Thesis

In December 2019, Boeing's Starliner, a critical component of NASA's Commercial Crew Program, was scheduled to dock with the International Space Station. However, a software error sent the uncrewed capsule into the wrong orbit, forcing an early mission termination and a staggering $595 million loss.

This failure is not an isolated incident. High-profile quality assurance setbacks, from the iSpace lunar lander crash in 2023 due to a software altitude estimation error, to mechanical failure detection issues that caused the Norfolk Southern East Palestine train derailment, have contributed to an annual $2 trillion loss. These expensive, mission-critical failures do not stem from a lack of engineering talent or ambition, but rather from an antiquated test stack.

Source: Nominal

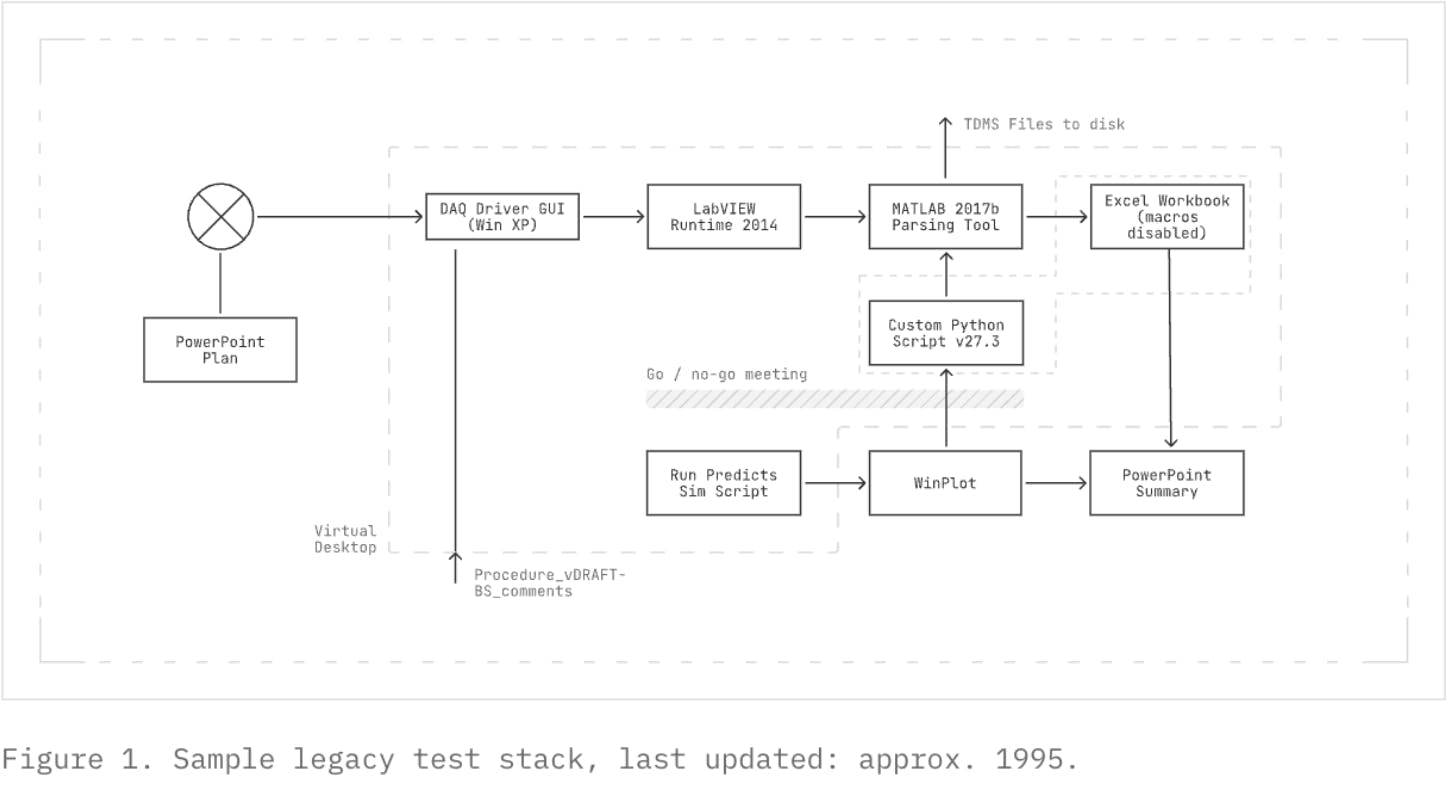

While testing and validating hardware, test engineers are forced to “stitch together a fragmented set of point solutions and custom code to process their test information.” This approach, rooted in tools often designed in a pre-Internet era, was designed when hardware development cycles assumed long timelines, rigid production cycles, and minimal testing after deployment. By using a patchwork of antiquated solutions not built for testing hardware, studies have shown that 68% of hardware projects encounter delays due to design issues and inadequate testing.

To make matters worse, the legacy test infrastructure is further strained by hardware becoming increasingly software-defined. As advanced systems, from autonomous vehicles to defense infrastructure, are stuffed with sensors and semiconductors, the volume of data they generate grows exponentially. A direct consequence of this explosion in data is that 80% or more of the data collected across the semiconductor supply chain is never examined, creating liabilities and limiting improvements. The ability to collect, trace, store, and analyze large volumes of test data simply cannot be handled by these legacy systems.

SpaceX identified this issue in 2006 during the development of Falcon 1, and invested tens of millions in creating its own modern, scalable test stack. This investment drastically improved its iteration velocity, with SpaceX accounting for 134 of the 154 US launches in 2024, compared to Boeing's joint venture with Lockheed Martin, which only launched five rockets. SpaceX’s success shows that testing can become a competitive advantage if hardware startups utilize a test stack that enables continuous testing throughout their entire development and operational lifecycle.

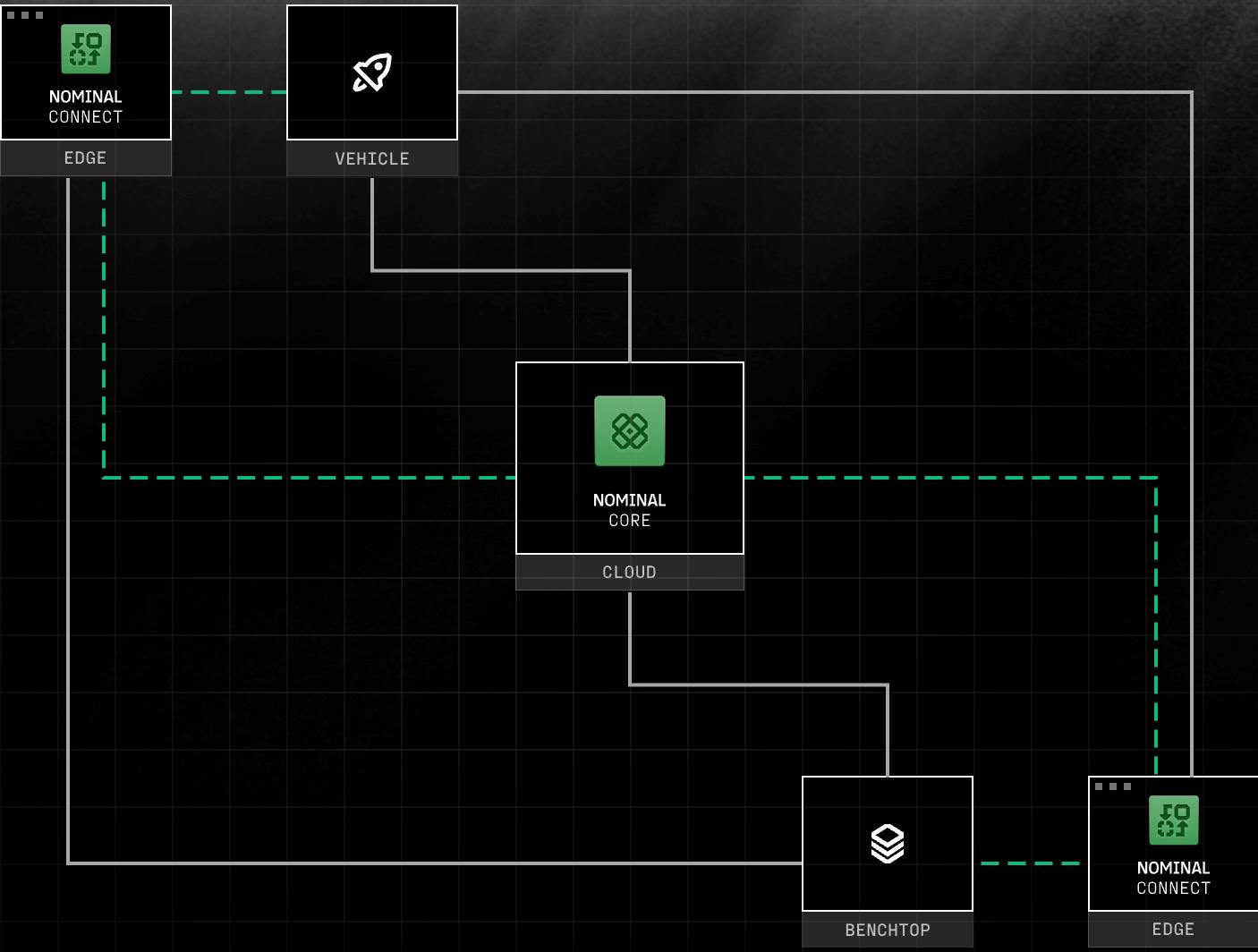

Nominal unlocks continuous testing through its unified platform. Core, the backbone of Nominal’s platform, is a cloud-hosted database that consolidates data from hundreds of sources in real time, allowing teams to search, visualize, and analyze data to spot trends, critical events, and anomalies. Connect, Nominal’s second product, links the tools and systems teams already use in the lab, online, and in the field, so tests are automated and insights from deployed systems flow back to engineering. Together, Core and Connect replace one‑off tests with a continuous build–test–learn cycle that spans the entire hardware lifecycle, from first prototype to live operations.

Founding Story

Source: BZ Notes

Nominal was founded in 2022 by Cameron McCord (CEO), Bryce Strauss, and Jason Hoch. Before founding Nominal, McCord and Strauss encountered hardware testing challenges from different angles for over a decade.

Inspired by his uncle, a Senior Admiral, McCord joined the Navy after participating in the Naval Reserve Officer Training Corps at MIT, where he was recognized as one of the fourteen most impressive students at the institution. As a submarine officer and nuclear engineer for eight years, McCord spent 484 days underwater and oversaw the nuclear reactor on the USS Helena, a fast-attack submarine that ranked number one in its squadron during his tenure. On Helena, McCord discovered that even frontier military assets relied on outdated technology "straight out of the 1980s," deepening his empathy for warfighters burdened by antiquated systems.

After leaving the Navy, McCord brought his military and leadership expertise to Anduril as an early member of the Counter UAS Team, where he learned to architect software stacks for iterative testing of anti-drone systems. Even at this well-resourced, agile company, he found testing software to be a bottleneck. Subsequent roles at Applied Intuition and Saildrone reinforced this observation.

At Lux Capital, McCord spoke with hundreds of hardtech founders and confirmed that hardware testing was a widespread bottleneck. While at Lux, McCord attended Harvard Business School, where he met Strauss, a former Lockheed Martin spacecraft engineer who had built satellites orbiting Jupiter and Mars. At Harvard, Strauss focused on commercial applications for connected hardware and embedded machine learning. In these emerging fields, he realized that software tools for managing data from modern devices couldn't keep pace with increasingly complex hardware.

Meanwhile, Hoch, who originally met McCord during their first week as undergraduates at MIT, where they joined the same fraternity, gained critical expertise in software architecture and deployment. He spent five years at Palantir, leading a key team that deployed its Foundry platform, which provided him with a crucial perspective on the "integration lift" and go-to-market strategies that Nominal would later employ.

Together, McCord, Strauss, and Hoch combined their complementary experiences in military operations, aerospace engineering, and enterprise software to build a testing platform that aims to transform hardware testing from a bottleneck into a competitive advantage.

Nominal strengthened its team by bringing Jack Parmer to lead the development of Nominal Connect, the company’s hardware-in-the-loop testing app. After graduating from Stanford, Parmer scaled Plotly, an open-source Python data visualization company, to 300 million users and $10 million ARR. He then founded FLOJOY, where he led efforts to improve test measurement and control for physical systems. After two years at FLOJOY, he joined Nominal. Recognized as a "10x founder," Parmer's expertise in data visualization and control frameworks, combined with his hands-on experience in physical system testing, strengthens Nominal's commitment to data accessibility in hardware testing.

Product

Nominal is a software platform that accelerates the development of mission-critical systems by enabling engineers to efficiently test and validate complex systems, such as hypersonic aircraft, nuclear reactors, satellites, rockets, and robots.

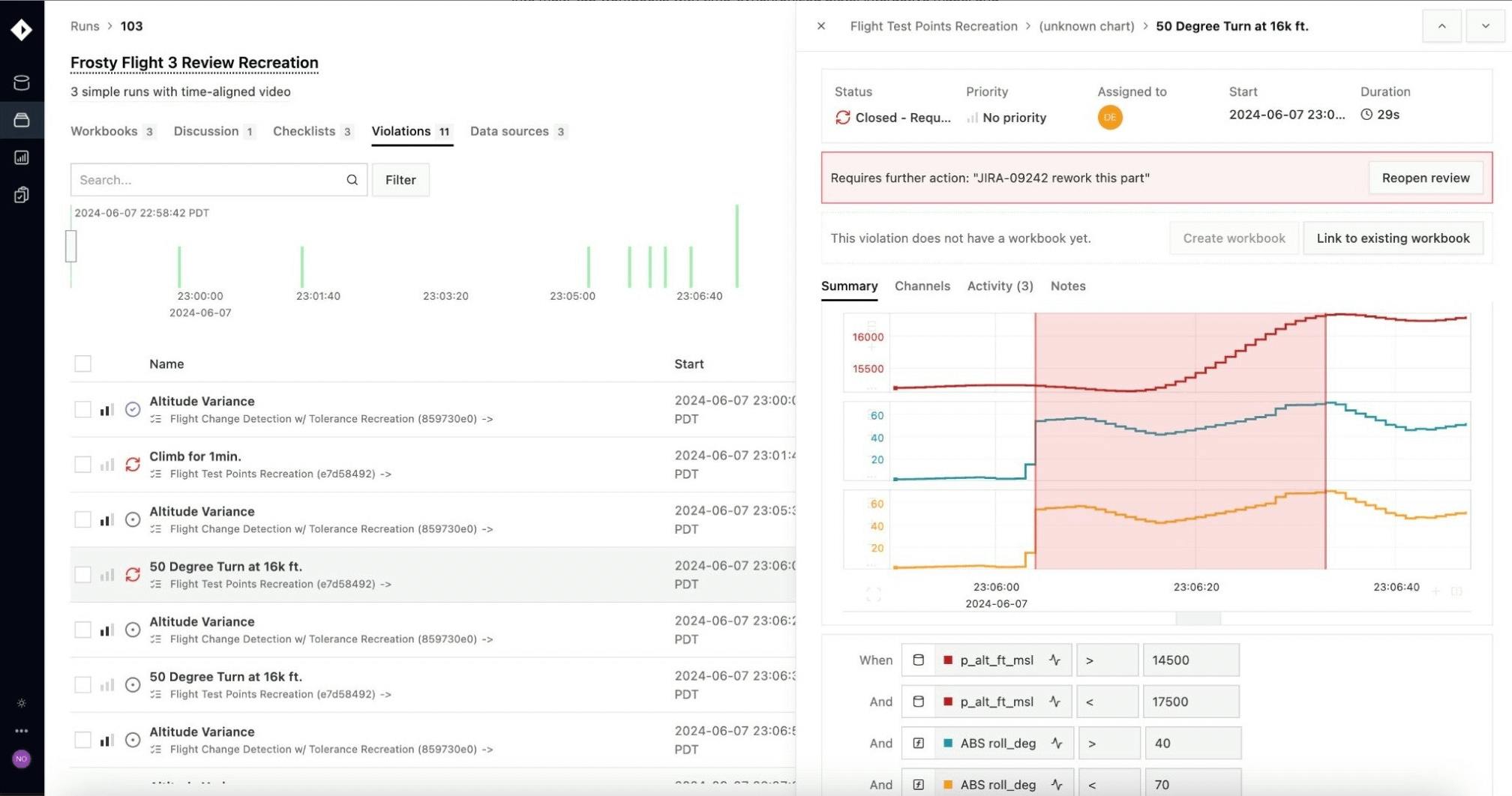

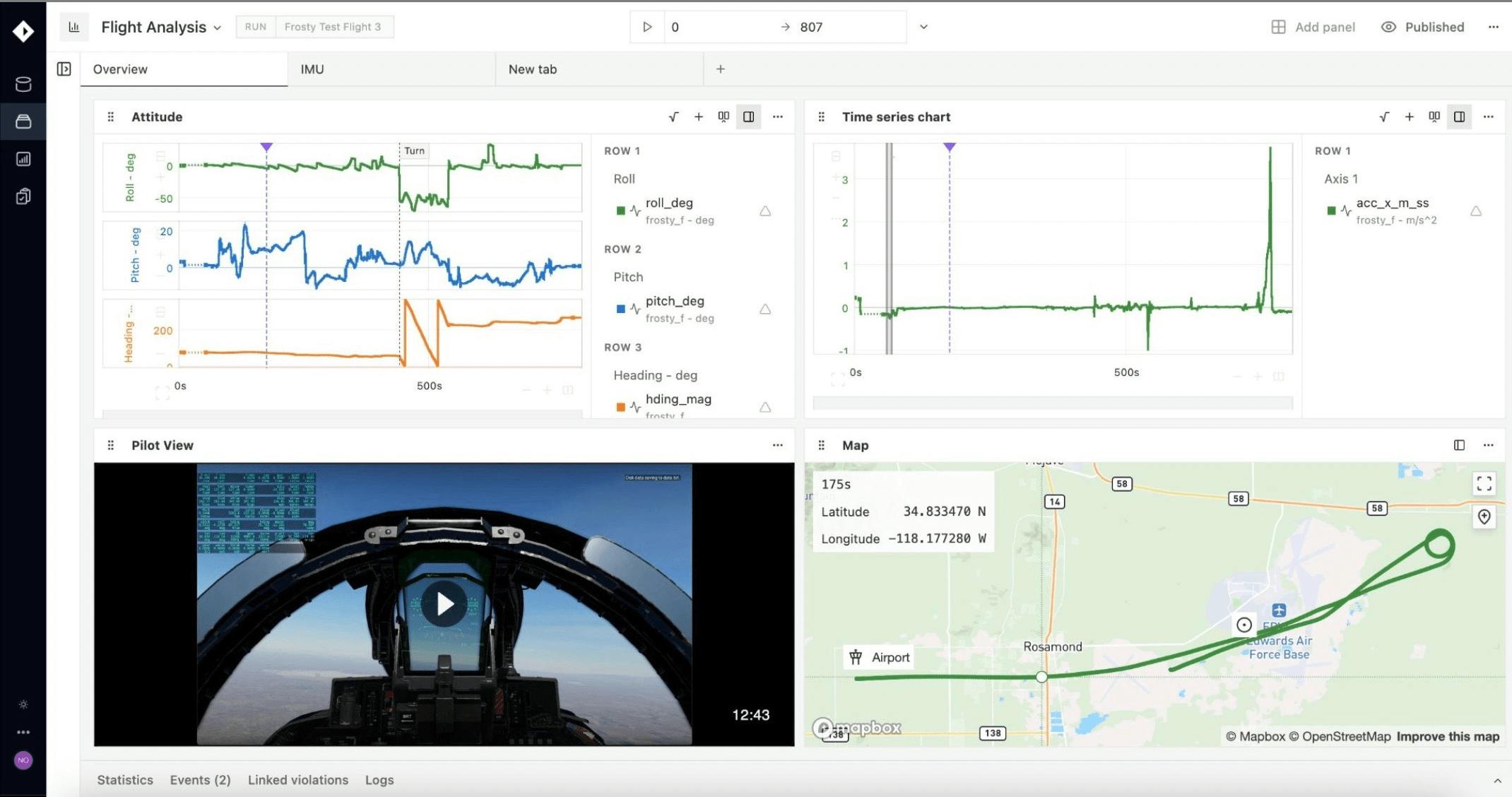

Modern hardware systems, such as Shield AI’s V-BAT, a vertical take-off unmanned aircraft system, are equipped with hundreds or even thousands of sensors, generating terabytes of flight data from kilohertz to nanosecond frequencies. For engineering teams, the critical challenge lies in immediately accessing, distributing, and interrogating these vast datasets to make real-time decisions. Nominal enables Shield AI engineers to review V-BAT test data before its engines cool, allowing them to instantaneously ask precise questions like “When we made a 50-degree turn at 16K feet, what happened to the engine’s temperature, and how does that compare to what happened yesterday?” This capability reduces test-to-decision time from days to minutes, accelerating product development through increased test velocity and faster iteration cycles.

Source: Nominal

This is a meaningful contrast from the traditional test cycle for an aircraft. After a test flight, engineers face a series of bottlenecks that can stretch the testing process to several days. The arduous process begins with pulling hundreds of terabytes of data off the aircraft (a task that can alone consume several hours) and uploading it to fragmented storage solutions like Box or SharePoint.

This initial transfer and organization of massive data files from the asset creates a major data ingestion bottleneck, as it is a slow and error-prone process. Once uploaded, a small team of engineers then downloads this data to their laptops, where they run analyses using tools like MATLAB or custom scripts. These reports are then circulated to the broader organization. However, data often remains siloed on individual machines, creating management and access barriers that bottleneck broader team collaboration. For example, identifying discrepancies or anomalies can lead to multi-hour or multi-day delays, as requesting new plots or analyses requires a protracted back-and-forth process, given that very few engineers possess the necessary skill set to interrogate the data.

Nominal Core

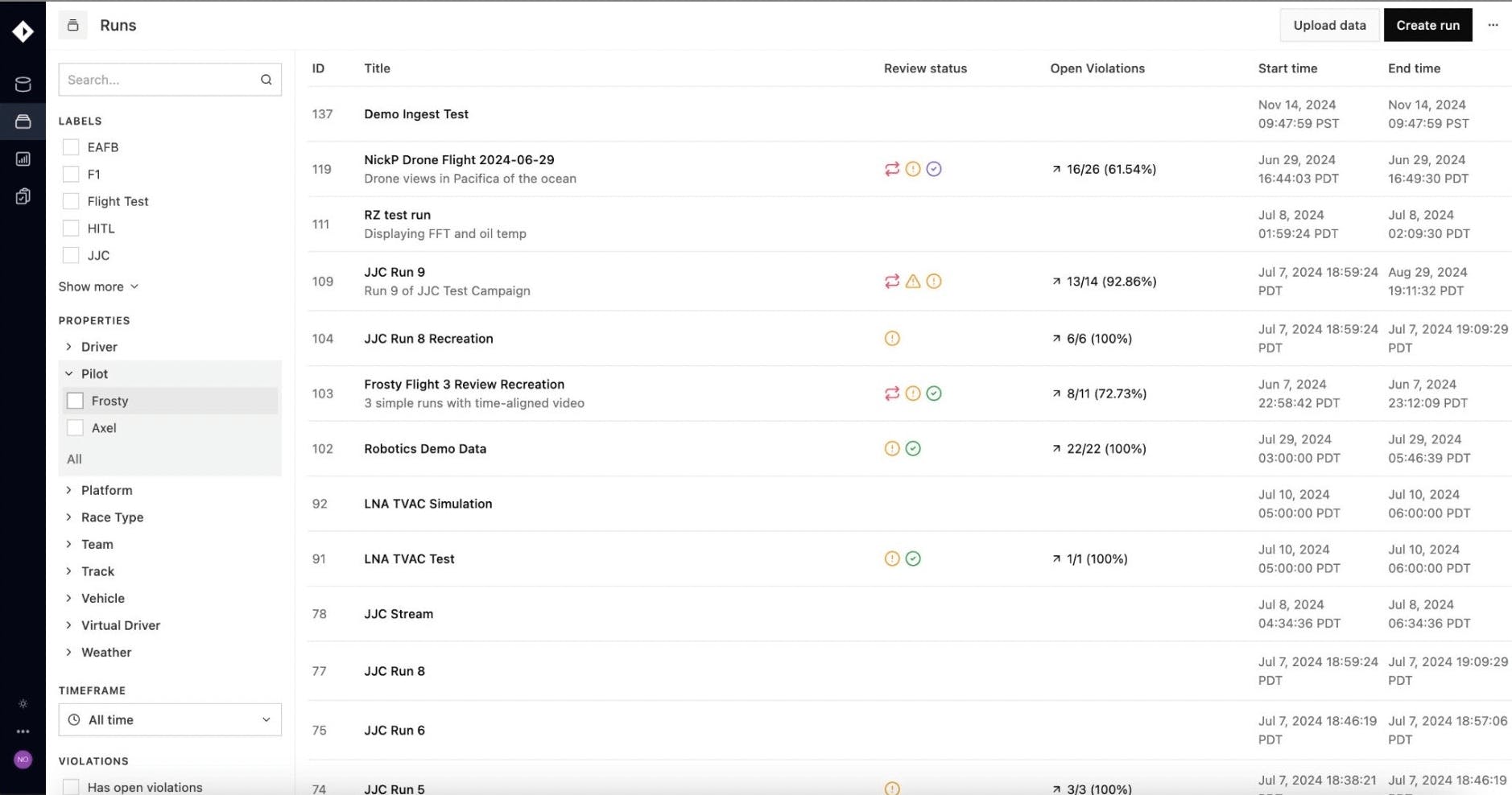

Nominal directly addresses these bottlenecks through its flagship product, Nominal Core. Core is a unified, cloud-based database designed to connect and organize hundreds of data sources in real-time. This product allows all team members to collaboratively search through or visualize data, facilitating the identification of trends, critical events, and anomalies.

Nominal Core accelerates the entire test and validation process by rapidly consolidating all data from any asset in one centralized location. This consolidation, coupled with its ability to empower any team member to interrogate the data, dramatically increases efficiency. After using Core, the percentage of a company routinely interacting with hardware test data rose from less than 10% to 30-50%. Core enables all engineers, VPs, and directors to directly engage with test data and generate insights, eliminating the reliance on test engineers with specialized skill sets.

Nominal Core initially began as Scout, “a data analysis tool that enabled test engineers to develop, validate, and monitor hardware” by seamlessly syncing and plotting test runs and performing conditional logic checks. This allowed analytical workflows that previously took hours to be completed in a few clicks. Nominal Core has significantly expanded upon the data review process, offering three primary workflows: Data Management, Data Analysis, and Automated Verification.

Data Management Workflow

Source: Nominal

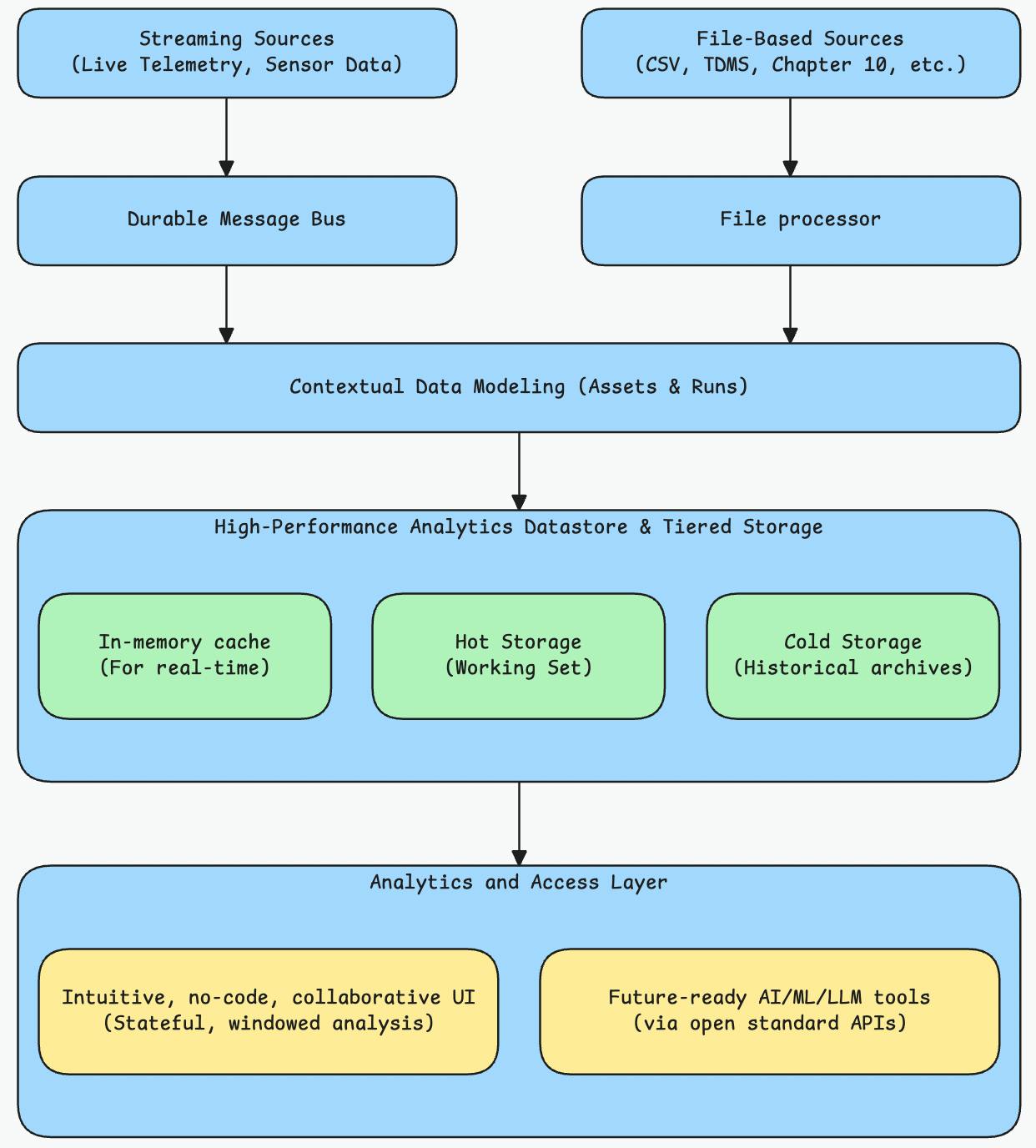

Nominal Core's Data Management workflow is designed to streamline handling test data, making it essentially invisible to the end-user. The objective is for engineers to focus solely on analysis, rather than the underlying logistics of file location, version management, or tool compatibility. This workflow is driven by two core pillars, built upon a state-of-the-art, multi-layered architecture featuring decoupled components. This design enables different parts of the system (such as data intake, processing, searching, and storage) to work independently, preventing a single heavy task, like merging terabytes of data, from slowing down real-time data access.

Source: Nominal

The diagram above breaks down Core’s architecture, illustrating how data flows from agnostic sources through specialized processors to a high-performance datastore. Nominal’s architecture enables the following two capabilities:

Rapid, Source-Agnostic Data Ingestion: Core prioritizes the seamless and swift intake of all relevant test data onto the platform, regardless of its origin (high-rate sensor data, low-frequency telemetry). The architecture supports both Streaming Sources and File-Based Sources. Nominal also builds first-class integrations and pre-built components, such as file upload routines and streaming data connections. This approach enables customers to begin analysis within hours of opening an account, eliminating the need for extensive documentation or custom coding.

Performant & Intuitive Data Presentation: Core focuses on delivering ingested data back to the user. Nominal has “invested thousands of engineering hours into optimizing its backend storage and compute systems” for scalability and speed. Processed data resides in a High-Performance Analytics Datastore, utilizing in-memory cache for real-time access, hot storage for working sets, and cold storage for historical archives. Data is then structured to represent "what was happening in the field" through contextual data modeling, organized around "runs" (test events occurring on the production floor, during flight tests, or in customer operations) and "assets" (the physical devices producing the data). This data model directly maps to an engineer's mental model of their systems, facilitating natural evaluation and analysis.

Data Analysis Workflow

Source: Nominal

Nominal Core's data analysis workflow empowers engineers to derive deep insights from their test results, building directly upon the seamlessly managed and organized data. This workflow combines two critical analytical models commonly employed in hardware engineering: broad visualization and specialized, in-depth analysis.

Traditionally, engineers navigate a fragmented landscape of tools for data analysis. For instance, a company like Anduril might use Grafana for visualizing cloud data and time-series information. However, Grafana's general-purpose nature means it lacks the specialized analytical capabilities needed for in-depth hardware analysis. Conversely, for highly specialized engineering analyses, engineers turn to MATLAB, even though MATLAB's local deployment creates a bottleneck for collaboration: an engineer cannot simply share results via a link; instead, they must resort to screenshots or sharing thousands of lines of code.

Nominal's innovation lies in lifting the core strengths of both these tools into its analysis workflow. By centralizing these capabilities, customers can perform collaborative analysis directly where their data is stored. The data analysis workflow empowers every engineer with intuitive, no-code analytical tools, allowing them to go beyond historical analysis and interact with their systems as they operate.

Automated Verification Workflow

The Automated Verification Workflow operationalizes insights from the data analysis phase into continuous, actionable intelligence, closing the loop from reactive problem-solving to proactive quality assurance and performance monitoring. As engineers analyze system behavior and identify critical operational thresholds or failure signatures within the data analysis workflow, these learnings become the foundation for automated rules. These rules, once defined, can then be deployed across environments like production, simulation, or operations.

Source: Nominal

Once defined, these rules become the system-wide standard for hardware performance, ensuring consistent quality and rapid issue resolution across all environments. For example, consider a new drone engine being developed. A rule initially defined to verify its performance during a controlled factory test can be automatically applied to continuously evaluate that same engine's behavior when deployed in a fleet of operational drones or integrated into a larger system undergoing simulation. This system aims to increase quality assurance and operational insight, catching deviations early regardless of the test context.

Nominal Core’s impact on accelerating product development is evident through its partnership with Shield AI. Through Nominal, Shield AI has “tripled its daily flight test cadence and reduced data review time from six hours to 30 minutes”, allowing for significantly faster iteration and validation of its autonomous systems.

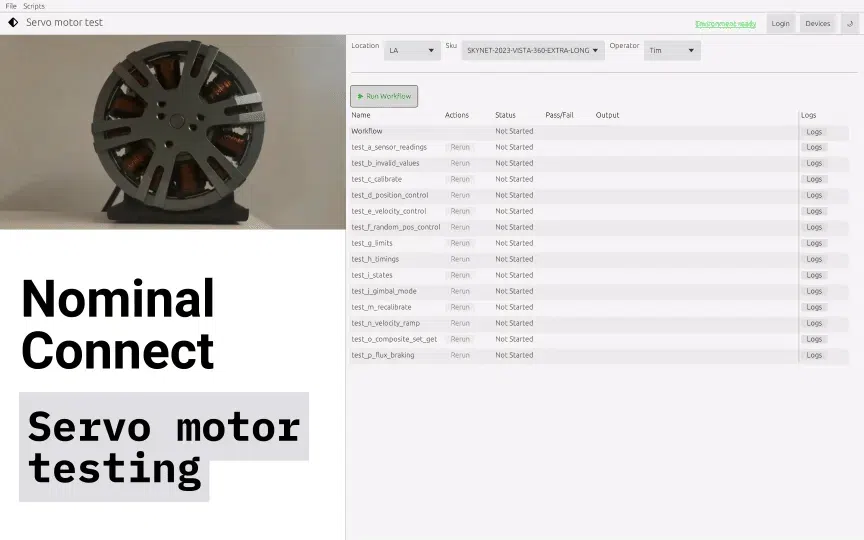

Nominal Connect

Source: Nominal

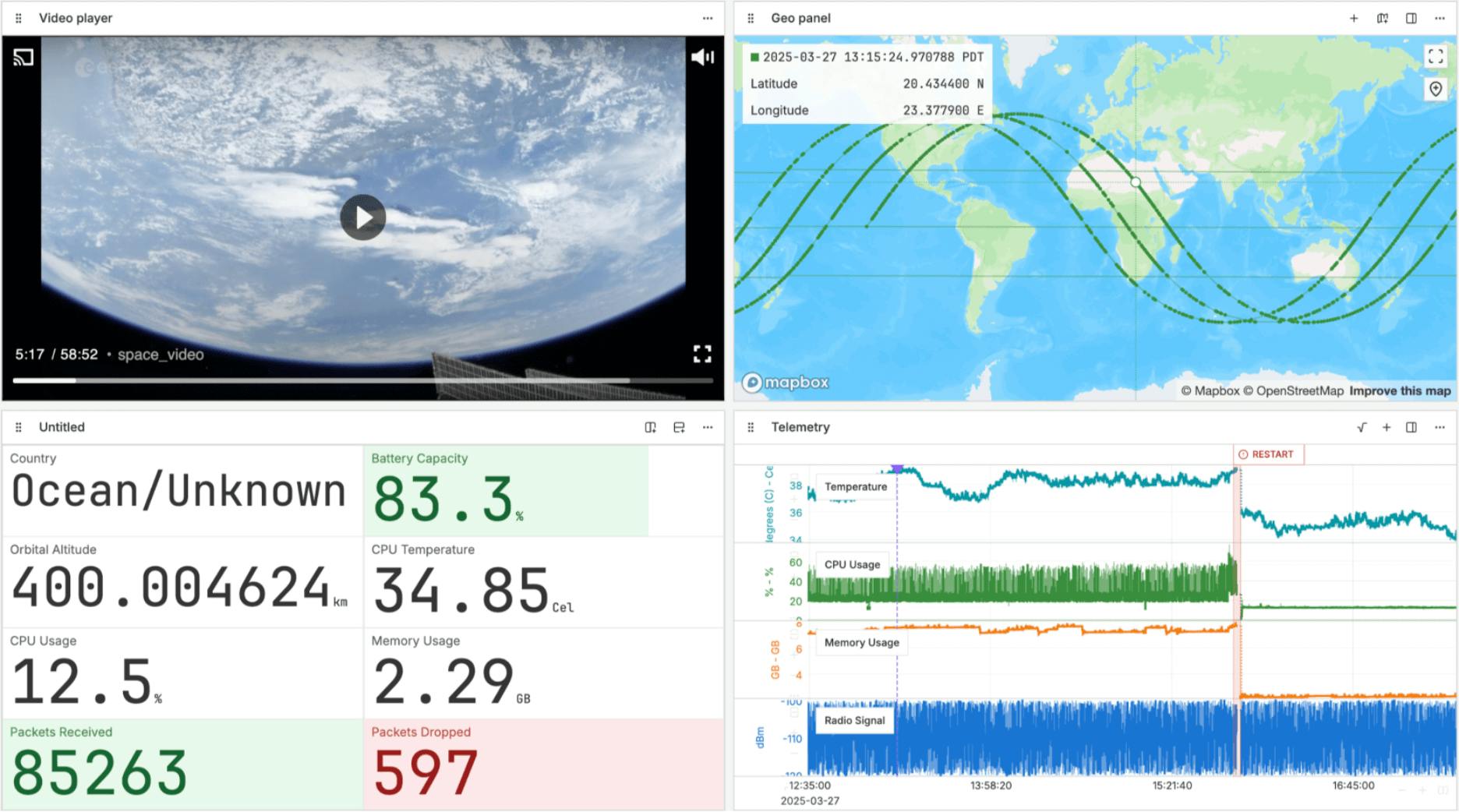

In modern hardware development, the most critical work occurs at the edge; the physical location where hardware is built and tested. This could be a benchtop, a factory production cell, or a launch pad. In these environments, decisions about safety and control are measured in milliseconds. A network delay to a distant cloud server can be dangerous and costly, potentially causing millions in damages. That’s why a responsive, intelligent software presence is required directly at the edge, running alongside the physical asset.

Connect is Nominal's solution for the edge. While Core handles large-scale data analysis and collaboration in the cloud, Connect manages the immediate, moment-to-moment tasks of controlling the test, ensuring safety, and capturing a perfect record of what occurred.

A test run using Connect follows a straightforward sequence. First, the operator selects a test procedure. Connect then establishes a link to the hardware, performs automated safety checks, and activates pre-set operational limits. As the test runs, Connect records every signal from the hardware at its native speed, synchronizing all data, including sensor readings, operator commands, and video feeds, to a single, precise clock. It also captures crucial context like the operator's name, the hardware's serial number, software versions, and environmental conditions. If any measurement exceeds a safety threshold, Connect automatically brings the system to a safe state and flags the exact moment and reason, preventing costly damage.

Source: Nominal

This capability enables improved troubleshooting. When a test fails, engineers no longer need to spend hours or days manually piecing together disparate data logs, video files, and sensor readings to identify the root cause. Instead, Connect offers an instant, synchronized replay of the entire event. This enables an engineer to see the exact moment a valve's pressure spiked while simultaneously watching the video feed and observing the specific software command that was sent. As a result, diagnostic time decreases from days to minutes, significantly boosting test efficiency and iteration velocity.

Flexible Framework

Teams adopt Connect to replace brittle, one-off test setups with a framework that integrates seamlessly with Nominal Core. The main challenge for any horizontal software platform is serving vastly different industries. Connect addresses this by acting as a flexible application framework rather than a rigid, one-size-fits-all tool. It provides a robust library of standard drivers and a widget-based interface, enabling teams to quickly assemble 90% of their required test setups without writing custom code. For the final 10%, or the "last mile", of customization specific to their hardware, customers can use Python to extend the platform's behavior. This framework is Nominal's answer to generalizability; it empowers technical end-users to build solutions on top of Nominal's foundation, reducing internal development costs by 60%, while allowing Nominal to scale efficiently across diverse markets.

This framework also enables Nominal to release new features frequently. In July 2025, Nominal announced a suite of advanced machine vision visualization tools to address a major bottleneck in robotics development. Engineers can replay tests and precisely see what a system's sensors detected, with synchronized overlays of LiDAR point clouds, camera feeds, and object detection algorithms. For a drone company, this allows instant comparison between an algorithm's object identification and the actual video feed, helping engineers diagnose perception errors. By tying this visual data to the same mission clock as all other telemetry, Nominal Connect accelerates the debugging of complex perception systems.

Market

Customer

Nominal partners with organizations building hardware, providing a modern testing platform that aims to accelerate product development. Nominal initially focused on supporting mission-critical companies by addressing their immediate hardware testing needs. As early customers saw faster product development cycles, Nominal's use cases expanded from R&D testing to broader operational applications, driven by increasing demand to use the same software for continuous monitoring of deployed assets.

Nominal's commercial customer base spans various hardware-intensive industries, including broader industrial sectors, aerospace, energy, transportation, advanced mobility, and traditional manufacturing. One notable partner is Hermeus, a startup developing hypersonic aircraft on an accelerated timeline. Hermeus shortened the development of Quarterhorse Mk 1, its first hypersonic aircraft, from a decade, the industry standard, to less than a year. To meet this ambitious target, Hermeus couldn't rely on outdated testing systems or spend millions on custom software, which risked years of delay. Instead, they chose Nominal, which integrated into every testing workflow during Mk 1's development. Nominal delivered an “80% reduction in time from ‘upload-start’ to ‘eyes-on-data,’” enabling Hermeus to design and build Mk 1 in just 7 months. Hermeus is now working on Mk 2, aiming for flight by Q2 2026, and is reconfiguring its manufacturing to be controlled by Nominal Connect.

Another commercial partner, Vatn, develops autonomous underwater vehicles designed for intensive maritime operations. Vatn rapidly transitioned from prototype to large-scale manufacturing thanks to Nominal’s automated testing pipeline. Before Nominal, Vatn's test results took hours to become actionable, as manual data analysis limited Vatn to one test cycle per day. After implementing Nominal, Vatn achieved validation in under 5 minutes per AUV, with fully automated pass/fail checklists, enabling dozens of test cycles daily. Other notable commercial partners include Varda (space manufacturing and re-entry capsules), Regent (electric maritime travel), and Radiant (nuclear microreactors).

On the government side, Nominal partnered with the Department of Defense, which recognizes the critical need for modernized hardware testing capabilities. As of January 2026, Nominal actively collaborates with the US Air Force Test Center at Edwards Air Force Base, tasked with testing and validating US Air Force weapon systems and new aircraft. Additionally, Nominal maintains a strategic partnership with the Test Resource Management Center, which oversees all US physical infrastructure and software test resources. These partnerships further Nominal's role in testing and validating within the US government and modernizing defense capabilities. Nominal was awarded a US Air Force STTR Phase 2 Contract in December 2024, which integrates Nominal's platform into the training and operational workflows of future flight test engineers at the US Air Force Test Pilot School.

Market Size

The market for advanced testing and validation software in hardware-intensive industries is continually growing, driven by the increasing complexity of physical systems, the shift toward software-defined hardware, and the need for faster hardware development cycles. Nominal operates in the hardware-in-the-loop (HIL) market through Nominal Connect and the broader test automation software market by aiming to provide a testing platform that replaces outdated legacy systems.

As of April 2025, the global HIL market was projected to grow from approximately $1.1 billion in 2025 to $1.8 billion by 2030, at a CAGR of 10.1%. This growth is fueled by rising demand for sophisticated testing methods in electric vehicles, autonomous systems, aerospace, and industrial automation. As of February 2024, the broader test automation software market is expected to nearly double from $28.1 billion in 2023 to $55.2 billion by 2028, with a 14.5% CAGR driven by the adoption of agile and DevOps practices, digital transformation efforts, and the need for cost-efficient testing.

Nominal's expansion into fleet management and operational use cases broadens its TAM beyond testing budgets. It now targets the significantly larger operational and sustainment budgets for deployed hardware assets. The global asset performance management software market, which aligns with Nominal's ability to deliver continuous monitoring and performance optimization for deployed fleets, is expected to grow from around $26.5 billion in 2025 to $47.2 billion by 2030, at a CAGR of 12.2%.

Based on the combined potential of these markets, Nominal's estimated TAM is approximately $64.5 billion in 2025, projected to reach $121.4 billion by 2030.

Competition

Competitive Landscape

Nominal operates within a competitive landscape broadly segmented into two groups: entrenched incumbents in industrial test & measurement, and newer companies offering modern test platforms specifically for hardware. The market for modern hardware testing software is ripe for disruption, as legacy systems struggle to centralize data and handle the speed and complexity of today's hardware. A defense procurement specialist notes:

“Legacy players are like Swiss Army knives — they do many things adequately but aren't optimized for today's integrated testing needs.”

Nominal differentiates itself from the incumbents by offering a purpose-built test platform, designed for how modern teams work across disciplines. Nominal also emphasizes its “defense-grade security and compliance (including FedRAMP-alignable infrastructure)”, giving it access to highly regulated environments that are inaccessible to many commercial-grade offerings.

Legacy Competitors

Siemens: Founded in 1847, Siemens is a global technology conglomerate with a vast industrial software portfolio, including Product Lifecycle Management (PLM), Manufacturing Execution Systems (MES), and specialized simulation and test software like its Simcenter suite. With a market capitalization exceeding $237.7 billion as of January 2026, Siemens provides broad, deeply integrated enterprise solutions managing complex industrial processes from design to production. However, its comprehensive nature means that specialized hardware test data remains fragmented or requires extensive customization to integrate fully within its broader PLM/MES ecosystems. Nominal, in contrast, is purposefully designed for the unique demands of high-fidelity hardware test and evaluation data, emphasizing real-time processing, cloud integration, and collaborative analytics that streamline workflows.

Emerson: Founded in 1890, Emerson is a global technology and engineering company providing automation solutions and software for process, hybrid, and discrete industries. It notably expanded its test and measurement capabilities by acquiring National Instruments (NI). With a market capitalization of approximately $84.5 billion as of January 2026, Emerson's extensive portfolio addresses general industrial control and asset management. While Emerson provides solutions for operational technology and control systems, Nominal's specialization lies in unifying the entire hardware test and evaluation data stack, including accelerating hardware R&D and continuous validation. This is an area where legacy industrial software, even with NI's integration, often results in fragmented data workflows and a less agile environment for rapid hardware iteration.

Keysight Technologies: Keysight’s roots trace back to Hewlett-Packard's test and measurement business. Spun out from Agilent Technologies in 2014, the company's core business is centered on selling sophisticated physical test solutions that accelerate the development of electrical systems. With a market capitalization of approximately $37.1 billion as of January 2026, Keysight also offers software platforms for instrument control and data analysis. Keysight's software core value proposition is the tight integration of its software with its physical hardware, creating a best-in-class user experience for its instruments. However, this integration can create a fragmented data landscape for customers who use multiple vendors, making it difficult to unify data from different sources into a single view. In contrast, Nominal's platform is natively cloud-first and hardware-agnostic, allowing engineers to centralize and analyze data in a single collaborative environment.

National Instruments (NI): Founded in 1976, National Instruments is a leading provider of modular hardware and software platforms for automated test, measurement, and control. It is widely recognized for its LabVIEW graphical programming environment and TestStand test management software. Acquired by Emerson Electric for $8.2 billion in October 2023, NI's ecosystem is robust and widely adopted, particularly for automated test stand applications. However, its proprietary programming (LabVIEW) and desktop-centric workflows can create data silos and hinder cloud-native collaboration and real-time enterprise-wide data access. Alternatively, Nominal offers a cloud-native, Python-first, collaborative platform designed from the ground up for modern data volumes and real-time operational insights, extending beyond traditional test execution to provide a more flexible solution for the entire hardware lifecycle.

dSpace: dSpace primarily focuses on Hardware-in-the-Loop and simulation solutions for automotive, energy, agriculture, and broader manufacturing industries. Founded in 1988, it offers a comprehensive suite of tools for rapid prototyping, model-based development, and test automation. dSpace's offerings are known for their speed and precision in a simulation-rich environment, enabling the verification and validation of complex embedded systems. Its product is a direct competitor to Nominal Connect.

Emerging Competitors

Applied Intuition: Founded in 2017, Applied Intuition provides software infrastructure to safely develop, test, and deploy autonomous vehicles at scale. The company’s primary product is Simian, a simulation system that tests autonomous vehicles across various environments, speeding up their development. Applied Intuition’s main customers are Original Equipment Manufacturers (OEMs), such as BMW, who use Applied Intuition to enhance their autonomous vehicles, and the company counts 18 of the top 20 automakers among its clients. In June 2025, Applied Intuition raised $600 million at a $15 billion valuation “to accelerate the rollout of intelligent, software-defined systems across all domains — defense, automotive, trucking, construction, mining, and agriculture.”

SimScale: Founded in 2012, SimScale is a simulation platform for computational fluid dynamics (CFD), finite element analysis (FEA), and thermal simulation, allowing engineers to design and optimize hardware in a virtual environment. With $59.4 million in total funding as of January 2026, SimScale's mission is to accelerate hardware development by focusing on the pre-physical design and simulation phase, rather than the physical testing and validation phase. While Nominal and SimScale do not compete directly in their core offerings, they are indirect competitors for the same customer persona: the hardware engineer seeking to accelerate development. Both companies have built a collaborative, unified platform to replace outdated, locally-deployed tools. Their competitive dynamic is rooted in their shared, long-term vision to become the central platform across the entire product development lifecycle. As Nominal expands its platform to cover aspects of virtual testing and simulation, and as SimScale moves towards correlating simulation data with real-world test data, their offerings will compete more directly over time.

Revel: Revel emerged from stealth in April 2025 with a software platform designed to accelerate hardware innovation, enabling engineers to build, deploy, and test more efficiently. The company's first customer was Impulse Space, and by September 2025, Revel had completed dozens of deployments. Following a $6.9 million seed round led by Felicis and Abstract Ventures, Thrive Capital preempted the Series A with a $23.1 million investment. Miles Grimshaw, a Partner at Thrive, identified manufacturing, automotive, medical devices, and industrial automation as key target areas for Revel.

Sift: Founded in 2022 by a team from SpaceX, Google, and Palantir, Sift aims to provide unified data pipelines, infrastructure, and analysis tools for testing mission-critical hardware, emphasizing precision and scalability. Less than a year after closing its $7.5 million seed round, Sift announced a $17.5 million Series A in June 2024 led by Google Ventures. As of January 2026, the company has raised $25 million in total. Sift shares a similar problem statement and target market with Nominal, focusing on modernizing the hardware test stack. Sift's differentiation lies in its specific emphasis on underlying data technologies like Go for high-performance data processing, and a deeper focus on certain data types, potentially leading to specialized applications within the hardware test domain.

Business Model

Nominal generates revenue primarily through an enterprise SaaS subscription model. This provides customers with access to Nominal Core (cloud-based or on-premises) and Nominal Connect (edge-native application) through recurring fees. Given the complex and varied needs of its enterprise customers in critical industries, Nominal offers custom pricing plans tailored to specific requirements, rather than publicly disclosed standard tiers. These plans are likely structured based on factors such as the number of users, the volume of data ingested and processed, the number of connected assets or test stands, and the specific suite of features required for their unique deployments.

Traction

As of January 2026, Nominal has grown to have more than 100 employees and was recognized on the NatSec 100, an annual list of top venture-backed defense companies, where it ranked 66th in 2024 and 19th in 2025. Nominal was also listed among Fast Company’s 10 most innovative data science companies of 2025.

Since November 2022, Nominal has seen a 10x increase in revenue and a 6x increase in customers year-over-year, reflecting strong demand for Core and Connect. In 2024, the company reportedly generated $5 million in revenue. The company’s growing customer base extends to dozens of operational field deployments, supporting a wide range of activities from hypersonic materials testing to daily drone sorties. Nominal also observes a high customer re-engagement rate, with organizations that initially deferred adopting the platform, indicating increasing market readiness.

As of January 2026, Nominal has been awarded $4.3 million by the Department of Defense, where it holds several active contracts. This includes a $1.2 million Small Business Innovation Research Phase 2 contract with the US Air Force Arnold Engineering Development Complex, focused on advancing hypersonic systems development. This nationally strategic initiative is supported by a $1.8 million Small Business Technology Transfer Phase 2 contract with the US Air Force Test Pilot School and MIT. By automating post-flight test data analysis and integrating rapid analytic techniques for future flight test engineers, Nominal is positioned to become an integral part of how the US Air Force tests and validates its systems. To better support these critical initiatives, Nominal expanded its on-the-ground presence with a new office in Tennessee in July 2024.

Valuation

Nominal closed its Series B in June 2025, raising $75 million. This round was led by Sequoia Capital. While the post-money valuation was not publicly disclosed, one estimate places Nominal's value between $290 million and $435 million as of January 2026. Total funding for Nominal stands at $102.5 million. Notable investors, across all three rounds, include Lightspeed Venture Partners, Lux Capital, General Catalyst, and Founders Fund.

Key Opportunities

Agentic Workflows

Hardware testing has yet to harness the transformative benefits of Artificial Intelligence, largely due to the unstructured and cluttered nature of existing sensor data and logs. Nominal views its platform as a "necessary stepping stone" to organize this complex data, making it suitable for advanced AI applications.

The current challenge with implementing AI is the raw, heterogeneous nature of hardware telemetry, which is often unusable for advanced machine learning. By leveraging Nominal Core’s well-structured data foundation, Nominal can progressively layer AI/ML capabilities to its platform. This includes developing advanced agentic workflows that can automate complex analytical tasks. Integration of AI can greatly improve analysis speed, predict maintenance needs, and offer proactive insights, which may improve Nominal's platform capabilities and value proposition.

Full Operational Lifecycle Management

Nominal has gained strong initial traction by focusing on the test & validation phase of hardware development, supporting rapid iteration and validation in mission-critical programs. However, a significant and natural expansion opportunity lies in extending its platform to manage the full operational lifecycle of hardware. Customers are already pulling Nominal into operational use cases, expressing a strong demand for the "same software suite" used in testing to also monitor deployed assets for fleet sustainability, readiness, and ongoing performance observation.

This opportunity would result in a significant expansion of Nominal's TAM beyond initial R&D budgets to encompass larger operational and sustainment budgets. By providing a consistent interface and data platform from development through deployment, Nominal creates a holistic, end-to-end value proposition. This enables continuous hardware testing from development to active operations, making Nominal an indispensable partner throughout the entire hardware lifecycle, from initial design validation to long-term fleet management and sustainment.

Key Risks

Vertical Integration

A significant risk for Nominal is that well-resourced hardware companies may vertically integrate and build their own internal software stacks. This "build vs. buy" decision poses a continuous challenge. Companies like SpaceX have committed significant resources to creating highly sophisticated in-house test stacks that accelerate development timelines. This approach, while more difficult, is attractive, as it enables tight feedback loops and rapid iteration without relying on external vendors. SpaceX's bespoke test stack acts as the central nervous system for its rapid iteration cycle, helping it account for 87% of US space launches in 2024. If more companies invest in their own testing platforms, this will likely lengthen Nominal's sales cycle as the company works to prove its platform offers a decisive advantage over internal solutions.

Supplying Defense Primes

Displacing deeply embedded legacy testing tools within large defense primes presents a formidable challenge. These organizations often operate with decades-old software, established procurement processes, and a high aversion to risk when it comes to mission-critical systems. The average acquisition timeline for a major defense program is over a decade, and this slow pace contributes to a history of significant cost overruns and project failures. For example, a 2018 GAO report found that the DoD’s 22 most expensive programs were a combined $628 billion over budget and years behind schedule.

The effort required to convince these large organizations to abandon their existing, albeit antiquated, tools and adopt a new platform can therefore be protracted and resource-intensive. This mirrors the historical challenges faced by companies like Palantir, which famously spent years navigating and even litigating against government procurement processes to secure adoption for its software. Nominal must demonstrate not just technological superiority, but also a compelling case for operational stability, security, and long-term cost savings to overcome this deeply ingrained resistance.

Summary

Nominal addresses the critical gap between advanced hardware innovation and its outdated testing infrastructure, a divide that has caused costly failures. Its integrated product suite, including Nominal Core and Nominal Connect, aims to replace fragmented legacy tools. Nominal has shown strong market traction, with 10x year-over-year revenue growth and 6x customer expansion. However, the key question for Nominal remains whether it can sustain its innovation and market penetration to become the definitive platform for continuous hardware testing and validation.