedly unbiased outputs. AI companies with ads integrated to outputs risk losing these users, but are betting on converting them to paid subscriptions without ads. This piece covers the potential return, trade-offs, and feasibility of ads in AI outputs as a driver of return for these companies.

The State of Online Advertising

Web service providers have nearly universally resisted advertising as the ideal business model. This includes the leading online advertising platforms globally. Jeff Bezos famously said, “Advertising is the price you pay for having an unremarkable product or service.”

In Sergey Brin and Larry Page’s search engine whitepaper “The Anatomy of a Large-Scale Hypertextual Web Search Engine,” theywrote, “We expect that advertising-funded search engines will be inherently biased towards the advertisers and away from the needs of the consumers."

Mark Zuckerberg, on the other hand, has defended ads on Facebook, saying, “If we're committed to serving everyone, then we need a service that is affordable to everyone. The best way to do that is to offer services for free, which ads enable us to do."

Five of the six largest companies in the US (Apple, Alphabet, Microsoft, Amazon, and Meta) sell ads. Even companies that offer an alternative revenue model (marketplace, credit card fees) have turned to ads to supplement that channel. As of 2026, companies like Uber and Instacart generate a sizable share of their revenue via ads. Eight of the largest 15 companies in the US sell ads (adding Walmart, Visa, and Mastercard to the list).

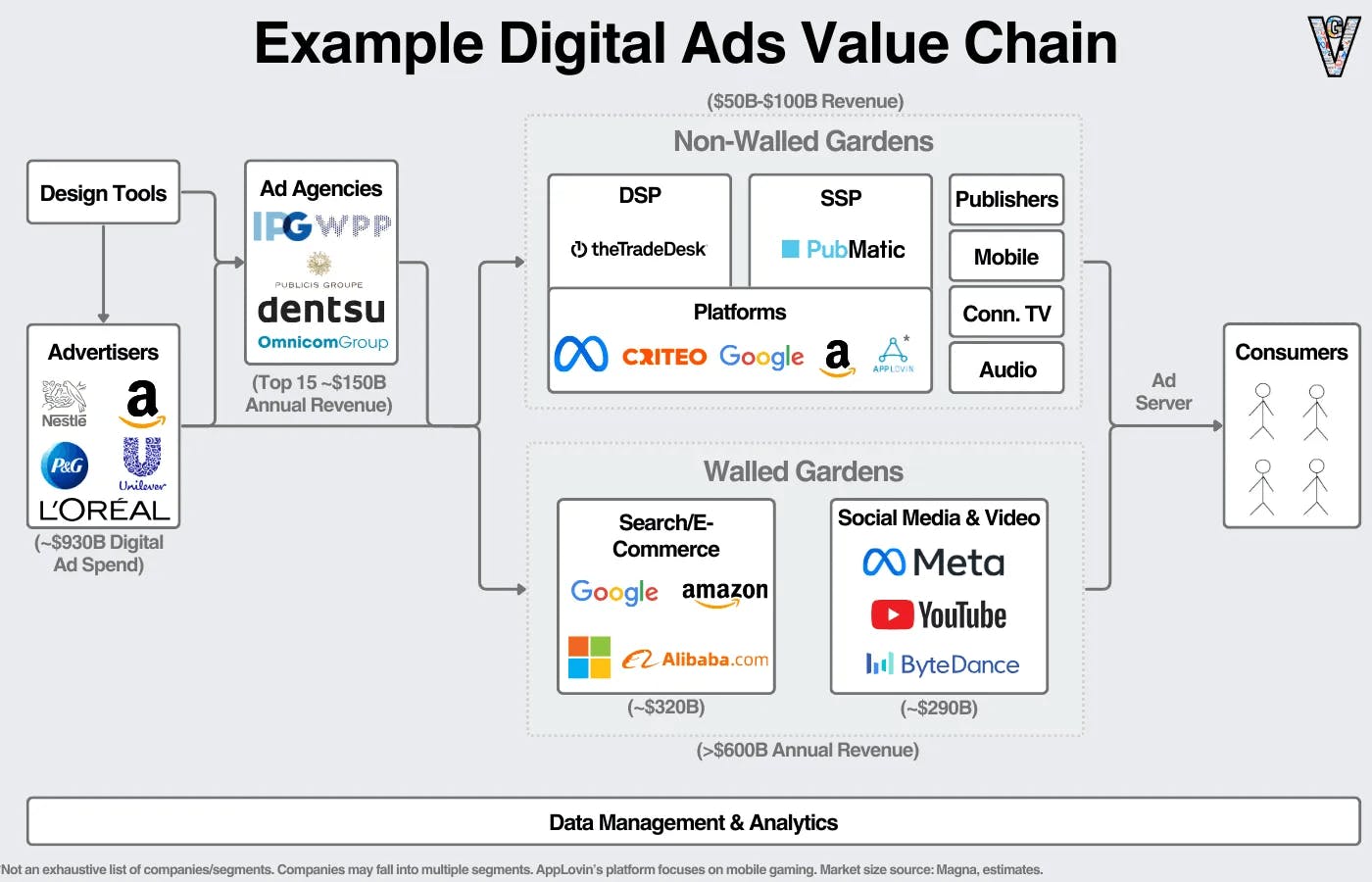

Digital Ads Ecosystem

Source: Generative Value

The advertising ecosystem can be broken down into key types of companies that play different roles: walled gardens, the open web, ad agencies, publishers, and supporting infrastructure.

Walled Gardens: Closed ecosystems (e.g., Meta, Google, Amazon, TikTok) that maintain end-to-end control over the advertising lifecycle, from audience identity and first-party data to the bidding logic and final ad delivery, forcing advertisers to operate exclusively within their proprietary, vertically integrated stacks.

The Open Web (Non-Walled Gardens): A decentralized network of independent publishers (e.g., The Wall Street Journal), streaming services (Netflix, Spotify), and mobile apps that trade inventory through a modular, interoperable programmatic ecosystem.

Demand-Side Platforms (DSPs): Buy-side software (e.g., The Trade Desk, Google DV360) that enables advertisers to programmatically purchase inventory across multiple exchanges by leveraging automated bidding algorithms and audience-targeting parameters.

Supply-Side Platforms (SSPs): Sell-side technology (e.g., Magnite, PubMatic, Google AdX) that allows publishers to aggregate, manage, and auction their advertising inventory to a global pool of buyers, optimizing for maximum yield and fill rates.

Vertical-Specific Infrastructure: Specialized ad networks and mediation layers (e.g., AppLovin for mobile gaming or Retail Media Networks like Walmart Connect) that provide highly optimized, channel-specific programmatic pipes tailored to unique environments like in-app ecosystems or point-of-sale data.

Ad Agencies: Global firms (e.g., WPP, IPG, Publicis) that provide strategic media planning, creative development, and managed programmatic services, acting as the primary interface between brand budgets and technical execution.

Publishers: Digital content owners (news sites, app developers, or streamers) that monetize their audience attention by offering ad inventory for sale via direct deals or programmatic auctions.

Supporting Infrastructure & Ad-Tech Stack: The toolset required for campaign execution, including Creative Management Platforms (CMPs) for dynamic ad assembly, Ad Servers for placement and tracking, and Measurement/Verification tools (e.g., IAS, DoubleVerify) to ensure brand safety, viewability, and ROI attribution.

Types of Digital Ads

While details of the advertising business model vary by platform, the format of ads that users interact with can be broken down into two primary buckets:

Sponsored Result Ads: These ads appear in line with the core results that the platform provides: product search results at Walmart, website results on Google, or chatbot outputs. Platforms are required by law to note that these results are sponsored or promoted by paying vendors. Also known as native ads, this format has been reported to have 53% higher conversion rates than display ads.

Display Ads: These ads are the equivalent of billboards for the web, and include banners, pop-ups, and commercials between videos. Unlike sponsored results, display ads are not necessarily related to the content of the site, but are usually directed to users based on collected consumer characteristics like age, interests, and shopping behavior.

How Many Ads Do We See Per Day?

Across the internet, ad and marketing agencies claim that American web users see between 4K and 10K ads per day. Despite the proliferation of web-based advertising, this number has been largely disputed and has not been verified.

In 2007, the American Association of Advertising Agencies released a document debunking this claim, saying, “These numbers are unsubstantiated, and the citations never get more specific than ‘experts agree‘...” and that “the wildly high estimates of ad exposure are overblown”.

Studies counting ad exposures manually have documented individuals seeing 76 advertisements per day in 1969 and 98.5 ads per day in 2007, using the same methodology. Other researchers counted 362 ads per day in 2014 using a different methodology. A different study from 2005 followed an individual wearing a video camera in London for 90 minutes, who saw 250 ads in that period, which translates to 2.7K per day (assuming the individual is awake for 16 hours a day). The article did not clarify whether this included exposure to logos and branded items.

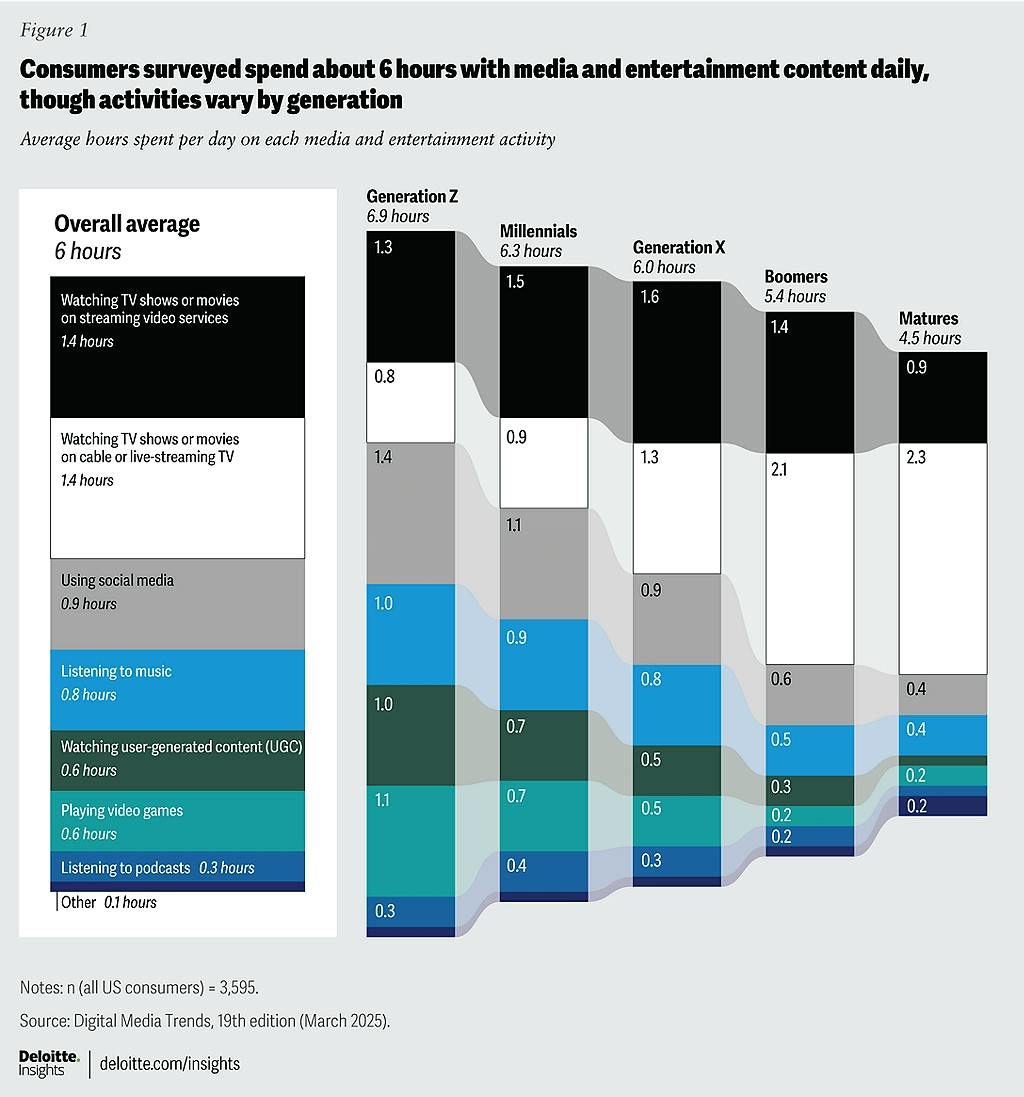

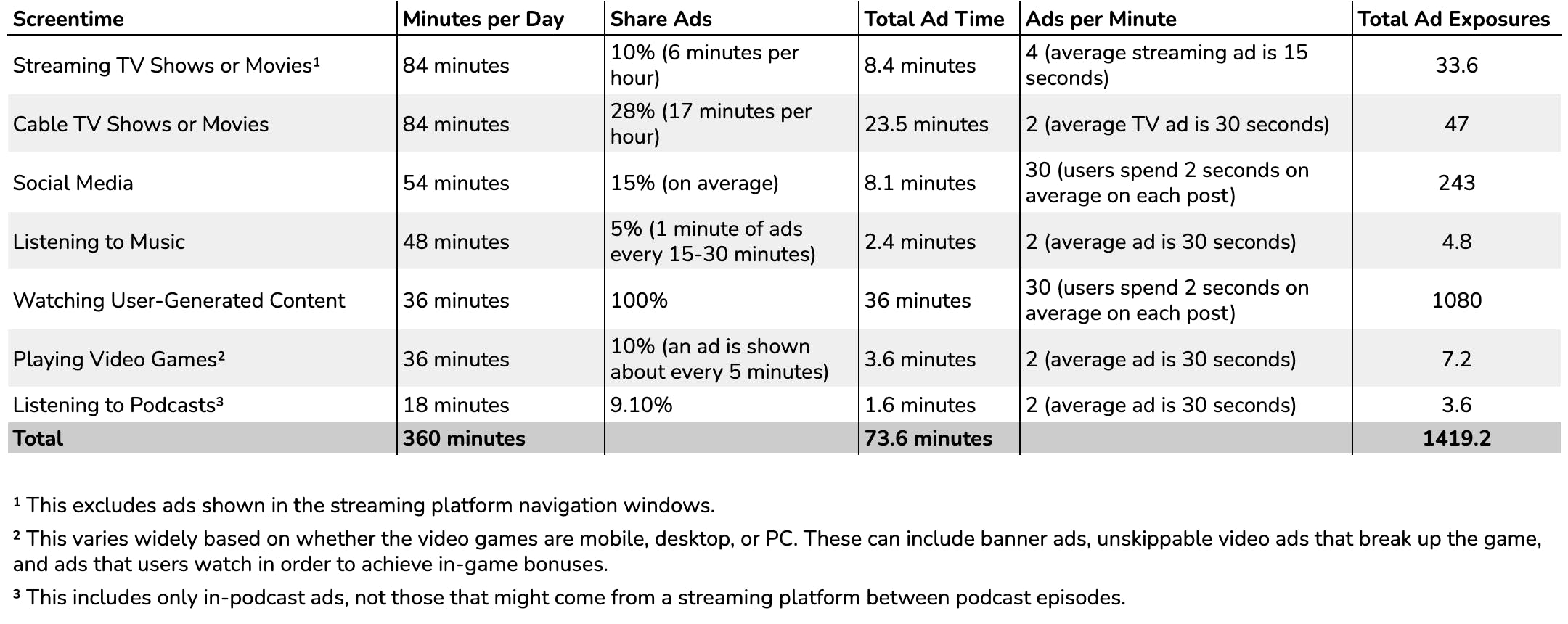

The number of ads individuals see today has not been well-documented. It is possible to proxy the amount of time Americans spend seeing ads based on screentime, but hard to measure the number of ads in total. User-generated content (UGC) in the graph refers to content created by paid users, like influencers, on behalf of a brand.

Source: Deloitte

Source: Contrary Research

This estimate doesn’t include ads seen using the internet, either for personal or business use, or ads seen in real life, which might imply that it underestimates the real prevalence of advertising. On the other hand, this estimate assumes users are not paying for services like Spotify Premium or Hulu Premium to reduce the number of ads seen. As of March 2024, 52% of Americans use ad-blockers on their browsers, and around half of streaming customers pay for ad-free or lower-ad versions.

The Cost of Ads

The cost of serving any individual ad is a function of the ad length (the amount of time the user sees the ad), the ad dominance (whether the ad interrupts the user’s attention completely or exists alongside other content), and the ad’s relevance to the user.

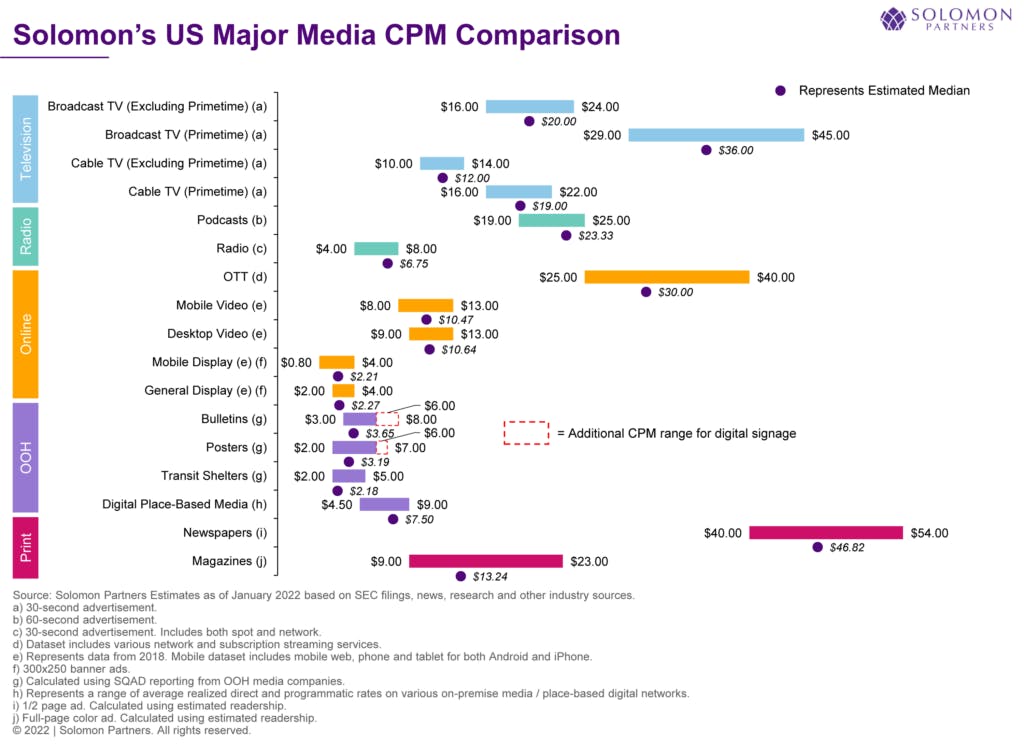

Ads are most often priced in CPM, or cost per 1K impressions. The cost of ads placed via different platforms, on average, varies depending on the factors outlined above:

Google: $14.29 per 1K impressions, though this ranges depending on keyword specificity

Instagram: $6.70 per 1K impressions

X: $6.50 per 1K impressions

TikTok: $10 per 1K impressions

LinkedIn: $6.59 per 1K impressions

YouTube: $20 per 1K impressions

Pinterest: $2 - $5 per 1K impressions

Source: Solomon Partners

It makes sense that platforms like YouTube and TikTok command higher costs per impression, given the nature of ads on these platforms, which consume 100% of user attention. These formats differ in various ways from AI tools, making it unclear what AI platforms might be able to charge for ads. On one hand, AI services are often rich in context about a user’s interests or goals. On the other hand, AI services often lack long-term context on user character due to context window limitations, which researchers are actively looking to address.

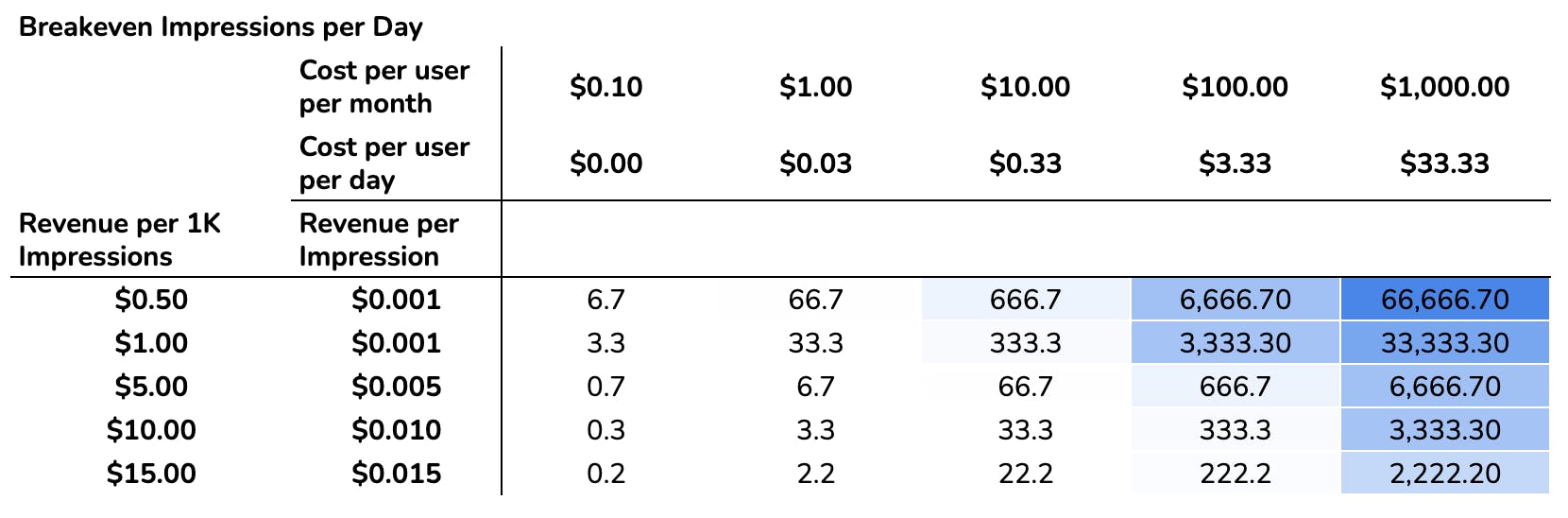

In order for AI platforms to use ads to break even on the cost of the free tiers of their services, they need to recoup the total costs of servicing each free-tier user (or convert that user to a more premium tier). The calculus on the number of impressions that need to be made on each user can be determined based on (1) the cost of servicing each user each month and (2) the revenue generated from every ad a user is shown.

OpenAI, for example, shared that its total revenue exceeded $13 billion in 2025. Its net losses aren’t publicly reported for the full calendar year, but reached $13.5 billion in the first half of the year alone. Assuming that enterprise customers and paid chat customer accounts break even (which is likely not the case for enterprise and was not the case for paid chat users as of January 2025), this loss could be attributed to free users, of which there are around 800 million (only around 35 million of ChatGPT’s users are paid). This back-of-the-envelope calculation ($13.5 million loss / 800 million users) suggests that each free user costs OpenAI around $17 a year, or around $1.50 per month. While this squares with Sam Altman’s comments that most queries cost only a few cents, it contrasts sharply with reports of single queries of state-of-the-art OpenAI models costing $1K.

To get a sense of how the advertising revenue channel might cover the costs of free users, the table below calculates the number of ad impressions per day required for AI companies to break even on the cost of individual users, depending on the revenue from those impressions and the costs of servicing those users.

Source: Contrary Research

This range is massive. For very high-value impressions offered to users who don’t cost AI companies much per month, the impressions required to break even constitute a meaningful, but still minority, share of the total ads those users might see each day. For very active users and lower-value ad placements, the breakeven number of ads is completely unreasonable.

These ad numbers will likely scale with how often a user queries, i.e., the more you use a service, the more ads you will likely see. Some queries will likely be more likely to elicit ads than others, i.e., searching for furniture ideas compared to solving a trigonometry question.

AI Ad Auctions

How much AI companies can charge for ad placements depends largely on the conversion rate to clicks that they can offer, which is a function of how relevant ads are to the users who see them and how likely they are to keep exploring a topic or make a purchase in their conversation. A user asking a chatbot about typical used car prices, for example, might be looking to buy a car or to sell a car, but could be shown the same ad.

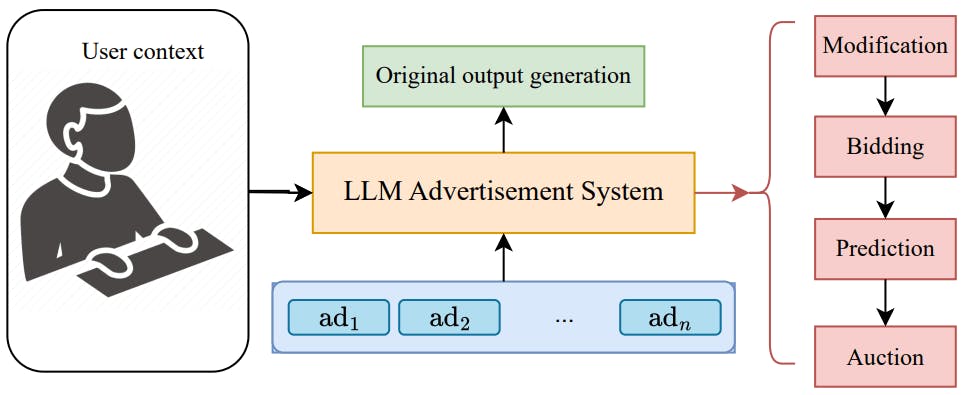

In existing online advertising transactions, when a user loads a webpage or app, the Supply-Side Platform (SSP) immediately triggers a bid request containing contextual data and user signals to an Ad Exchange. This exchange broadcasts the request to multiple Demand-Side Platforms (DSPs), where automated algorithms evaluate the impression's value against advertiser-defined targeting and budget constraints.

Competing bids are then ranked using a programmatic Ad Rank formula, which balances the maximum bid price with a quality score derived from the ad’s relevance and expected click-through rate. The auction concludes in milliseconds, typically awarding the placement to the highest-ranked bidder who then pays the minimum amount necessary to surpass the next closest competitor in a second-price auction model.

Source: Feizi

This model poses a challenge for AI-based outputs because the content is not fixed, but rapidly evolving. Taz Patel, Perplexity’s former head of advertising, said advertisers “want to take what they do, maybe on traditional search platforms, and dump it into Perplexity with keywords and blocklists,” Patel said. “But it doesn’t work that way.” Research has been completed studying how advertiser auctions might operate for results, either by embedding ads in LLM outputs or placing ads alongside those outputs.

One 2024 Google Research paperintroduced a formal "token auction" framework where LLM agents acting on behalf of advertisers bid on the probability distribution of subsequent tokens in a generated sequence. This mechanism operates on a token-by-token basis, aggregating the preferred distributions of multiple models into a single weighted output based on the participants' bids. While this approach provides a rigorous way to align preferences during the generative process, it requires deep access to the internal generation functions of the LLM agents and assumes the ability to define welfare objectives through the weighted combination of these distributions.

In contrast, another 2024 paper identified significant practical hurdles in token-level auctions, specifically the high communication overhead and the financial risk of advertisers paying for sequences that may eventually deviate from their goals. To resolve this, they proposed a sequence-based auction that relies on standard LLM API calls rather than internal model weights, evaluating the value of entire candidate strings instead of individual tokens. This approach utilizes a reward-based system similar to Reinforcement Learning from Human Feedback (RLHF), providing a strategy-proof payment model that ensures advertisers bid truthfully while allowing the platform's output to converge toward an optimally fine-tuned objective.

AI Platform Ads

This piece focuses specifically on placed advertisements alongside AI outputs, in which advertisers pay for the placement of a link. This is distinct from link placement, where AI platforms are compensated for purchases made that originated on their site, and distinct from ads made using generative AI tools but displayed elsewhere.

Chatbots

Chatbots are one of the primary free consumer platforms for AI companies, and make up a major share of consumer AI attention span. The primary appeals for marketing teams to place ads in chatbot outputs are the increasing share of attention (given decreasing time spent on traditional browsers) and theoretically improved personalization. This includes both better knowledge of user habits/behaviors/interests, leading to more effective ad placement, and the potential to collect data based on users.

OpenAI

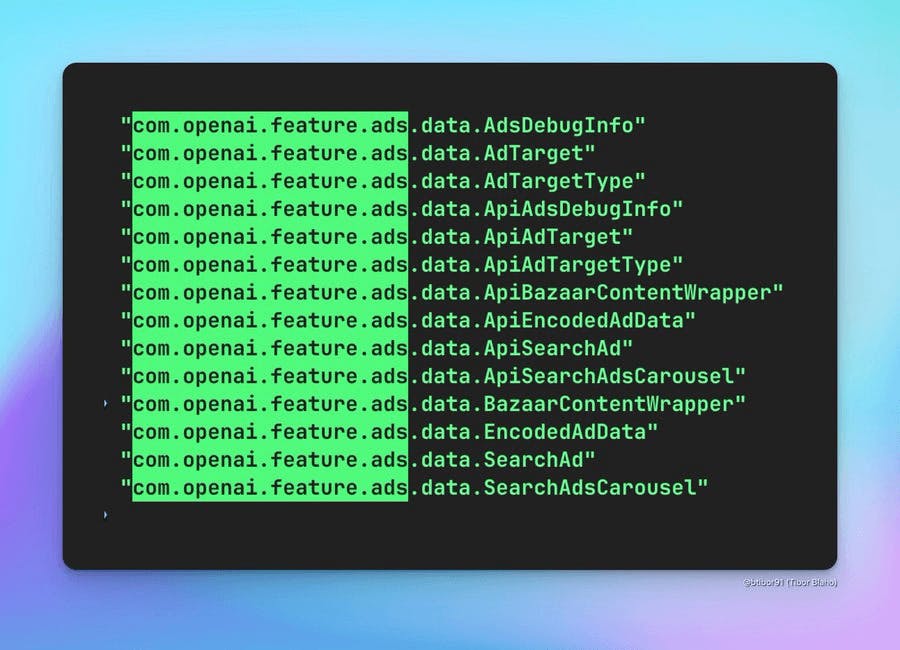

In November 2025, a widely-shared OpenAI code snippet indicated that ads were likely on their way to ChatGPT, showing a feature that was apparently set up to support ads in chatbot outputs. A shift towards inclusion of ads had been suspected for some time, with industry analysts pointing to the fact that OpenAI hired Instacart’s CEO, Fidji Simo, who had previously helped lead Meta’s mobile-advertising business, in October 2025.

Source: Business Insider

The progression to the inclusion of ads in ChatGPT represents a meaningful departure from OpenAI’s previous plans surrounding ads. During a 2024 event at Harvard Business School, Altman called ads in ChatGPT a “last resort,” saying that subscription-based models create a “cleaner relationship.” He also opposed ads on principle, saying:

“I kind of hate ads as an aesthetic choice. I think ads needed to happen on the internet for a bunch of reasons, to get it going, but it’s a momentary industry… I like that people pay for ChatGPT and know the answers they’re getting are not influenced by advertisers… ads-plus-AI is sort of uniquely unsettling to me… I’m not going to say what we will and will never do because I don’t know, but I think there’s a lot of interesting ways that are higher on our list of monetization strategies than ads right now.”

In June 2025, however, Sam Altman said, regarding ads in ChatGPT outputs, that:

“I’m not totally against it. I can point to areas where I like ads. I think ads on Instagram are kinda cool. But I think it’d take a lot of care to get right… If you compare us to social media or web search, where you can kinda tell that you are being monetized… how much do you believe you’re getting the thing that the company actually believes is the best content for you versus something that’s also trying to interact with the ads?”

“If we started modifying the output, like the stream that comes back from the LLM, in exchange for who is paying us more, that would feel really bad. And I would hate that as a user, I think that’d be like a trust-destroying moment,” … any ads would need to be “really useful to users and really clear that it was not messing with the LLM’s output.”

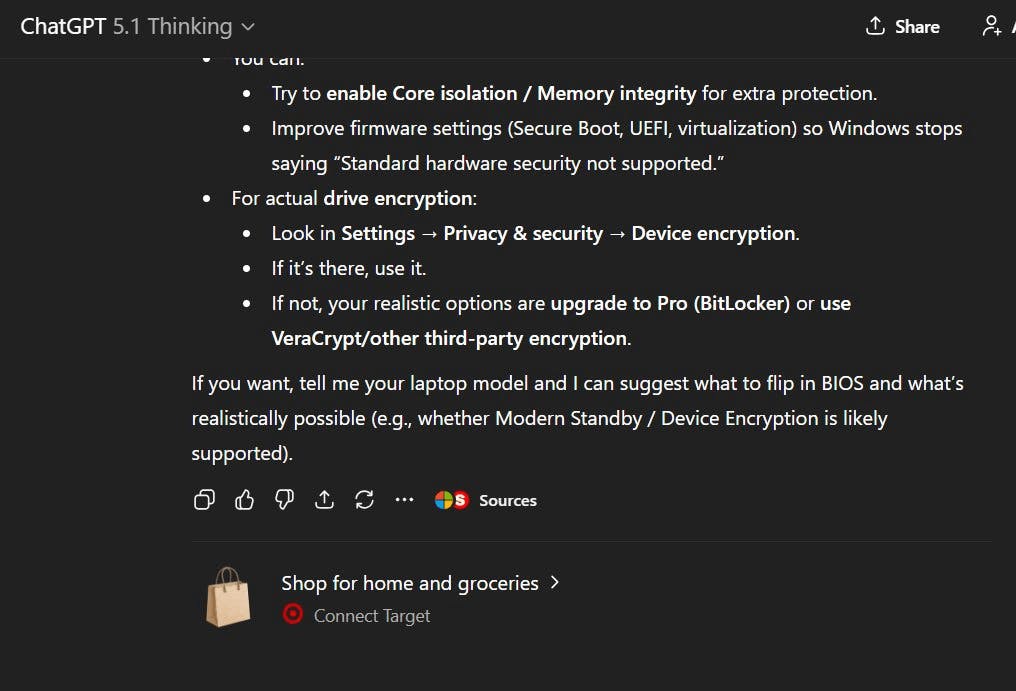

During this period, Altman suggested ads might be available as sponsored links in the sidebar or footers adjacent to the primary outputs. After the November 2025 discussion about ads coming to ChatGPT, OpenAI paused ad work as part of its “Code Red” response to Google’s Gemini advancements. Around the same time, a post circulated on social media showing a ChatGPT screenshot with a link to shop at Target in a conversation about laptop encryption.

Source: Mashable

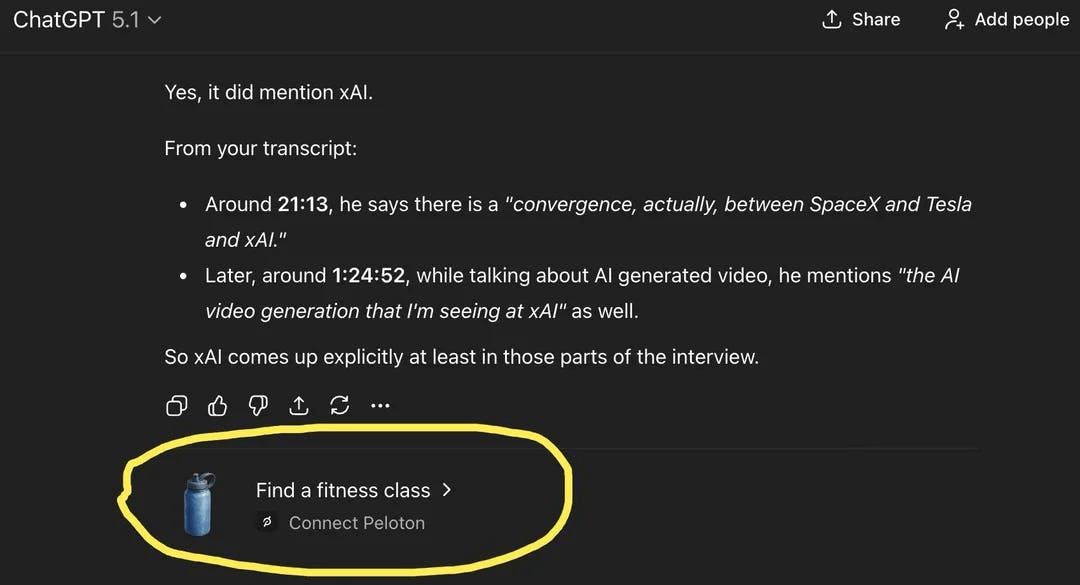

Users also reacted to a similar post suggesting a Peloton fitness class in a conversation about SpaceX, which OpenAI dismissed as “not real” or “not ads.”

Source: Reddit

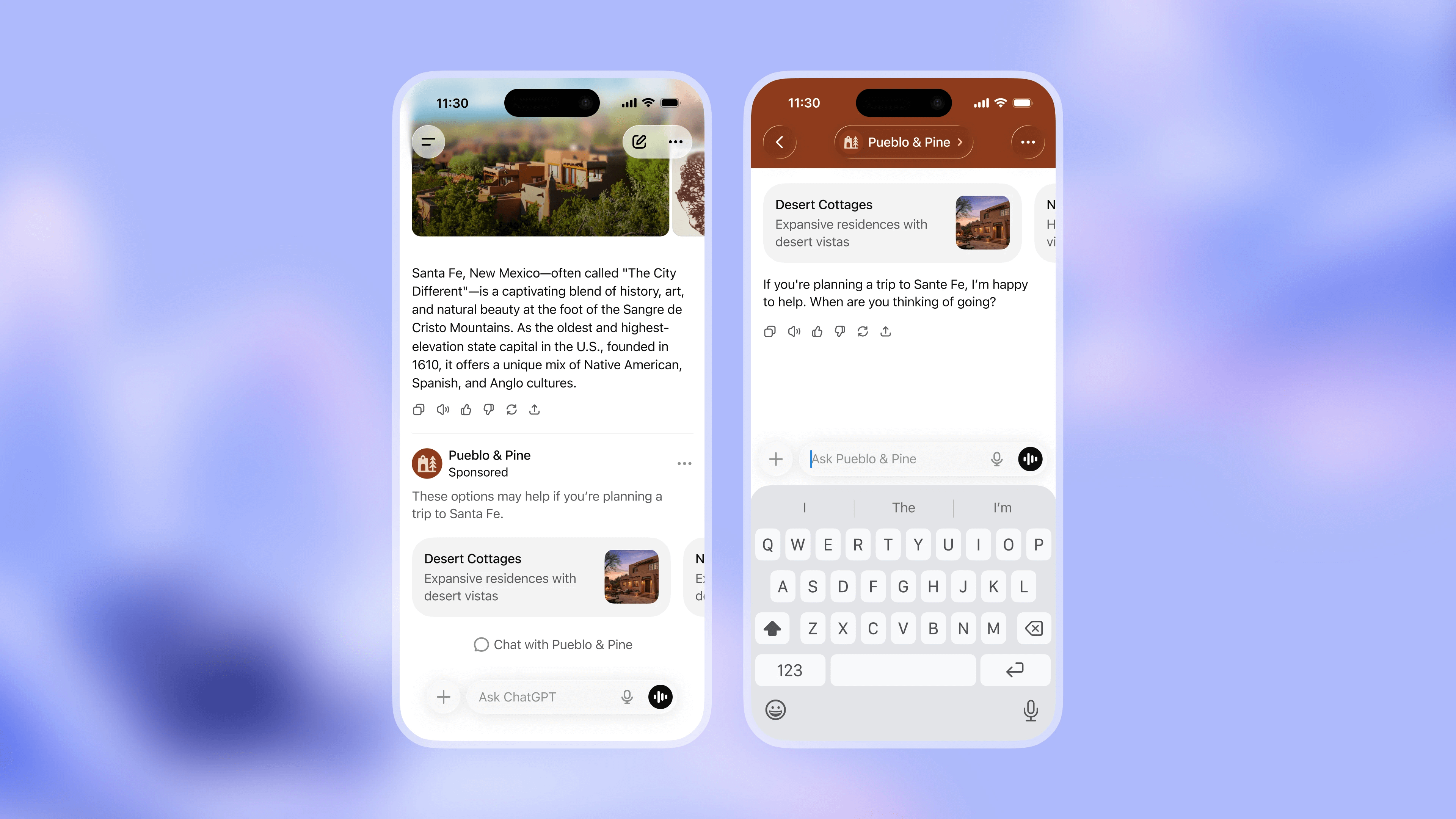

In January 2026, OpenAI publicly announced its plans to place ads in free and lower-cost versions of ChatGPT, in a widely announced shift in strategy that has been referred to in the media as the “Meta-fication of OpenAI.” It has described the placement of ads as independent from the ChatGPT outputs, saying, “Ads do not influence the answers ChatGPT gives you. Answers are optimized based on what's most helpful to you. Ads are always separate and clearly labeled.” OpenAI has also said that user “data and conversations are protected and never sold to advertisers,” meaning the benefit to advertisers is in conversion alone.

Source: OpenAI

This shift is distinct from OpenAI’s ecommerce initiative, announced in October 2025 and launched in collaboration with Stripe, partnering with Etsy and Shopify to allow users to buy products directly through the chatbot. The program has hit roadbumps in integrating with early partners Shopify and Stripe as of January 2026. This business model would allow OpenAI to earn part of the revenue from any purchase made that originated in ChatGPT conversations.

Based on Sam Altman’s comments in a March 2025 Stratechery interview, ecommerce would be the company’s preferred path to monetization:

“The kind of thing I’d be much more excited to try than traditional ads is a lot of people use Deep Research for ecommerce, for example, and is there a way that we could come up with some sort of new model, which is we’re never going to take money to change placement or whatever, but if you buy something through Deep Research that you found, we’re going to charge like a 2% affiliate fee or something. That would be cool, I’d have no problem with that. And maybe there’s a tasteful way we can do ads, but I don’t know. I kind of just don’t like ads that much.”

Gemini

In February 2025, Google CEO Sundar Pichai began discussing the idea of ad placement in Gemini, saying,

“I do think we’re always committed to making the products work and reach billions of users at scale. And advertising has been a great aspect of that strategy. Just like you’ve seen with YouTube, we’ll give people options over time. But for this year, I think you’ll see us be focused on the subscription direction.”

In May 2025, Google began testing ads in chatbot outputs before officially rolling them out to the public or to its advertising partners. Bloomberg reported in April 2025 that Google had begun exploring ad placement in AI outputs in 2024. This testing did NOT include Google’s own Gemini, but rather chatbots of its advertising partners via AdSense (a network that Google uses to place ads in the search results of other websites).

In December 2025, news circulated reporting that the Google Gemini team shared plans to bring ads to the platform in 2026 with its advertising clients. Google’s VP of advertising, Dan Taylor, said, “This story is based on uninformed, anonymous sources who are making inaccurate claims. There are no ads in the Gemini app, and there are no current plans to change that.”

Like OpenAI, Google has also introduced ecommerce via Gemini. Unlike OpenAI, however, Google is not planning to take a cut of the revenue from transactions that originate in Gemini. Instead, the company plans to sell advertisers the opportunity to place products for purchase on the spot, through Gemini (distinct from a click-away-to-purchase ad). Brands like Walmart and Shopify have already signed agreements to showcase products in this way.

xAI

Elon Musk announced in August 2025 that Grok would begin showing ads directly within its conversational responses, saying that marketers could pay to have their offerings recommended by the AI when a user asks a question relevant to their company. Musk has described these ads as a way to "pay for those expensive GPUs."

Beyond showing ads in chatbot responses, xAI’s technology is being used to overhaul the broader X advertising engine, including using "vector matching" to better pair ads with user interests and an "aesthetic score" generated by Grok to reward high-quality, visually appealing ads with lower costs. Musk said this integration will also add an “Explain this post” feature providing more information to users about the advertising brands and their products. He has also said Grok could be useful to advertisers as an ad generation tool and that X is building out in-app checkout as a future feature to convert ads to sales directly.

Meta

While Meta is still a relatively small share of overall chatbot usage, but a major presence in advertising. In its Q2 2024 earnings report, Meta shared that 98% of the company’s sales came from advertising. In October 2025, Meta shared that it would begin using user conversations with the Meta chatbot to inform targeted ads, beginning in December 2025. Users would not be able to opt out of having their conversation data used for targeting ads, though only conversations after the launch date would be used for advertising

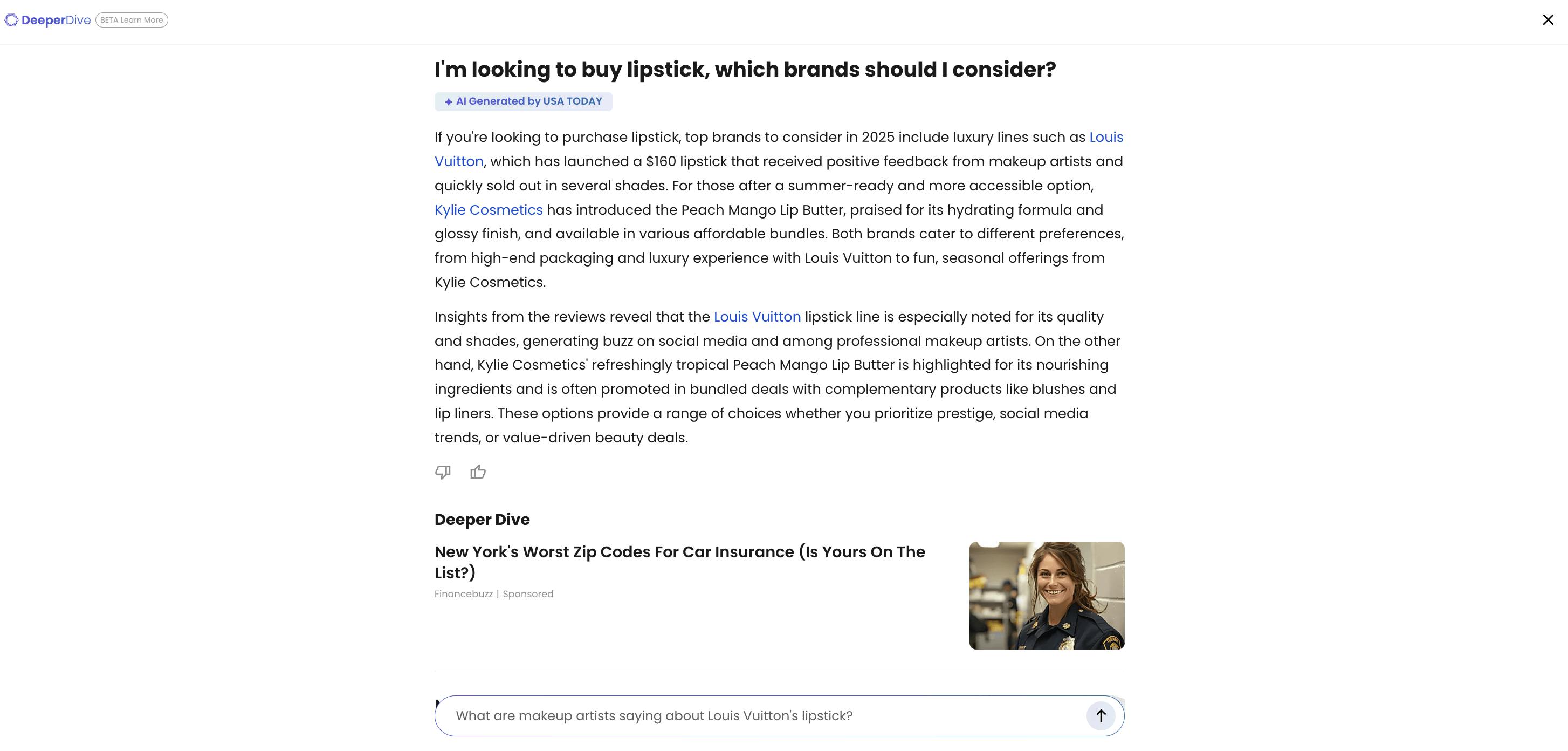

USA TODAY

Outside of tech companies, media and commerce companies that host website chatbots have also experimented with ad placement in chatbot results. USA Today tested ads in its chatbot “DeeperDive” in November 2025. The bot was developed with Taboola, a native ad platform for recommended reading links on news publication sites, and Dappier, an ad tech company for publishers. The DeeperDive chatbot was fed information only from Gannett sites (the organization that owns USA Today), and both answered questions from users as well as provided them with relevant follow-up questions. These questions were based in part on user data, including online habits and first-party data collected by Taboola publishers.

Chatbots like the one created by Taboola for USA Today are described as “advertising-first,” meaning their goal is to deliver ads in a format users are more likely to interact with. The platform can show traditional image and video ads in the chatbot, where the ads are provided by partners like Google and Magnite. Tests of the bot showed that even when faced with purchase-specific questions, it failed to make strong recommendations, like showing ads for flashlights and weight-loss drugs in response to the question “I’m looking to buy lipstick, which brands should I consider?”

Source: Ad Age

Customer Conversion

Chatbots on websites have been proposed as conversion assistants for potential buyers of products by answering questions for those customers, comparing the products to alternatives. Some research suggests that businesses utilizing conversational AI can see an increase in lead qualification and conversion rates, with some reports indicating that 41% of consumers prefer using chatbots to get detailed information during the pre-purchase phase.

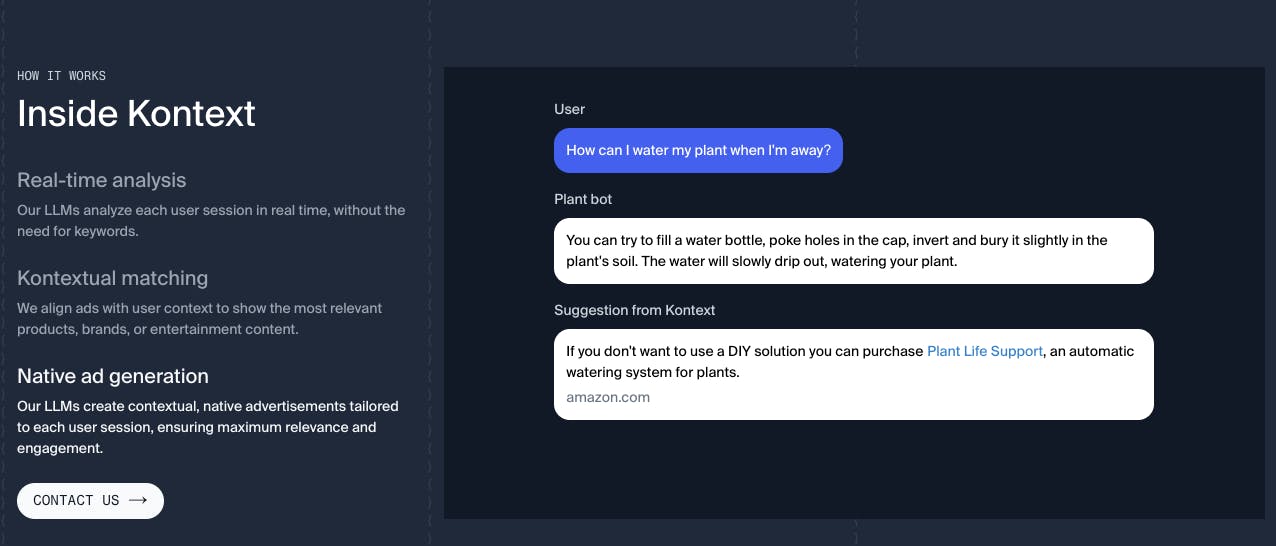

Startups like Kontext have also emerged in the world of chatbot advertising, providing a platform for advertisers to insert contextually relevant product placement in LLM conversations. The platform performs session-level analysis to generate native ad content that matches a user’s immediate conversational intent, eliminating the need for traditional keyword bidding or behavioral tracking of users. The platform integrates with AI search engines, virtual characters, and productivity tools, allowing the providers of freemium AI model usage to monetize traffic and advertisers to reach users of these models.

Source: Kontext.so

Browsers

Unlike chatbots, browsers are already a platform where users are accustomed to interacting with ads. Both traditional and AI-based browsers have embraced ads enabled by and alongside LLM-generated search summaries and conversations with users.

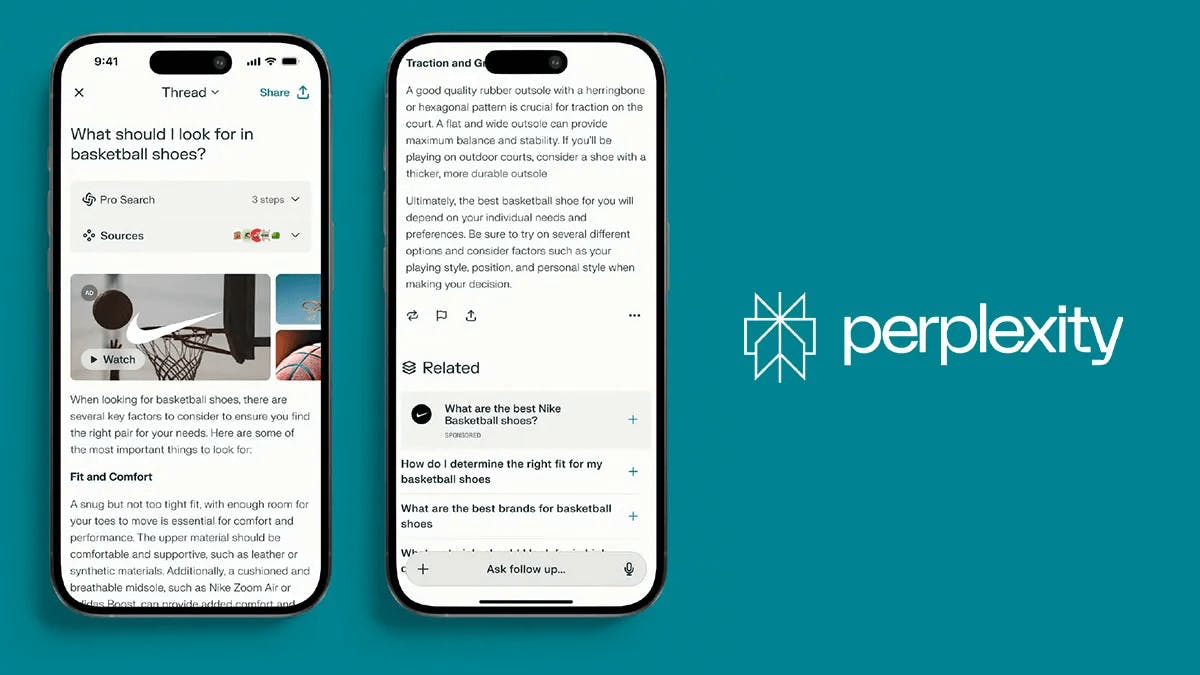

Perplexity

AI Browser producer Perplexity was one of the first frontier AI companies to meaningfully reverse course in its stance on ads as a part of its business model. An early version of Perplexity’s website pledged that the company’s products would remain ad-free, saying “Perplexity was founded on the belief that searching for information should be a straightforward, efficient experience, free from the influence of advertising-driven models.”

In November 2024, the company flipped its stance, announcing the introduction of ads to the platform in the form of follow-up questions suggested after responses to user queries. In a blog post announcing the change, the company held a similar advertising standard as OpenAI, committing to labelling ads as sponsored and to protecting its model outputs from the influence of advertisements. The company removed language about remaining ad-free from its website, and Perplexity’s Chief Business Officer, Dmitry Shevelenko, even said, “advertising was always part of how we’re going to build a great business.” Perplexity used its own AI models to generate the ads, not allowing advertisers to customize the ads that users would see, and said it would not share customer details with advertisers, like OpenAI.

Source: Adweek

Perplexity announced in October 2025 that it was stepping back from advertising as part of its AI browser, and that ads would no longer be available on its browser after introducing them a year and a half before. The company didn’t publicly provide a reason for this shift.

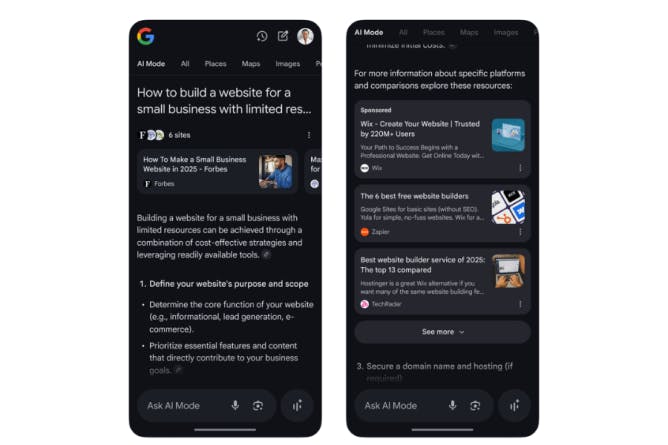

Google AI Mode

Google embedded ads into its browser’s AI Mode in May 2025. These ads are analogous placements to those sponsored results or now-discontinued sidebar ads that appear in traditional Google search pages. Google claims that these advertisements are positioned to intercept users during "high-intent" discovery phases, appearing either embedded within the AI’s generated response or immediately following the summary to capture attention while the user is actively processing complex information. Google uses both the content of the user query and the generated AI Overview to determine ad placement.

Source: TechCrunch

Ad buyers reported that calculating essential success metrics, such as click-through rates and return on ad spend (ROAS), remains difficult because AI Mode lacks the self-serve tracking suites that have long been the industry standard for established search engines. While Google has since integrated AI Mode metrics into Search Console, early adopters faced a total data blackout where traffic was erroneously categorized as “Direct” or “Unknown” when ads were featured in AI Mode. This lack of referral data sparked pushback from the marketing community, as the absence of associated metrics made it impossible to verify the quality or volume of AI-driven visits.

The Future of Ads in AI

As of January 2026, the transition of frontier AI companies from venture-backed "growth at all costs" models to sustainable profit engines remains precarious, with advertising emerging as a double-edged sword rather than a guaranteed life raft. OpenAI’s January 2026 pivot to testing ads within the ChatGPT free and lower-cost tiers exemplifies a survival tax aimed at offsetting staggering infrastructure costs, which are projected to reach $1.4 trillion over the next decade. Advertising via AI outputs forces advertisers to consider differences in predictability, user targeting abilities, and ad formats compared to traditional search engine ad placement. Perplexity AI’s early attempt at advertising alongside AI outputs struggled to maintain advertiser momentum in late 2025, suggesting that traditional click-through monetization may not succeed in a zero-click environment.

In this shifting landscape, the winner of the AI race may not be determined solely by models’ reasoning capabilities, but by the efficacy of their ad placement. While companies like Anthropic have prioritized algorithmic efficiency to avoid the "ad-trap" for now, companies like xAI and OpenAI are already considering ads as an important channel for revenue. As public skepticism about the economics of the global AI buildout grows, companies are running out of time to show investors they are on a path to profitability. The companies that endure this shift may not be those with the best AI models, but also those with the best business models.