Thesis

In 1984, the Defense Advanced Research Projects Agency (DARPA), in partnership with the Army, began work on the Autonomous Land Vehicle (ALV). The ALV marked the first effort of the United States Department of Defense (DoD) to venture into autonomous vehicles. While the system was revolutionary, it was in no way capable of reliably completing dynamic combat operations.

By the early 2000s, DoD autonomous vehicle projects had advanced significantly and were capable of operating at high speeds off-road. At the same time, the United States was involved in numerous counterinsurgency operations in the Middle East to support the global war on terror. The largest cause of US combat deaths during this period was improvised explosive devices (IEDs). These IEDs largely targeted vehicles and accounted for 48% of American service member deaths in Iraq and 45% in Afghanistan from 2006 to 2021.

Advancements in technology, combined with the growing threat of IEDs, led to increased focus on autonomy programs. In fact, autonomous versions of the Army's Stryker armored fighting vehicle were slated for use in combat operations by 2010. However, the mass utilization of autonomous vehicles never occurred. Instead, the United States chose to procure mine-resistant ambush-protected (MRAP) vehicles to limit troop casualties from roadside IEDs.

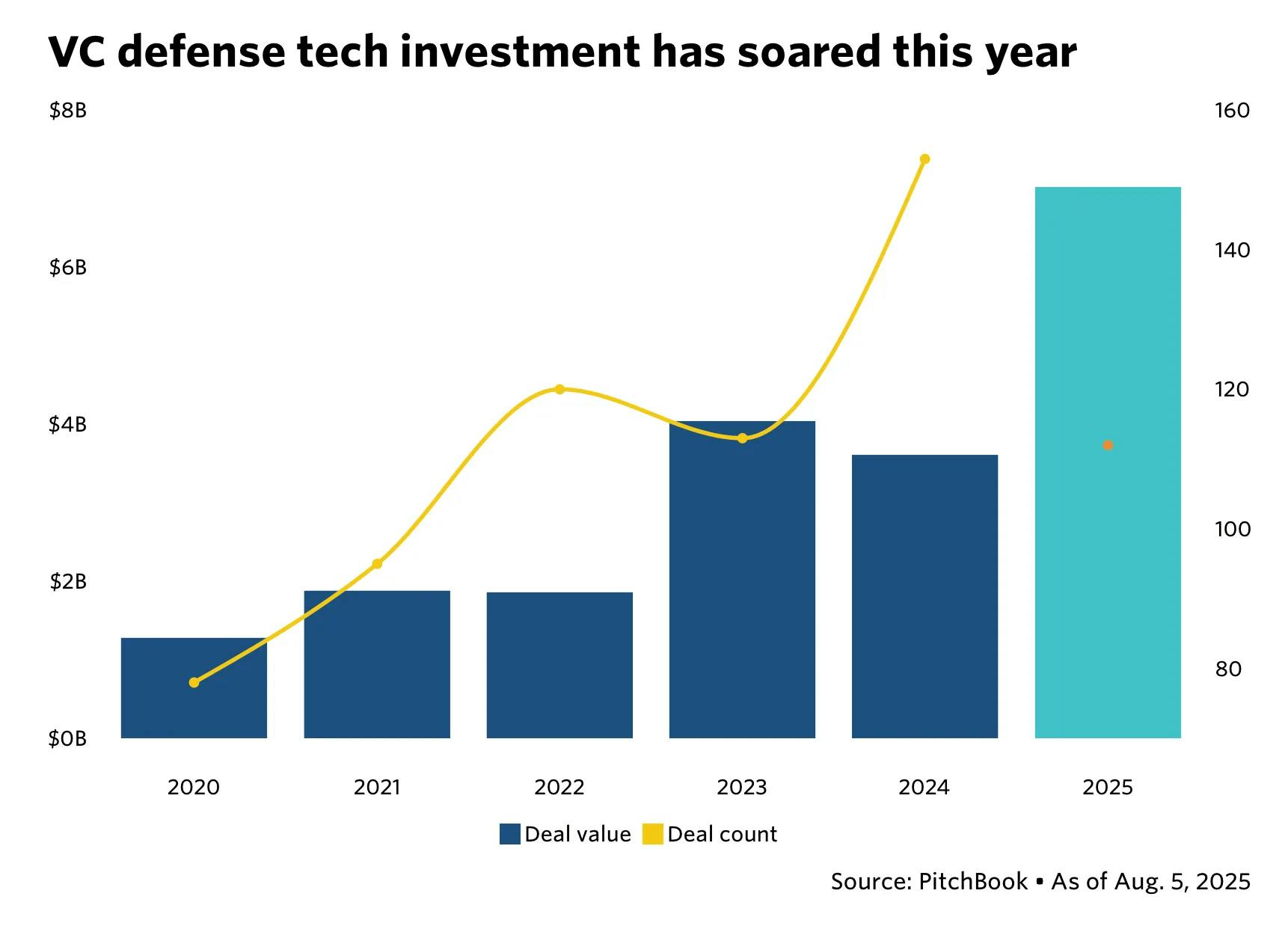

The early 2020s saw a resurgence in defense technology innovation. With tensions rising across the world, defense technology saw a notable increase in venture investment. This trend, coupled with monumental advancements in autonomous technology, led to a renewed focus on unmanned fighting platforms.

Source: PitchBook

Within the defense technology sector, unmanned ground vehicles (UGVs) emerged as critical force multipliers, used extensively by both sides in the Russo-Ukrainian conflict. These UGVs are utilized for a wide variety of missions near the frontlines, like casualty evacuation, resupply, and fire support as a mobile weapons system. Because of their utility, Ukraine has expressed interest in acquiring UGVs in larger quantities. In a November 2025 interview with the Ukrainian media outlet Telegraf, Viktor Pavlov, the founder of the Ground Robotic Systems School in Ukraine, projected a necessary acquisition of 30K UGVs in 2026.

Forterra provides an ecosystem of hardware and software products that enable third-party ground vehicles to operate autonomously off-road. Its systems are used in programs that require reliable navigation, perception, and remote operation in contested environments. The company’s modular approach allows defense and commercial customers to upgrade vehicle fleets without redesigning core hardware.

Founding Story

Forterra was founded as Robotic Research LLC in 2002 by Alberto Lacaze (President) and Karl Murphy (Vice President). Lacaze holds over 100 patents in the field of robotics and is an expert in vehicle autonomy. In the early years of the company, Lacaze led Robotic Research to develop the first fully autonomous convoy vehicles for the DoD.

For nearly 20 years, the company continued to operate as a small defense contractor without receiving any outside investment. During this period, Robotic Research subsisted on revenue from government research, development, testing, and evaluation contracts for autonomous systems.

The early 2020s saw the company respond to the rapid growth of the defense technology industry with a series of sweeping changes and rebranding. In 2021, Robotic Research’s $228 million Series A funding round, led by Softbank, marked the first outside investment in the company’s history. That same year, the company began a complete change in leadership.

In April 2021, Josh Araujo was hired as COO of Robotic Research. Araujo previously served as the Senior Vice President for Aerospace and Defense at Jefferies, and he was later promoted to CEO of Robotic Research in 2024. Joseph Putney, an engineer with Robotic Research since 2006, was promoted to CTO in 2022.

Scott Sanders joined Robotic Research as Head of Business Development in January 2022, and he was promoted to Chief Growth Officer in November 2022. Sanders has prior experience at both Anduril and Vannevar Labs. Colin Chisholm joined the company as COO in September 2024. Lacaze remains with the company as Chairman of the Board and President, while Murphy serves as Vice President and a senior engineer.

In February 2024, Robotic Research underwent a complete rebranding to become known as Forterra. The Latin root “-terra” in the company’s new name, meaning “earth” or “land,” emphasizes the company’s focus on ground-based autonomous systems, rather than the airborne autonomous systems that have become commonplace in modern warfare.

Product

Forterra develops hardware and software products that enable third-party vehicles to operate autonomously in off-road conditions. While the company primarily focuses on defense-related programs, Forterra also develops commercial autonomy solutions.

AutoDrive

Forterra’s core product, AutoDrive, is an integrated hardware and software autonomous vehicle control kit. The system is largely vehicle and payload-agnostic and has been installed on a variety of platforms, from small vehicles like the Squad Multipurpose Equipment Transport (SMET) to large, five-axle missile-launching trucks.

AutoDrive’s modular, open, scalable architecture enhances interoperability functions with different vehicle platforms and payloads. It is designed to operate on and off-road, in all weather conditions, and through GPS-denied environments.

The hardware consists of an AutoDrive Core computer, multi-range LiDAR cameras supplied by Ouster, infrared cameras, color television cameras, and an integrated communications suite. These components enable AutoDrive to offer a variety of driving functions to its users. A vehicle equipped with the system can perform advanced maneuvers like synchronized convoy movements and even drive in reverse with a trailer.

Source: Forterra

Forterra’s AutoDrive package must be paired with drive-by-wire vehicles. Such vehicles substitute or augment physical connections between human input devices and the systems they actuate with sensors and motors. This system is then capable of replicating human input and relaying the status of the mechanisms they control, like the steering rack or brakes, back to the vehicle’s computer.

While many new vehicles are drive-by-wire, older vehicles in the Army and Marine Corps’ fleets are not. However, these vehicles can be retrofitted with drive-by-wire components, an approach Forterra has taken numerous times for testing purposes. Since Forterra doesn’t develop vehicles, it needs to integrate AutoDrive on third-party platforms to produce completed self-driving vehicles for the end user. One of Forterra’s closest partners is Oshkosh Defense, the leading supplier of tactical wheeled vehicles for the DoD.

In October 2025, Oshkosh, Raytheon, and Forterra unveiled a full lineup of autonomous missile-launching platforms known as the Family of Multi-Mission Autonomous Vehicles (FMAV). In the partnership, Oshkosh provides the vehicles, Raytheon provides the vehicle payloads, and Forterra integrates the AutoDrive system and associated software. The FMAV consists of the Light, Medium, and Extreme Multi-Mission Autonomous Vehicles (L-MAV, M-MAV, and X-MAV, respectively).

Source: Oshkosh Defense

While FMAV is an Oshkosh corporate branding term, the systems included in this family are closely related to those that compete for DoD contracts under military program names like ROGUE-Fires, DeepFires, and DeepStrike.

Forterra has also integrated AutoDrive on vehicles for commercial applications. In March 2024, Forterra announced a partnership with logistics equipment manufacturer Kalmar to produce a line of autonomous trucks called the Ottawa Autonomous Terminal Tractor (AutoTT). These vehicles, known as terminal tractors, are designed to transfer semi-trailers within the confines of shipping yards and ports. This means that the AutoTT does not need to pass extensive regulations to qualify for use on public roads.

Source: Forbes

The vehicle consists of a Kalmar Ottawa terminal tractor fitted with a Forterra AutoDrive sensor suite and computer. The AutoTT is set to be available in 2026, with full production scheduled for the latter half of the year.

TerraLink

While AutoDrive operates at the vehicle level, Forterra’s TerraLink software operates at a higher command level, enabling users to orchestrate the movement and operations of multiple vehicles simultaneously.

TerraLink can be accessed through common military interfaces like the Tactical Assault Kit (TAK), Warfighter Machine Interface (WMI), and traditional console and tablet computers. Through these interfaces, users can plan, oversee, and control complex vehicle movements.

Source: Forterra

Service members accessing TerraLink through an interface like TAK are provided with vehicles’ positions, critical data, and live video through vehicle-mounted cameras. The user can then set waypoints and alter vehicle movements to support military operations. The capabilities that TerraLink provides can be used for coordinating multi-vehicle operations like convoy movements, distributed sensor networks, or synchronized tactical maneuvers.

Vektor

Forterra’s communication software layer, Vektor, is designed to function and sustain a reliable connection between vehicles and operators in environments contested by adversarial electronic warfare signals. Vektor is an “edge-deployed, software-defined communication and smart data-brokering layer” that is designed for continued use in disrupted, degraded, intermittent, and low-bandwidth situations. In modern conflicts, adversaries routinely employ jamming and spoofing techniques to deny communications and GPS signals. Vektor ensures that autonomous vehicles can maintain connectivity with operators and coordinate with each other even under these challenging conditions.

Oasis

Forterra describes Oasis as an “end-to-end ontology platform” that facilitates the communication between Forterra products and third-party products. Oasis is a key part of the modular, open, scalable architecture of Forterra's autonomy stack. Since the company doesn't develop complete vehicles, but rather modifies third-party vehicles, Oasis is necessary to enable Forterra to integrate the AutoDrive system with new platforms while requiring minimal specialization. This capability reduces integration time and costs, allowing Forterra to adapt its autonomy systems to new vehicle platforms as customer needs evolve.

goTenna

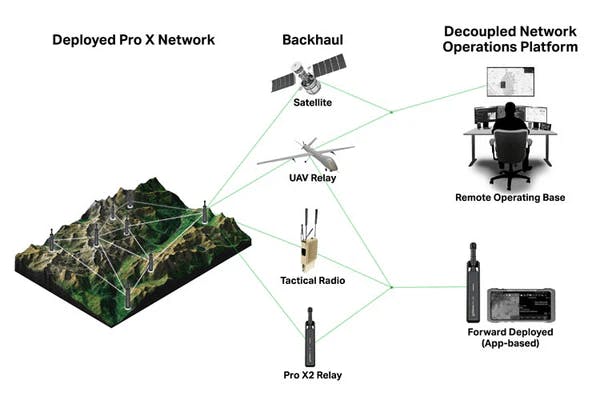

In October 2025, Forterra acquired mesh radio network company goTenna. Mesh radios are designed to relay messages between nodes without having to rely on a central hub. As a result, the goTenna mesh network system is useful in scenarios where communications infrastructure is damaged or nonexistent.

The DoD maintains a strong focus on systems that function without relying on traditional infrastructure or networks. The vulnerability of such infrastructure has been repeatedly exposed through cyber attacks, physical attacks, natural disasters, and accidents. As electronic warfare progresses, jamming techniques become increasingly advanced.

Source: goTenna

Forterra’s acquisition of goTenna extends the company’s vertical integration by incorporating a proprietary communications network. Since vehicles equipped with Forterra’s AutoDrive are designed to operate as a convoy or by the command of a remote user through TerraLink, reliable communications are a necessity for the autonomous vehicles.

Market

Customer

Forterra’s primary customers are defense companies like Raytheon and Oshkosh, vehicle manufacturers like Kalmar, and the United States DoD. Because Forterra serves as a subcontractor on many DoD programs, it sells its vehicle autonomy products to the prime contractors that are then paid by the DoD for the finished vehicle.

Forterra also serves as the prime contractor on many Army and Marine Corps programs aimed at retrofitting existing DoD vehicles with self-driving technology. The extensive ground vehicle fleets of these two branches make them more relevant to Forterra than other military branches.

Beyond military services, Forterra's commercial offerings target logistics and industrial customers like Kalmar. Kalmar then sells the finished AutoTT vehicle to final customers after Forterra integrates the AutoDrive system.

Market Size

The United States DoD operated an estimated 420K ground vehicles, including both 250K combat vehicles and 170K non-combat vehicles as of 2023. Of the total ground vehicle fleet, approximately 100K were vehicles in the High Mobility Multipurpose Wheeled Vehicle (HMMWV) or “Humvee” family as of 2025. As of December 2025, the DoD was actively replacing the up-armored variant of the Humvee one-for-one with 61.6K of the newer Oshkosh Joint Light Tactical Vehicle (JLTV) family of trucks.

The ground vehicle fleets represent a significant opportunity for Forterra as the DoD seeks to modernize these existing platforms rather than procure entirely new vehicles. Forterra has been selected for programs like the Ground Expeditionary Autonomous Retrofit System (GEARS), which seeks to retrofit the Oshkosh Palletized Load System (PLS) trucks with autonomous driving technology.

Beyond the United States DoD, Ukraine is significantly expanding its acquisition of UGVs, with projections estimating that 30K are to be acquired in 2026 alone. This increase reflects the combat-proven value of autonomous ground systems in modern warfare, where unmanned systems serve as force multipliers that allow smaller units to hold territory against numerically superior forces.

Forterra also targets commercial markets with its AutoTT, co-produced by Kalmar. In 2021, a North American Council for Freight Efficiency report estimated there were 25.2K total terminal tractors actively operated in the United States and Canada. Since the 1950s, Kalmar has produced over 85K terminal tractors. Its Ottawa T2 model, the platform on which the AutoTT is based, is one of the most common terminal tractors in operation.

Competition

Several companies compete with Forterra for military ground-based autonomous systems contracts. These competitors include both legacy prime contractors producing complete vehicles as well as smaller startups modifying existing systems or producing lightweight UGVs. In Europe, there are a multitude of UGV manufacturers that develop systems to support the effort in Ukraine.

Adjacent Competitors

Overland AI: Founded in 2022, Overland AI develops autonomous all-terrain vehicles for military use. As of February 2026, the company has raised a total of $142 million, including a $100 million round raised in January 206. Overland’s OverDrive system is a vehicle-agnostic sensor and software stack analogous to AutoDrive. In addition to OverDrive, the company sells Ultra, an autonomous vehicle based on a Polaris RZR side-by-side chassis with extreme modifications.

In October 2025, Overland AI partnered with Anduril to conduct a joint field demonstration of autonomous technologies. The demonstration featured Ultras equipped with Anduril radars and electronic warfare payloads working in tandem with Anduril’s Ghost unmanned aerial ISR platform.

Applied Intuition: Founded in 2017, Applied Intuition is heavily involved in vehicle autonomy and has partnered with many major automotive brands like Volkswagen Group, Toyota, and Nissan. As of February 2026, Applied Intuition has raised a total of $1.5 billion and is valued at $15 billion. It is backed by Andreessen Horowitz and Kleiner Perkins.

The company’s defense division, Applied Intuition Defense, offers two complementary software products known as Axion and Acuity. Axion is an autonomy development and testing tool that allows for the design, simulation, and validation of autonomous software. Acuity is the company’s onboard autonomy software designed to work with vehicles in all domains.

In addition to its software lineup, Applied Intuition Defense demonstrated its hardware integration capabilities by converting the Army’s Infantry Squad Vehicle (ISV) to operate autonomously. The company completed this integration in just 10 days as part of an Army challenge to demonstrate rapid autonomy capabilities.

Kodiak Robotics: Founded in 2018, Kodiak AI is involved in vehicle autonomy and robotics in both the defense and trucking industries. The company provides sensors and software systems to convert existing vehicles to autonomous vehicles. In May 2024, Kodiak partnered with defense contractor and ground vehicle developer Textron to develop autonomous military vehicles. In September 2025, Kodiak began trading on Nasdaq under the ticker symbol KDK. As of February 2026, Kodiak has a market cap of $1.6 billion.

Scout AI: Founded in 2024, Scout AI emerged from stealth in April 2025 with a $15 million seed round, which remains its total funding to date as of February 2026. The company develops unmanned vehicles for defense applications. Similar to Overland AI, Scout AI offers an autonomous off-road military vehicle based on the Polaris RZR chassis known as Fury.

Primes

General Dynamics Land Systems: General Dynamics Land Systems (GDLS) is a prime contractor and was the leader in military ground autonomy for decades. The company has been involved in several high-profile contracts and programs like the SMET and XM30 Optionally Manned Fighting Vehicle (OMFV), and competed against Forterra. GDLS’s autonomous vehicles include the Multi-Utility Tactical Transport (MUTT), which competed for the SMET program, and the Tracked Robot 10-ton (TRX).

Unlike Forterra, GDLS develops both the chassis and autonomous technology for its autonomous vehicles. In addition to its increased vertical integration, GDLS also benefits from deep-rooted ties with DoD entities, formed over decades of work.

General Motors: Like GDLS, General Motors (GM) has been a prime contractor for DoD ground vehicles for decades. In June 2020, GM was awarded a $214.3 million Army contract to mass-produce the ISV. Upon increased interest in autonomous vehicles from the Army, GM began working in November 2025 to apply its commercial autonomy to the ISV.

Similar to GDLS, GM benefits from its history of developing vehicles for the DoD. Because GM designed the ISV, its complete knowledge of the system, combined with its experience in commercial autonomy, provides the company with a unique advantage.

Ukrainian UGV Technology

Following the Russian invasion of Ukraine in 2022, rapid advancements were made in defense technology as both sides adapted and acquired autonomous systems for military use. While unmanned aerial systems like one-way attack quadcopter drones quickly took the spotlight, the countries continually developed autonomous systems for all domains.

In 2024, UGVs served in a variety of roles in the Russo-Ukrainian conflict. The most common use cases for such vehicles were support roles along the front lines, like casualty evacuation, resupply, and fire support.

Source: Ministry of Defence of Ukraine

The acquisition of UGVs is rapidly increasing in Ukraine. In 2024, the country deployed approximately 2K UGVs, with a goal to operate roughly 15K UGVs in 2025. In a November 2025 interview, Viktor Pavlov, the founder of the Ground Robotic Systems School in Ukraine, projected a necessary acquisition of 30K UGVs for 2026.

Several makes and models of UGVs were acquired by Ukraine. Some of the most common platforms include the TerMIT (pictured below), developed by the Ukrainian company Tencore, and the Estonian-made THeMIS.

Source: Ministry of Defence of Ukraine

In a July 2025 announcement, MITS Capital, an investor in Tencore, reported that the company had successfully delivered 800 TerMIT units with plans to bring total production to 2K units by the end of the year.

Business Model

Forterra relies on DoD contracts as its primary source of revenue. These contracts often originate from Army or Marine Corps programs due to the branches’ reliance on ground vehicles. The company generates revenue through a combination of software licenses, hardware sales, and integration services for third-party vehicles and payloads.

Since Forterra does not offer any complete vehicles, it is largely positioned to be a subcontractor, rather than a prime contractor, on high-profile new vehicle programs. However, Forterra competes as the prime contractor on DoD programs aimed at retrofitting existing DoD vehicles with autonomous technology or designing smaller, infantry support autonomous vehicles.

In addition to government contracts, Forterra also develops commercial off-road autonomy solutions like the AutoTT, produced in partnership with Kalmar. This dual-use approach allows Forterra to utilize defense research and development investments for commercial applications while diversifying revenue streams beyond government contracts.

Traction

Following Forterra’s organizational transformation, the company landed several high-profile contracts and formed partnerships with multiple high-profile defense and automotive companies. These contracts include programs like ROGUE-Fires, the first production autonomy DoD contract, as well as many other smaller research and development contracts. To deliver complete vehicles to the DoD, Forterra has partnered with a number of companies, including Oshkosh, Raytheon, CHAOS, BAE, and Volvo.

ROGUE-Fires

In January 2025, Forterra was selected as the subcontractor for vehicle autonomy to Oshkosh on the Marine Corps’ Remotely Operated Ground Unit for Expeditionary Fires (ROGUE-Fires) production contract. The ROGUE-Fires program resulted in the development of a vehicle known as the Navy and Marine Corps Expeditionary Ship Interdiction System (NMESIS). The NMESIS consists of an Oshkosh JLTV chassis modified with a Forterra AutoDrive system and a launcher for the Kongsberg Naval Strike Missile (NSM).

Source: Naval News

The award of the $29.9 million contract for ROGUE-Fires marked the first-ever DoD production contract for full-size autonomous vehicle production. This contract follows two ROGUE-Fires low-rate initial production contracts for development and testing, worth $39.6 million and $40 million awarded to Oshkosh with Forterra as a subcontractor in 2023 and 2024, respectively.

DeepFires and DeepStrike

DeepFires and DeepStrike are two closely related Army programs for autonomous wheeled missile launching platforms. Both programs use the Oshkosh Family of Medium Tactical Vehicle (FMTV) A2 chassis with Forterra's AutoDrive system. The programs differ in their Raytheon-supplied mission payloads.

DeepFires is designed to work with multiple missile launchers and types, including Patriot surface-to-air missiles and Tomahawk cruise missiles. DeepStrike is designed for use with missiles developed under the Army's Joint Reduced Range Rocket (JR3) rapid-prototyping initiative. The JR3 program aims to develop mid-range precision strike capabilities using solid rocket motors supplied by Ursa Major.

Source: RTX

The Forterra, Oshkosh, Raytheon, and Ursa Major team successfully demonstrated the autonomous driving and missile launch capabilities of DeepStrike to the Army in a March 2025 test. In October 2025, the same team, minus Ursa Major, showcased DeepFires in Washington, D.C.

Other Partnerships

In addition to Oshkosh and Raytheon, Forterra has formed partnerships with several other defense and automotive companies. These alliances enable Forterra to develop autonomous systems integrated with new weapons systems and underlying vehicle platforms while also expanding the company to new markets.

In October 2025, Forterra announced a partnership with counter-drone radar company CHAOS Industries. Together, the companies integrated and tested a CHAOS unmanned aerial system (UAS) detecting radar known as the VANQUISH on the back of a Forterra-controlled Squad Multipurpose Equipment Transport (SMET).

BAE Systems, one of the largest advanced military systems developers, partnered with Forterra in April 2025. Later in September 2025, the team announced its goal to deliver a functioning autonomous prototype of the Army’s Armored Multi-Purpose Vehicle (AMPV) by 2026. The AMPV is a tracked, armored fighting vehicle first introduced by BAE in 2016.

In a move to expand to European markets, Forterra partnered with Volvo, the Swedish automotive manufacturer with several European defense contracts. In September 2025, the two companies demonstrated the use of a Volvo truck integrated with Forterra’s AutoDrive at the Defence and Security Equipment International trade exhibition in London.

Other Contracts

In addition to subcontracting on high-profile programs like ROGUE-Fires, Forterra has been awarded the prime contractor position on several DoD contracts. In November 2025, Forterra announced its award of three more Army contracts, including a contract for Phase II of the Ground Expeditionary Autonomous Retrofit System (GEARS) program, a $114 million contract for autonomous breaching systems, and a $4.8 million contract for the Unmanned Systems (UxS) Program. All of these contracts are for vehicle autonomy integration rather than the production of complete vehicles.

Valuation

In November 2025, Forterra announced its $238 million Series C funding round led by Moore Strategic Ventures. This round brought the total funding raised by the company to nearly $700 million and pushed the company’s valuation over $1 billion. Previous funding rounds included a $75 million Series B funding round in September 2024 and a $228 million Series A in December 2021.

Prior to 2021, when the company was still known as Robotic Research LLC, it subsisted without venture capital support, relying primarily on revenue generated from government contracts. Softbank’s investment in the company in December 2021 marked the first outside investment.

Key Opportunities

Increased Geopolitical Instability

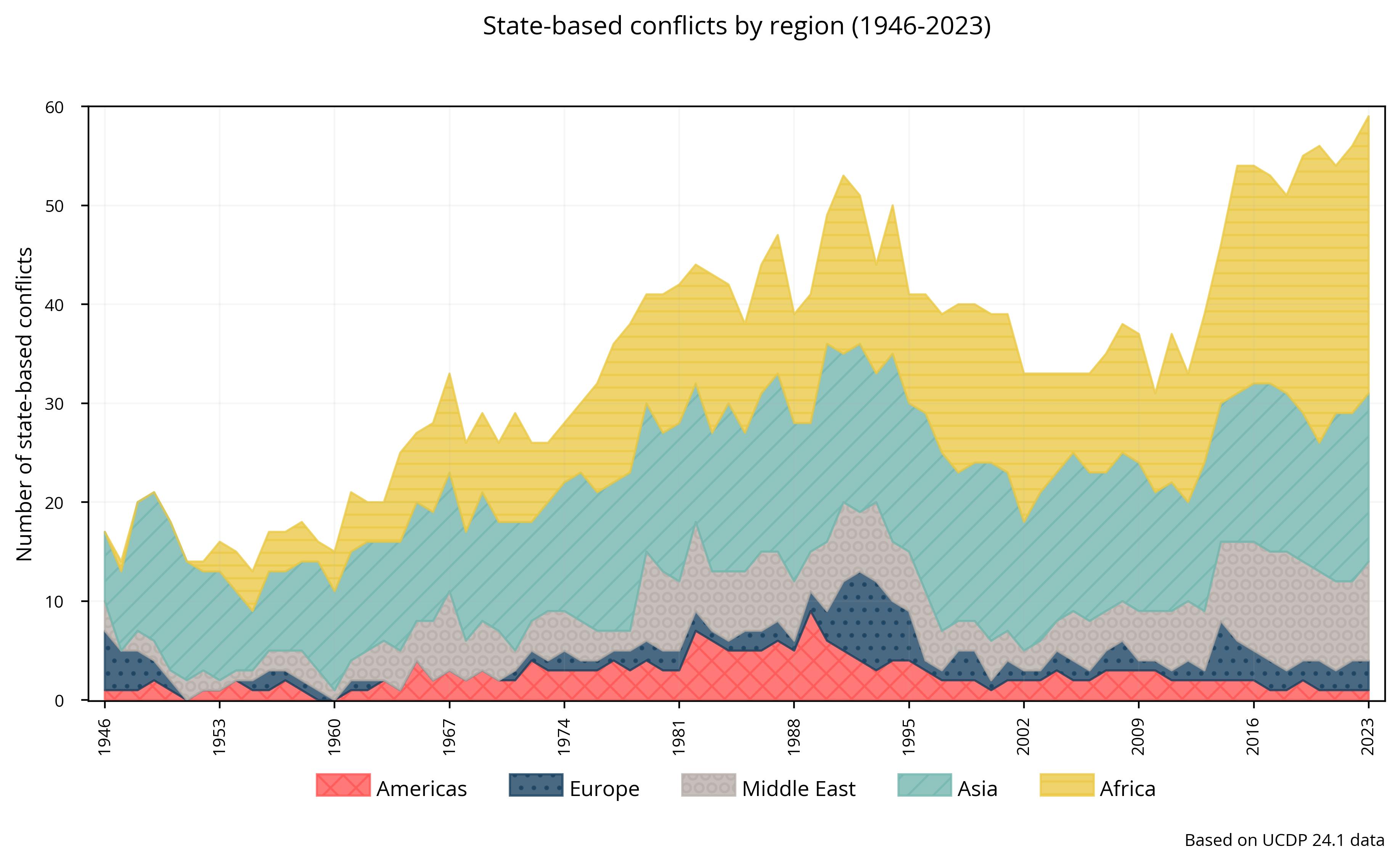

Global conflicts intensified in the early 2020s, with wars in Ukraine, the Middle East, and ongoing tensions in the South China Sea reshaping defense priorities worldwide. Apart from a brief dip in the late 1990s and early 2000s, the number of state-based conflicts has followed a general upward trend since the end of World War II, with 60 conflicts occurring in 2023.

Source: World Economic Forum

With increased conflict prevalence and geopolitical instability comes increased defense spending as countries seek to modernize their military assets. In 2024, the total military expenditure across the world was $2.7 trillion, a 9.4% increase over 2023 spending. This increase was the tenth consecutive year of growth and the greatest increase in a single year since the end of the Cold War.

As global military expenditure continues to increase, companies like Forterra that draw the majority of their revenue from DoD contracts benefit. If 2025 trends continue, defense spending could reach as high as $6.6 trillion by 2035.

Collaboration with Primes

Since Forterra's business model relies primarily on integrating autonomous driving technology on existing vehicles rather than developing original vehicles, the company is uniquely positioned to work with traditional defense prime contractors like Oshkosh. Instead of competing directly against legacy defense companies like many other modern defense startups, this approach enables Forterra to benefit from the longstanding relationships these companies cultivated with DoD acquisition departments. This collaborative approach allows Forterra to access major programs where traditional defense contractors serve as lead contractors by providing the specialized autonomy solutions that such companies lack expertise in.

Commercial Expansion

Just as Forterra partnered with Kalmar to produce autonomous terminal tractors, it could partner with other commercial vehicle manufacturers to produce autonomous platforms for other off-road use cases. Industries like agriculture, forestry, mining, and construction all operate numerous types of ground vehicles separate from public roads in conditions similar to those the AutoTT or NMESIS may experience. Such an expansion would allow Forterra to diversify its revenue streams across many industries while still remaining clear of the legal restrictions surrounding autonomous vehicle usage on public roads.

Key Risks

Historical Failure of UGV Programs

Despite Forterra's increased traction in the early 2020s, the contracts and revenue realized were still largely related to research, development, testing, and evaluation programs. For over two decades, Forterra received and successfully delivered on such contracts. Even still, widespread procurement of autonomous vehicles has yet to occur as of December 2025.

The Marine Corps plan for NMESIS procurement lists 261 vehicles to be delivered by 2030. Although this is the largest order of autonomous vehicles in DoD history, it is only a small fraction of the 61.6K conventional JLTVs, the chassis on which the NMESIS is based, that are proposed to be acquired over the lifetime of the program.

As of December 2025, heavy-duty autonomous trucks have yet to be combat validated in significant numbers. The majority of the UGVs operated in the Ukraine war are small, tracked platforms like the TerMIT and THeMIS. Combat validation of such full-sized autonomous trucks will be critical for long-term success.

Limited Vertical Integration

Forterra does not develop or produce any complete vehicles. Instead, it modifies existing vehicles provided by third parties like Oshkosh and Kalmar. This lack of vertical integration poses a risk to Forterra as companies like GM and GDLS have increased access to and understanding of the vehicles they already sell to the DoD, making integration of their own autonomous driving systems easier.

This dynamic puts Forterra at the mercy of third-party companies. Forterra needs to find a prime contractor to partner with in order to compete for many of the DoD’s autonomous vehicle contracts. Similarly, on the commercial side, Forterra cannot sell direct to consumer. Instead, it needs to find a vehicle manufacturer to partner with in order to integrate AutoDrive onto a usable platform.

Export Regulations

While Ukraine and many other European Ministries of Defense expressed great interest in acquiring UGVs, sensitive technology export regulations stand between Forterra and such foreign contracts. The International Traffic in Arms Regulations (ITAR) and Export Administration Regulations (EAR) tightly control the export of defense technologies with potential military applications. These regulations are designed to protect advanced technologies and maintain American strategic advantages.

Despite these constraints, Forterra can pursue Foreign Military Sales (FMS) to make its technology available to European and other allied partners through United States government programs. Forterra’s partnership with Volvo and the subsequent demonstration of AutoDrive technology on Volvo trucks in London indicate Forterra’s pursuit of FMS.

Summary

For nearly two decades, Forterra (then known as Robotic Research) produced autonomous ground systems for defense applications. Then, in the early 2020s, global military spending and defense venture investment began to rise rapidly in response to increased geopolitical instability.

Forterra responded to this market shift by accepting its first outside investment, hiring an entirely new C-suite, and undergoing a complete rebranding. The company has since secured DoD contracts, including ROGUE-Fires, the first DoD production contract for full-size autonomous vehicles, and has partnered with legacy prime contractors like Oshkosh, BAE, and Raytheon. In addition to defense applications, Forterra’s dual-use commercial strategy, demonstrated by the AutoTT, provides revenue diversification beyond DoD contracts.

Going forward, Forterra faces challenges including limited vertical integration, potential competition from primes developing in-house autonomy solutions, and the historical difficulty of transitioning autonomous ground vehicle programs from development to widespread procurement. At the same time, Forterra is uniquely positioned to partner with traditional prime contractors and capitalize on the DoD’s increased focus on autonomous systems.