Thesis

When Apple went public in December 1980, it was only a little over four years after it was founded in April 1976 in Cupertino. By comparison, Airbnb took nearly 12 years to IPO, Uber took 10 years, and many other startups founded in the 2000s and 2010s strategically delayed their IPOs. The average time for a startup to go public had increased by four to six years in the last two decades as of July 2023.

Part of the reason for this may have been a slowdown in public markets. One study conducted in June 2024 found that private company returns had been 10% higher than public corporation returns since 2000. In 2000, there were $600 billion in private market AUM globally. As of June 2023, this number had increased to $13.1 trillion. As a result, within the US technology sector, the average time for a private company to go public increased from 4.5 years in 1999 to more than 12 years in 2020. In April 2022, there were 2.8K public US companies with annual revenues greater than $100 million. By comparison, there were 18K private US companies of equal size or larger.

In addition, as of May 2024, there were 1.2K private companies worth $1 billion or more globally and about 60% chose to stay private for at least nine years. The value generated during the time these companies remain private is inaccessible to most investors due to high regulatory barriers to entry. Middle-class investors are often shut out from investing in these hyper-growth startups especially if these companies delay going public or never do. For example, had Apple waited eight more years to go public, the company would have quadrupled in size and many of Apple's early public investors would not have been able to benefit from those returns.

It's not just investors who are missing out on these opportunities. Employees with stock options at startups are too. An estimated $30 billion was lost in unexercised stock options in 2023. As of February 2023, 41% of employees of private companies lacked the upfront cash before the time of option expiry to exercise their options. Employees of private companies are unable to sell-to-cover since there is no public market to sell and use the proceeds to cover any exercise or tax costs. As a result, the upfront costs required to exercise options are often too much of a burden for most private company employees. As of 2021, there were over 6 million US startup employees with some form of equity which summed up to almost $60 billion worth of stock options. More than 55% of such options were being left unexercised every year due to employees lacking the knowledge and capital required to do so before their options expired as of September 2021.

Equitybee is a platform that helps private company’s employees access the funding they need to exercise their stock options by connecting them with investors. Investors provide the funding for employees at discounted costs of equity and share any potential profits if the company has a successful liquidation event. Equitybee allows employees to capitalize on their equity with low risks of funding, while investors gain access to high-growth opportunities typically unavailable to them.

Founding Story

Source: Equitybee

Equitybee was founded by Oren Barzilai (CEO), Oded Golan (CPO), and Mordechay (Mody) Radashkovich (COO) in Israel in 2018. Following a domestic launch in Israel, it expanded to the US in February 2020 and is headquartered in Palo Alto as of October 2024. The three founders met as childhood friends in Israel and have a combined 45 years of experience in the finance and technology industries.

Barzilai has been involved in the startup ecosystem for over 15 years as both an employee and a founder prior to founding Equitybee. For example, he began working on Tapingo, a mobile commerce app offering pickup and food delivery services for college campuses, in 2008. It officially launched in 2012, but Barzilai left the company in 2012 to start another endeavor. Tapingo was acquired in November 2018 by Grubhub for $150 million.

In 2013, Barzilai and Golan co-founded Start A Fire, a company with a mission to enable “those who discover and share content to get the attribution they deserve.” It served more than 3K of the world’s biggest brands and raised a $3.6 million Series A round in March 2016. Ultimately, Barzilai left Start A Fire in 2017 and eventually, the business closed its doors for unknown reasons.

The inspiration for Equitybee came from the founders’ past experiences working at startups. Barzilai noted that he often witnessed many colleagues and friends lose out on significant parts of their compensation because they “couldn’t afford to exercise the options they worked so hard to earn.” He also explained that most employees neglect stock options for small cash bonuses because they don’t understand or see any value in options. Stock options make up a significant portion of employee total compensation and its importance should not be understated as a driving force for shared company success.

Equitybee's goal is to help employees own their hard-earned shares and provide a mutually beneficial platform for investors to tap into the wealth of startups. Radashkovich left Equitybee in May 2023 but continues to serve on the board as an advisor.

Product

Equitybee describes itself as a "stock options funding platform" that allows startup employees to partner with accredited investors to "unlock the value of startup equity." For employees who receive stock options in their compensation packages but can’t take advantage of them due to high upfront costs and risks, Equitybee provides a way to connect to accredited investors who may have an interest in buying equity in their startup. Investors, meanwhile, can use Equitybee to gain access to startups they may have an interest in investing in.

Employees can create an account on the platform if they have stock options they would like an investor to fund. Once vetted, a contract is made between the employee and the investor with agreed-upon interest rates and earnings attributions. Employees can remain the sole owner of their stock options with investors taking on the risks. This is because employees are not obligated to pay investors in the event their company goes bankrupt or the stock options become worthless.

Equitybee offers access to pre-IPO companies typically inaccessible to individual investors such as Databricks, Miro, Discord, Rippling, and Stripe. For example, as of September 2023, Databricks was valued at $43 billion and as of July 2024, Stripe was valued at $70 billion, and both of these private companies are sought after by many investors. Equitybee claims that investors benefit from a median discount of 77.6% from the last known preferred share price. When stock options appreciate in value, investors have a say in when they are sold and make a portion of the profits as outlined in a contract with the employee. Based on the type of investor, Equitybee also offers a diverse array of funds and options to suit varying risk and product preferences.

Single Company Investors

To invest in a single private company on Equitybee, a customer must be an accredited investor according to the SEC. Investors can choose between investing in singular companies or a fund designed by Equitybee called the Venture Portfolio Fund (VPF). For single-company investments, investors can sign up and browse the companies listed on EquityBee. They can also customize their own “Wishlist” to add companies and industries of interest that aren’t listed on Equitybee.

After signing up, accredited investors will be paired with an investor relations manager to walk them through the rest of the process. Then, customers will confirm that they are accredited investors, review disclosure materials, sign subscription documents, and wire their investment to Equitybee’s fund manager. From there, investors can invest in startups of their choice by funding an employee’s stock options. In the case of a successful liquidity event, they can share the stock value with the employee they funded.

Venture Portfolio Fund (VPF)

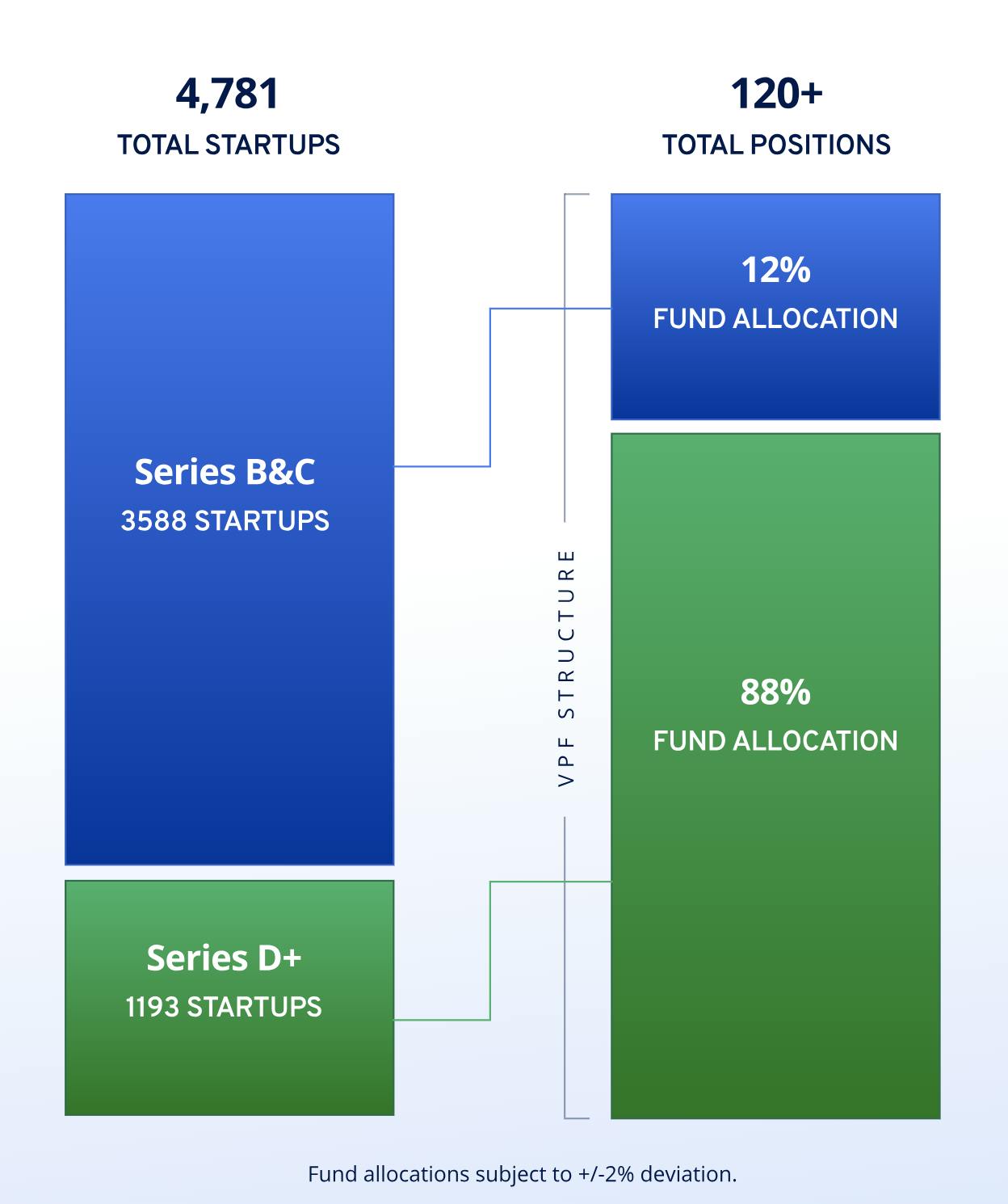

Instead of choosing a singular company, accredited investors can also invest their money in a fund made up of several companies. Developed in-house, this diversified and data-driven index-like fund provides exposure to over 120 startup companies backed by the top 25% of VC firms in the US. Equitybee calls the VPF the S&P 500 for private markets. It is estimated that prices are usually discounted by 30% compared to the last known common share prices. Over 85% of the fund’s investments are in later-stage companies (Series D+).

Source: Equitybee

The VPO is a proprietary model that leverages 24 years of venture data based on more than 10K data points across more than 4.7K startups. The portfolio mix is created by considering both failure rates of startups across stages and timeframes to experience liquidity events. Equitybee uses venture data because VC “has been the top performing asset class for over a decade, with top VCs achieving a median IRR of 27% for the vintage years of 2010-2020.” An investor must invest a minimum of $100K in the VPF for 12-18 months, with a target fund life of five years.

Institutional Investors

Source: Equitybee

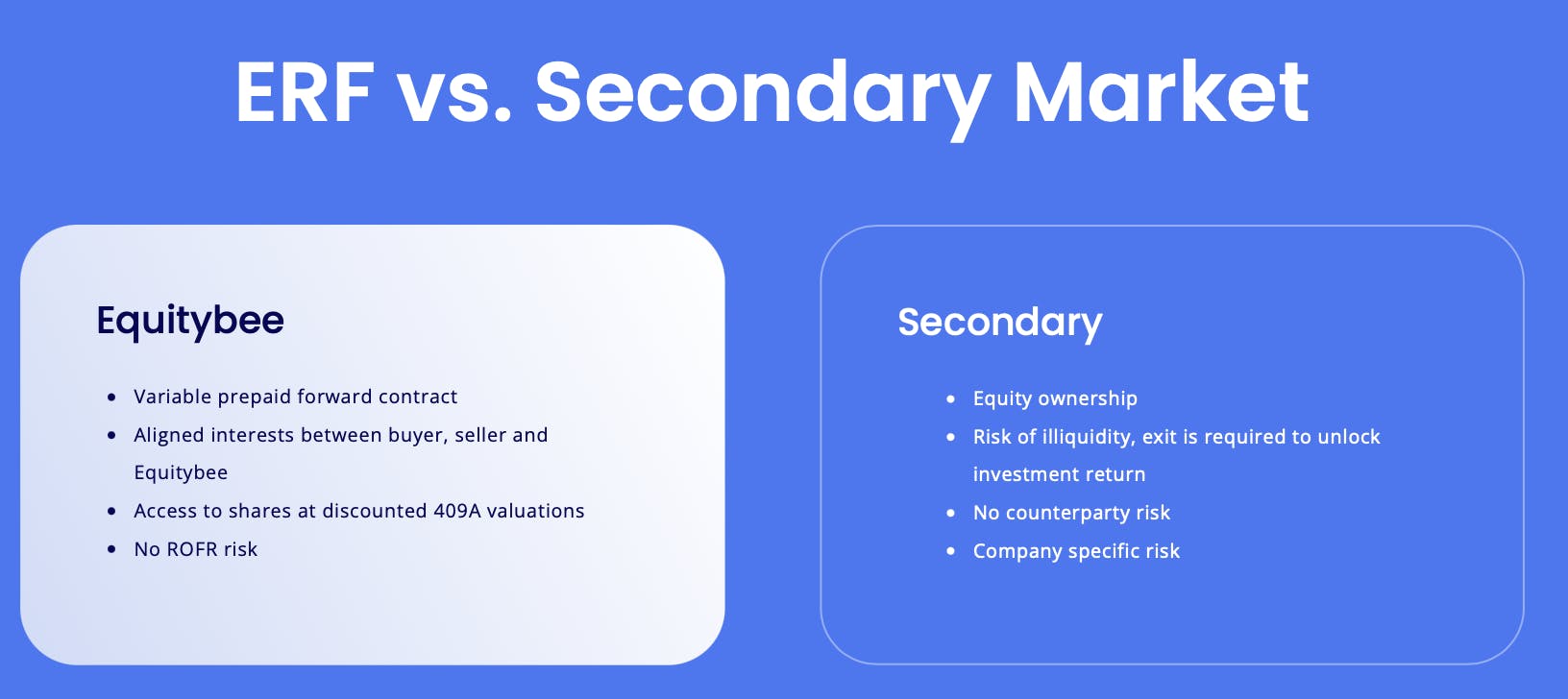

Equitybee Reserve Fund (ERF) is offered to institutional investors who have “a large amount of capital to deploy.” Investors can customize their selections by choosing companies with a specific amount of VC funding or by their preferred industries. Once selections are made, their capital is automatically deployed to fit their chosen criteria, thereby creating a zero-touch investment curation strategy.

ERF also offers priority and exclusivity to competitive offers before they are formally released on the platform. For example, under this program, investors accessed companies like Coursera, Bentobox, and Monday.com before going public. The following image depicts differences in the ERF compared to the secondary market such as variable prepaid forward contracts and no Right of First Refusal (ROFR) risk. This risk occurs when an existing shareholder exercises their right to purchase shares, which can lead to the cancellation of the original deal or other disruptions.

Employees with Stock Options

For an employee at a startup with stock options that require funding to exercise, Equitybee provides educational resources and a platform to connect with investors who may be interested in funding the options. The platform provides resources on calculating employee stock option value and examples of when the best time to exercise is to help employees better understand the value of their shares. Once vetted, employees can put out offers of their stock options and investors can bid to finance them. After being funded by an investor, employees own their shares with the investor and can access immediate cash without paying out of pocket.

The risks for employees are reduced because they remain sole owners of their options and are only required to pay back the funded amount by the investor after a successful liquidity event. In this case, both investors and employees earn a portion of the gains. If there isn’t a successful exit, the investor writes off the loss and the employee isn’t required to return any of the funding.

Market

Customer

Employees with stock options are one of the two primary customer segments on Equitybee’s platform. These are the customers who seek the capital required to exercise their stock options before the time of expiry. Investors who have the capital and are interested in investing in startups are the other group of customers. They provide liquidity to help employees exercise their stock options on time and reap the benefits in case of a successful liquidation event by the startup.

Employees who lack the necessary capital to exercise their stock options in time could lose out on potential earnings. Equitybee connects these customers with investors by providing a platform to fund stock options. These employees work in a variety of industries including “financial services and insurance, AI/ML, education, healthcare, hardware, cleantech, transportation, logistics, cybersecurity, space, robotics, precision manufacturing, nano-tech, AR/VR, IoT, marketing and advertising, agriculture, biotech, telecom, technology infrastructure, e-commerce, gaming, and entertainment”.

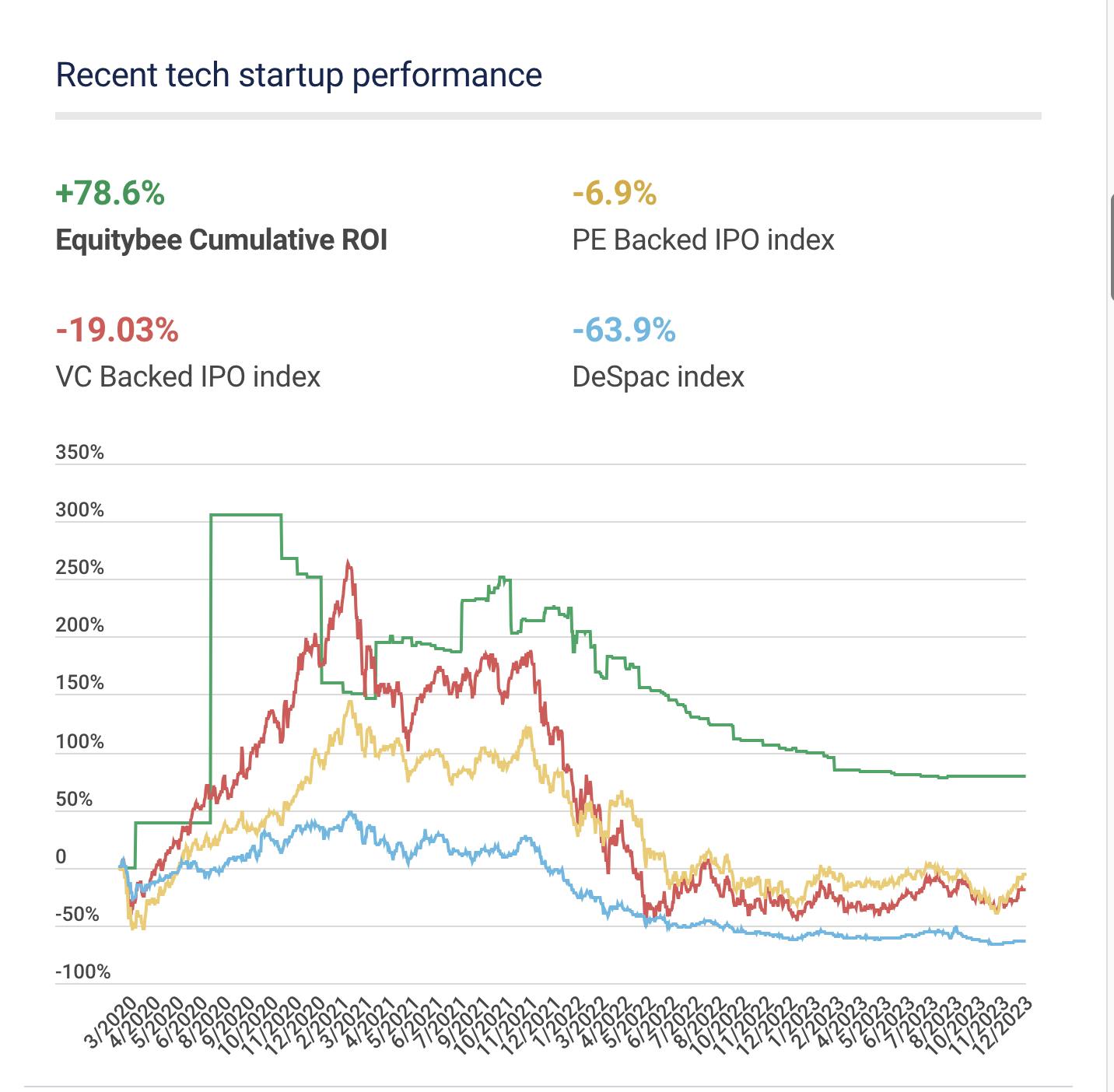

One example of a successful investment in a startup using Equitybee is Confluent, a leader in real-time data streaming and event-driven architecture. The time to liquidity was nine months, and an IRR of 101.6% was achieved after it completed its IPO in June 2021, just a few months after the employee received funding from Equitybee’s investors. Their stock options were exercised at 61% lower than the last known common share price. A few more examples of successful IPOs of companies on Equitybee are Palantir which achieved a 150% ROI for its investors, Affirm at 215% ROI, and Docker at 486% ROI.

Source: Equitybee

Market Size

There were over 6 million startup employees with equity totaling up to $60 billion worth of stock options in the US as of September 2021. As of August 2023, about 50% of these stock options, or up to $30 billion, went unexercised because employees didn’t have the capital to exercise it, it was too risky, or they didn’t know how or why to do it.

According to a February 2022 survey conducted by Carta on 1.5 million US employee stakeholders, 23% of employees didn’t exercise their stock options because they could not afford the cost and associated taxes, 18% thought it was too much of a financial risk, and 11% didn’t think the value was worth it. Additionally, 46.1% of in-the-money options were left unexercised and expired as of February 2022.

Since 2000, there has also been an increase in the length of time a startup stays private as it has been raising more capital which is what allows it to stay private for longer. This trend is shown when examining the amount of private market assets under management globally which rose from $600 billion in 2000 to more than $9.7 trillion in 2022. With this amount of private capital, private companies delay going public to maintain financial privacy, access to capital, and control and flexibility as of September 2024. This resulted in more growth for startups before going IPO. The average age of a company going public in the tech sector jumped from 4.5 years in 1999 to over 12 years in 2020.

As of May 2024, there were over 12K private companies worth over $1 billion globally. In some cases, private companies already become the leading industry players by market value, like Uber and Airbnb before their IPOs.

Competition

Emerging High-Growth Startups

Secfi: Secfi was founded in 2017 and provides stock option exercise cost financing for employees while they retain full ownership of their shares. Similar to EquityBee, there is no repayment required by employees until the company is acquired or goes public in which case the employee only owes the amount originally financed plus a fee. In November 2022, Secfi announced a $700 million financing partnership with Serengeti Asset Management, a New York-based investment firm. Secfi has $48 billion worth of equity registered by 30K employees on the platform as of September 2022.

Quid: Founded in 2018, Quid provides employees who own stock options with loans and uses their equity as collateral. It has provided funding to employees at companies including Palantir, Uber, Lyft, and Unity. Quid collaborates with startups to run programs for its employees as well as directly with employees. In November 2020, Quid raised $320 million which it planned to break down by allocating $30 million per high-growth startup on track to IPO to fund each company’s loans. The fee structure is a flat 7% annual fee on the amount of the loan based on the value of equity owned. Similar to Equitybee, employees are not required to pay back the full sum in the event the company goes bankrupt because Quid absorbs this risk. The downside to Quid is that employees must be from its carefully vetted list of companies based on growth rates and other factors, so not all startup employees can be eligible for its loans.

Venture Capital and Fund Management Firms

Section Partners: Founded in 2012, Section Partners is a growth-stage VC firm that provides a variety of financing solutions for executives and shareholders of private companies. For example, it provides structured financing which helps with exercising stock options and is ideal for “significant life events” such as purchasing a home. Secondary Capital is another product offered for diversification and Primary Capital is an option given to founders to capture the value of future opportunities. Section Partners had $120 million in capital committed to helping employees facing option expiration as of January 2020. It also raised $319 million as of September 2021 across four funding rounds and provides access to startups like Notion, Verkada, and Cedar. As a VC firm, Section Partners benefits from its ties with the startups and founders it has invested in.

Liquid Stock: Liquid Stock, founded in 2019, is an independent and institutionally backed investment firm that provides liquidity to employees and shareholders of privately held pre-IPO companies. It provides tailor-built stock options financing solutions that focus on optimizing taxes, reducing risk, and maximizing value. The partners at Liquid Stock have over 60 years of combined experience in VC, legal and regulatory, and wealth management. They also have experience working with shareholders at companies like Airbnb, DocuSign, and Uber. As of July 2023, Liquid Stock closed its second fund which recorded over $300 million in AUM.

Established Players

Eso Fund: Founded in 2012, Eso Fund captures the title as both the world’s oldest and largest employee equity company. Eso fund has no hidden fees, closing fees, or yearly fees, but only simple and clean funding solutions. It offers immediate cash for restricted stock units (RSUs) and will pay for stock option exercises and take on any relevant risks, similar to the role of an investor on the Equitybee platform. Eso Fund has provided funding to employees at more than 600 companies and earned over $1 billion in wealth through exits from companies like Snowflake, Coinbase, Roblox, and Robinhood as of June 2022. Eso Fund raised $200 million for its fifth fund in June 2022.

Forge: Founded in 2014, Forge is a global private securities marketplace providing liquidity to employees through accredited investors. It offers Forge Pro which is an advanced institutional trading platform for private markets. Forge is also known for Forge Insights, a proprietary resource hub providing private market insights and extensive data reporting. Forge serves institutional and accredited investors, employee shareholders, and private companies.

Similar to Equitybee, Forge connects accredited investors with employee shareholders to purchase shares at a mutually decided price. Some examples of companies listed on Forge include Cerebras, OpenAI, Anthropic, and Anduril. As of March 2022, it became publicly traded and its Q2 2024 revenue exceeded analyst estimates by 9.1% and is up $22.3 million from Q2 of 2023. EPS also surpassed analyst predictions by 29%. Revenue is forecast to grow 24% per annum on average in the next three years as of August 2024, compared to a 5.3% growth forecast for the capital markets industry in the US. Forge’s market cap is $234.4 million as of October 2024.

Business Model

For customers who are employees, Equitybee charges a 5% placement fee for using the platform and a 5% stock appreciation fee if a profit occurs as of October 2024. If there is no profit, no fee is charged. An employee will only be required to repay the amount funded by an investor if their company has a successful exit event. If there’s not a successful exit, the investor writes off the loss and the employee isn’t required to return any of the funding. Employees will also be required to pay interest and the predetermined share value. Equitybee charges investors a 5% brokerage fee upon funding an employee’s stock options. In the case of a successful liquidity event, Equitybee also charges investors a carry fee of 5% of profits as of October 2024. Any further charges are negotiated by the employee and investor such as the interest rate (at least 1%) and any portion of proceeds from sales.

Equitybee offers a mutually beneficial risk and reward model. Investors invest their capital at discounted prices into private companies of their choice. Employees with stock options who use Equitybee have risk protection as they don’t pay investors back until liquidity events and the capital funding from investors allows them to exercise and own their shares.

Traction

When Equitybee launched in the US in February 2020, the amount of capital it raised to fund employee stock options on the platform increased by over 5x, and the number of employees funded grew by over 3x. Equitybee has funded employees from popular pre-IPO companies such as Stripe, Databricks, Airbnb, Palantir, Unity, and more.

In 2020, Equitybee grew by 560% the amount it raised to fund employee stock options. The number of employees funded also grew by 360%, and its investor community make-up increased by 700% comprised of family offices, funds, and high net-worth individuals.

As of July 2024, Equitybee hosted over 750 startups, and over 3.5K active customers including both startup employees and investors. Since its inception, there have been 202 liquidity events for 151 different companies. As of October 2024, Equitybee facilitated over $100 million in total investments unlocked by employees from “the hottest US VC-backed startups.”

Equitybe also went through two rounds of layoffs. In August 2023, 25% of the team was cut, amounting to 24 employees, and another 25 employees were let go in May 2023.

Valuation

In September 2018, WeWork co-founder Adam Neumann led Equitybee’s $1.5 million pre-seed round. Then, in February 2020, it raised a $6.6 million seed round led by Group 11. "Impressed by what it described as the company’s perfect product-market fit and triple-digit growth,” Group 11 also led Equitybee’s $20 million Series A round in February 2021, and its $55 million Series B round in September 2021 at an undisclosed valuation. As of April 2024, Equitybee’s Series B consisted of a total of $57 million, signaling that an additional $2 million was raised at an unknown time. In a total of four rounds, Equitybee has raised $85.3 million as of October 2024.

Key Opportunities

Create Partnerships

EquityBee could formalize partnerships with companies as the go-to financial tool for its employees. Many employees have suggested Equitybee to their employers allowing it to potentially create partnerships with startups. Barzilai noted that partnering with companies to offer Equitybee as part of a wider suite of benefits and HR services could be a seamless next step. This would be a win for both the company and Equitybee because it allows more employees to take part in the equity structure and success of their company even when they lack the funds to do so.

This would also align the interests of the company and its employees. If employees have the capital to exercise their options, they may value options as part of their compensation package, as opposed to asking for other forms of payouts like cash bonuses. Furthermore, employees who care about their equity compensation are motivated to perform in the best interest of the company’s success. Equity is a strong force in how startups are built, and company success hinges on the shared goals of employers and employees. If Equitybee can partner with companies as the go-to product for stock options financing then it could significantly increase its customer base.

Diversifying Forms of Equity

Equitybee also plans to provide other forms of liquidity such as cash against an employee’s value of options even if they are not vested or don’t plan on vesting. This would expand the scope of Equitybee’s product line because as of October 2024, shares need to be vested and exercised for them to be funded on the current platform. More options such as providing cash on the value of options could attract more employees as customers who have not yet vested their stock options and allow them to directly compete with competitors like Quid which already offers these capabilities.

Expansion and Diversification of Fund Types

Equitybee announced its VPF product in June 2024 which gives investors a discount on a fund comprised of leading hyper-growth pre-IPO companies. As the number of startups on the platform grows, Equitybee has the opportunity to tailor design even more types of funds to expand its product offering to appeal to different investors. For example, designing funds based on varying risks and maturity of a private company or funds that comprise industries such as AI or healthcare can attract different groups of investors.

Global Expansion

Founded in Israel and headquartered in the US, Equitybee has built a network of connections in both these countries. Half of Equitybee works in Tel Aviv, Israel, but Equitybee has created and maintained connections with startups and investors in the US as well. Equitybee has the opportunity to continue expanding in both North American, Asian, and European markets. For example, the European Private Equity Market size was valued at $215 billion as of 2024, representing an opportunity for expansion for Equitybee.

Key Risks

Stock Options Legitimacy

Phantom stock options, which offer employees the benefits of stock ownership without granting actual company shares, pose a potential risk when listed on Equitybee. This practice can erode trust between investors and employees and may raise concerns about Equitybee’s credibility. Equitybee has developed a thorough due diligence initiative where all offers listed on the platform are subject to approval by a registered principal of Equitybee securities, who is an SEC-registered broker-dealer and member of FINRA.

Equitybee also conducts all necessary background and credit checks and is committed to communication processes with funded employees to ensure compliance. In the event of a mistake, Equitybee could lose credibility and employees may not trust the platform much after an incident like that. It could be beneficial to hire more registered principals or leverage AI to double-check all offers made by investors.

Competitive Landscape

Stock options financing is a common endeavor for both VC firms and startups alike. For example, the startup SecFi directly competes with Equitybee and has over $48 billion worth of equity registered by over 30K employees on the platform. VC firms like Section Partners also provide structured financing plans for employees and have strong ties with their portfolio companies to implement these plans.

Partnerships with existing startups also give VC and asset management firms a leg up to provide exclusive stock options to attract investors. Furthermore, financing can be obtained in many other ways, such as through a traditional bank loan. Due to the range of competition in the industry, customers are free to choose the option with the least risk and cost to them and as a result, it’s important for Equitybee to take note of the alternative solutions to help differentiate itself.

Breach of Contract

Retaining investors is vital to Equitybee as investors provide the necessary liquidity and funding required by employees seeking financing options. As a result, investor risk must be carefully mitigated in the case of contract breaches. Equitybee uses a carefully written private financing contract which includes several protective clauses, most notably requiring that employees receive approval from both Equitybee and the investor before the sale of assets.

Equitybee also maintains power of attorney to arbitrate any employee-investor disagreements and may exercise this power to settle. Contractual protective clauses, power of attorney, spousal consent, and restrictions on sale events are some examples of steps Equitybee takes to protect its customers. The risk must be carefully mitigated to avoid a breakdown in trust as contract breaches could leave one party without the profits they deserve.

Legal Regulations and Compliance

The private funds and investment products market is under intense security by regulatory bodies such as the SEC and FINRA. Compliance breaches could lead to Equitybee getting shut down.

Equitybee took steps to mitigate this by appointing Susan Woodard as Chief Compliance Officer in October 2021. Woodard also served as the CEO of Equitybee Securities, which is Equitybee’s SEC and FINRA-licensed brokerage firm. She supported the creation of various proprietary retirement indexes at BlackRock before Equitybee and also has experience as Chief Compliance Officer at other companies including Victory Capital. However, Woodward left the company in August 2024 to take a new role at a different company, and her position at Equitybee is yet to be filled as of October 2024. Hiring a new compliance officer could be imperative for Equitybee due to the severity of rules initiated by regulatory bodies.

Summary

Private companies represent a large yet inaccessible market for most investors. As many of these companies are choosing to stay private longer, more of their value is generated before going public. The current profitability and high value of longstanding startups or unicorns are examples. However, stock options granted to employees of these companies are often wasted due to insufficient funds or risk constraints at the time of exercise. This creates a demand from investors to fund employees’ stock options. Equitybee’s platform connects employees with investors who are interested in their startup and want to invest as early as they can. This mutually beneficial relationship means investors can access startup stock at a discount and employees enjoy lower risks of financing. When a successful liquidity event occurs, both parties reap the benefits.

Equitybee has seen growth since launching in 2018 and has increased both its employee customer base and the number of investors providing funding. However, there remains competition from players like VC firms with established ties to startups and other employee stock option exercise startups. Furthermore, the private funds and investments market is also heavily regulated so legal challenges must be mitigated carefully. Equitybee's strategic positioning must be executed thoughtfully to establish itself as the go-to platform for employees and investors looking to fund and exercise their options.